Numbers:

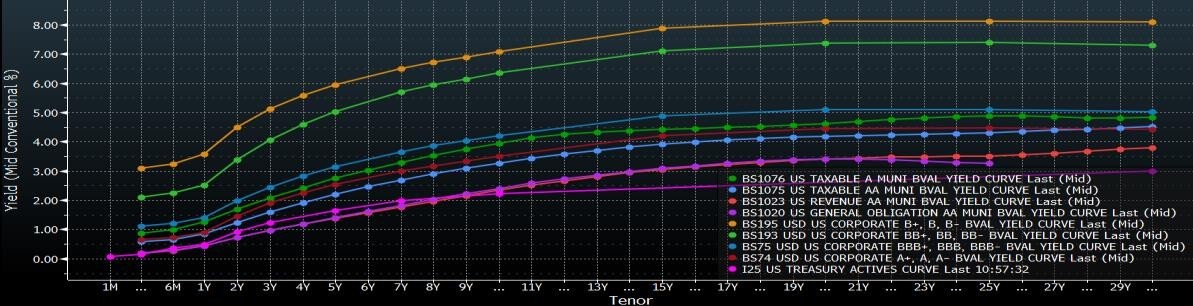

Yield Curves:

Credit Curves:

Making Sense:

The second look at Q3 GDP is in and it appears that the U.S. economy grew at a faster pace than originally believed. According to GDP data, “2” is the magic number.

We got the (second) Look

The second look at Q3 U.S. GDP indicated that the U.S. economy grew at an annualized 2.1%, up from an initial read of 1.5%. The upward revisions was due to a stronger inventory build in September. However, what the September inventory build giveth, the September inventory build taketh away. Following the data, many economists revised their Q4 GDP forecasts lower on the belief that the stronger September inventory build probably pulled economic activity forward from the fourth quarter. Word on the Street following the data is that the consensus forecast for Q4 GDP could be revised lower to the 2.0%-2.1% area from the 2.3% to 2.4% area. This points to an annual U.S. GDP growth rate of 2.175%. The 2.0% economy appears entrenched.

Of concern is that inventory levels remain high, questioning the need for the September inventory build in the first place. Demand for goods has not been strong enough to significantly deplete inventory stockpiles. Some economists have opined this morning that inventory stockpiles are so high, growth could be shaved off of Q4 2015 and Q1 2016 GDP totals. We shall soon see Personal Consumption was revised lower to 3.0% from an initial read of 3.2%. Wages and salaries rose by $102.7 billion in the third quarter. This was a somewhat slower pace than the $109.4 billion increase in Q2. Other than inventories, nearly every other component of GDP was unchanged or revised lower.

This is the last look at GDP prior to the December FOMC meeting. There was nothing in the GDP data which should influence the Fed, one way or another. Tomorrow we get October PCE data. The Street consensus estimate for annual headline PCE calls for an inflation rate of 0.3%, up from

0.2%. The consensus estimate for Core PCE calls for an increase to 1.4% from 1.3%. An improvement (in Fed terms), but hardly Earth-shattering.

Gun-shy and Roses

Cheap credit might not have caused a bubble, at least not in the classic sense, but it appears to have caused an over-allocation of capital in the high yield energy sector. In fact, it has caused some investors to double-down on the sector. I opined that junk debt appeared way overdone in Q2 2014. This morning, an article in Bloomberg News states:

“After six years of easy-money central-bank policies kept over-leveraged companies afloat and left scant opportunities for traders who profit off the market’s scrap heaps, a rout in commodities prices in 2014 presented what had seemed like a perfect chance to buy again. Instead, those prices only declined further this year, causing the debt of everyone from oil drillers to coal miners to fall deeper into distress. As the losses intensified, gun-shy investors pulled back from almost anything that smacked of risk, spreading the losses to industries from retail to technology.”

Leave A Comment