Daily Forex Market Preview, 19/02/2016

The Dollar was mixed in yesterday’s session with USDJPY turning bearish for the day while EURUSD was mostly limited in its declines. Gold prices managed to fill the gap at 1238 in yesterday’s trading and formed a lower high, which could signal a correction to the rally. Watch for a test to $1200, followed by $1130 and eventually to $1110.

EURUSD Daily Analysis

EURUSD (1.11): The modest declines in the US Dollar did not help the Euro much which posted a fifth day of the decline off the highs above 1.13. On the daily session, the price is seeking dynamic support off the 20 EMA, and so far is trading within yesterday’s range. A bullish close is needed today, failing which EURUSD could see further declines. On the 4-hour chart, the support at 1.113 – 1.11 remains in focus with prices briefly trading below this support level yesterday before pulling back into the support zone. A close above 1.113 on the 4-hour chart is essential for price action to break higher. 1.1227 and 1.13 remain in focus to the upside but if the support fails to hold prices, EURUSD could see strong declines down to 1.095 – 1.093 lower support.

USDJPY Daily Analysis

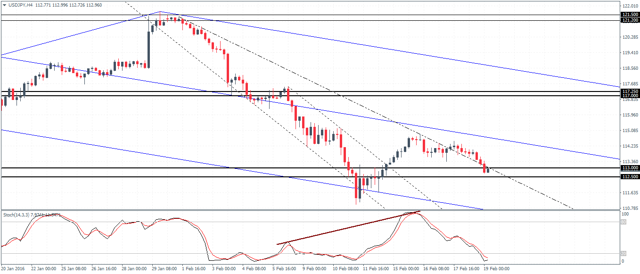

USDJPY (112.9): USDJPY closed bearish following the doji candlestick pattern from the day before. Prices closed below the doji’s low of 113.377 at 113.241 yesterday indicating further downside. Support at 112 comes into focus to the downside. USDJPY is currently trading at the support level of 113 – 112.5, following a breakout from the falling price channel. The trend line connecting the lower highs off 1st February and 17th February shows a brief attempt to break the trend line before prices continued to decline lower. However, with support zone of 113 – 112.5, the declines could be limited giving scope to a possible move to 117.25 – 117 resistance. In the event that the support fails, USDJPY could down to 112 and potentially post a new low.

Leave A Comment