The merger between Halliburton HAL and Baker Hughes BHI has been the talk of the oilfield services industry. However, the transaction is not a layup. It has garnered major scrutiny from the DOJ, faces regulatory hurdles down under and required assets sales have yet to be announced. Despite all the hoopla, Halliburton is still suffering from lower oil prices and the contraction in oil & gas E&P.

Source: Shock Exchange

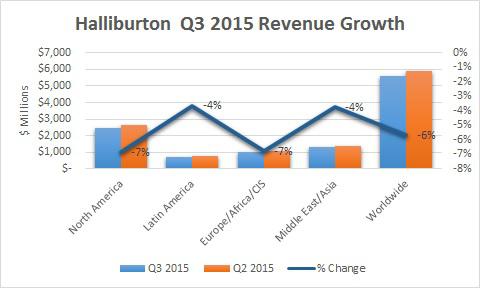

The company’s Q3 revenue was off 6% sequentially. This follows a 16% decline in Q2. North America (45% of revenue) was one of the worst performers with a 7% decline. North American land drillers are demanding price concessions from vendors in order to compensate for declining cash flows. Meanwhile, EBITDA was off 16% sequentially despite tens of thousands of headcount reductions.

I believe a lot of Halliburton’s $33 billion market capitalization is driven by euphoria over the Baker Hughes merger and potential cost synergies. I did a bottoms up analysis of HAL and it wasn’t pretty.

Halliburton Is 28% Overvalued

Based on a bottoms up analysis, HAL is at least 30% overvalued.

Revenue

Revenue of $24.7 billion is simply YTD revenue through nine months 2015 annualized. It equates to about 25% less than the $32.9 billion the company reported for full year 2014.

EBITDA

EBITDA is nine months results annualized. It equates to an EBITDA margin of 16%, down from about 21% for full year 2014.

Enterprise Value

The company’s enterprise value (equity and debt) is $28 billion at 7x EBITDA.

Equity Value

After subtracting net debt (debt less cash and equivalents) of $5.6 billion, I derived an equity value of $22 billion.

Leave A Comment