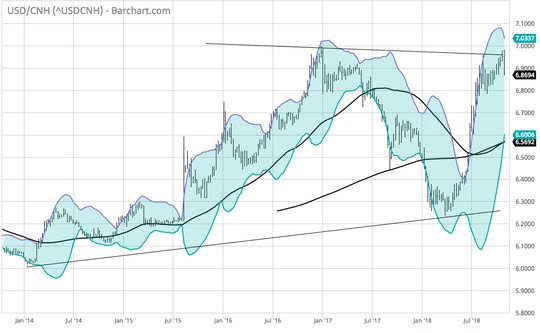

Being present emotionally, intellectually and spiritually requires effort. Meditation, exercise, diet, and communion – these all are part of the fullness of human experience and time but all require work. The natural state is entropy and markets are no different. Only work can keep a trend intact. The problem with living only in the moment, living without expectations, is that now is the best it can be and the risks for tomorrow remain. Markets are living this with this the best of times and the steady creep of peak earnings, peak growth thrives – witness the Apple earnings beat and outlook fail overnight. The bounce off the October lows (now reaching 5%) is evidence. The work behind this move rests today on Trump trade deal hopes with Xi in China. Bloomberg reported that President Trump has asked his cabinet to draft a possible China trade deal. For the cynics, this is a forced effort ahead of the mid-term elections to lift the stock market as that has become the President’s barometer for almost everything. Regardless of the future, the momentum for more money flows back to risk, away from safe-havens – particularly the USD – drives the headlines today, even with a cacophony of weaker economics from Australian retail sales to Swiss retail sales to Eurozone PMIs where Italy falls to contraction and the EU outlook dips with export orders. The mood maybe for buying value more than growth at least until the US jobs report. There are plenty of anomalies to consider today as well – Iron ore futures fell in China, EUR/CHF is lower, Oil hasn’t bounced. The tension for traders also returns with rates over risk with US 10-year yields back to 3.16% watching 3.20% for another run to 3.25% and a stop fest. On the other hand, the moment that seems to matter most is the drop in USD with the CNH revealing a larger play back to 3.80 again implying better EM and commodity markets. The move today in CNH and CNY is the most in 2-months and many see it as evidence of Chinese 7.00 defense working with stimulus plans and Xi’s determination to win back business confidence.

Question for the Day: Is it all about wages? The US jobs report today seems a side-show to the US/China trade deal hopes. But there is a key issue still about wages and inflation and the FOMC reaction. Higher US rates today matter and they could derail the hope-a-thon ongoing. The wage growth seems to be more important than the job creation but the whispers on jobs at 220,000 are to be respected. The ADP and other indicators point to a good report. If the unemployment rate dips below 3.7% or NFP is over 220,000 then wages not going up to 3.1% maybe less of an issue. Faith remains in a US Phillips Curve.

Leave A Comment