JAKKS Pacific (JAKK) is a company we have long considered the third choice you should make when investing in a toy company. We have long preferred Hasbro (HAS) and Mattel (MAT) before considering JAKKS. That said, JAKKS is a fantastic trading idea, as it frequently makes high percentage runs up and down, making it a great long and short candidate, depending on the situation. Have a look at the recent chart:

Source: Yahoo Finance

In this column, we discuss the recent performance of the company. We also investigate recent portfolio developments, and opine on 2018 projections. Ultimately, we think JAKKS Pacific is at a level where a speculative buy can be made for a quick trade. However, given how ugly the chart is, and the performance of the stock, we would not recommend a buy long-term. Let us discuss

Q4 performance

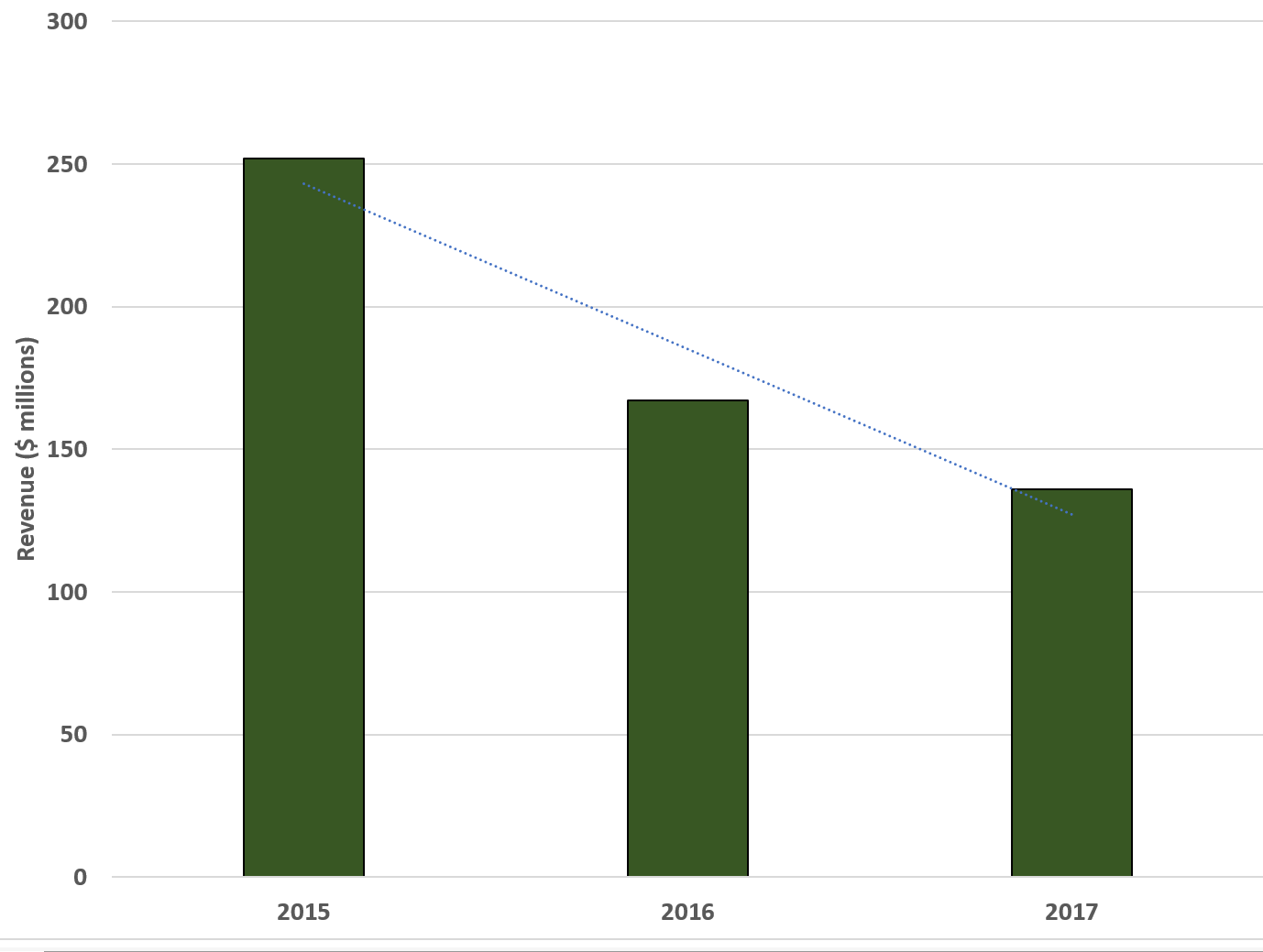

Net sales for the fourth quarter were $136.6 million compared to $167.0 million reported in the prior year period, continuing a downtrend:

Source: SEC filings

As reported GAAP gross margin in the fourth quarter 2017 was 22.1%, down from 31.2% last year, primarily as a result of minimum guarantee shortfalls, inventory impairment and the impact of low margin sales recognized in the quarter. Operating costs for the quarter were $56.7 million, which included certain pre-tax charges totaling $2.5 million related to restructuring and bad debt write-offs.

Products that had a significant positive contribution to fourth quarter sales included Squish-Dee-Lish, Tangled, Stanley, Chocolate Egg Surprise, Moana and various DC Comics products. Products that showed significant declines included Tsum Tsum, Graco, Frozen, Elena of Avalor and Gift ‘Ems. When considering revenues and expenses, earnings took a hit.

GAAP net loss attributable to JAKKS Pacific was $30.4 million, or a loss of $1.33 per basic and diluted share, which included pre-tax charges totaling $17.2 million relating to the impairment of inventory, minimum guarantee shortfalls, restructuring charges, bad debt expense, and the impact of the exchange of convertible notes. This compares to GAAP net loss attributable to JAKKS Pacific of $7.6 million, or a loss of $0.47 per basic and diluted share, reported in 2016. What about for the full year 2017?

Leave A Comment