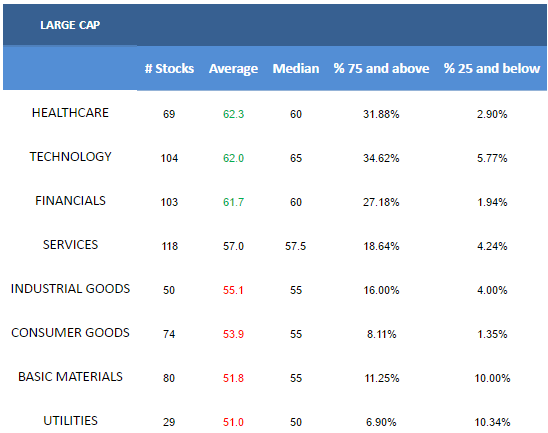

The average large cap score is 57.65. Over the past four weeks, the score has averaged 62.39. The typical large cap stock in our universe is trading -14.48% below its 52 week high, 2.69% above its 200 dma, has 4.8 days to cover short, and is expected to grow EPS by 13.7% in the next year.

Healthcare is the top scoring large cap sector. Technology and financials also score above average. Services score in line. Industrials, consumer, basics, and utilities score below average.

The following table shows the best and worst large cap stocks.

The next chart shows how many stocks in our universe are trading greater than 5% below their 200 dma. Historically, when we get to these levels, markets risk increases.

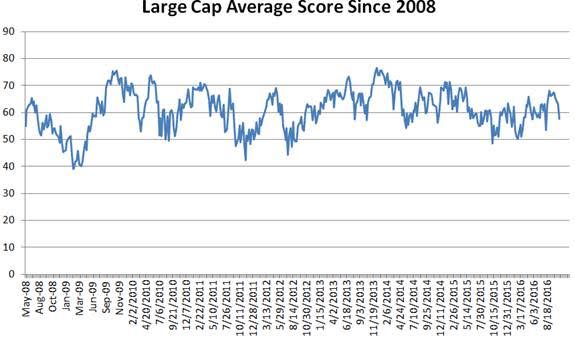

The next chart shows average large cap scores over time.

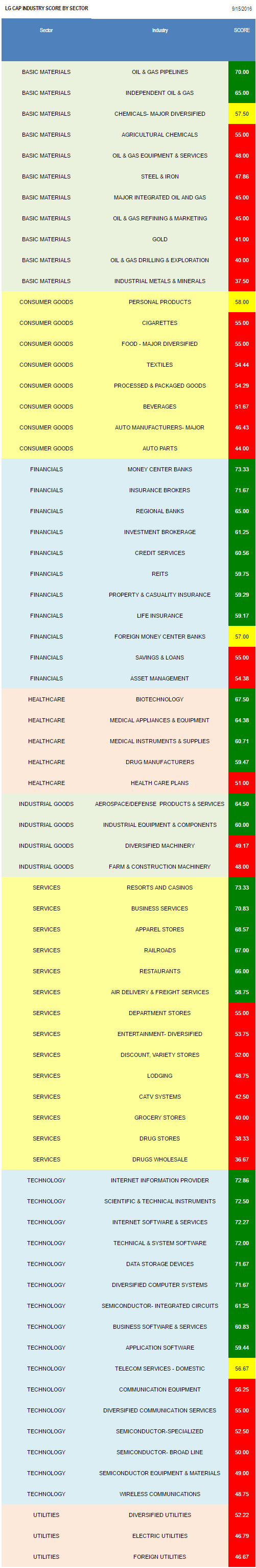

Money center banks (BNS, BAC, STI, JPM) are top scoring in large cap. Resorts/casinos (MGM, WYNN), Internet information (FB, NTES), scientific & technical instruments (MTD, WAT), and Internet software (OTEX, SYMC, RAX, AMZN) are also strong.

Oil & gas pipelines (WMB, SE) and independent oil & gas (APC, NBL, DVN, CNQ, CHK) are best in basics. No consumer goods industries score above the average large cap universe score. Money center banks, insurance brokers (AJG), and regional banks (C, BBT) are best in financials. Focus on biotech (SGEN, BMRN, AMGN), medical appliances (STJ, VAR, EW), and medical instruments (COO, BCR) in healthcare. Concentrate on aerospace/defense (GD, TDG) and industrial equipment (PH) in industrial goods. Resorts/casinos, business services (CTAS, V, FLT), and apparel stores (FL, URBN, ROST) are best in services. Internet information, scientific & technical instruments, and Internet software are top scoring in technology. No utilities groups score above average.

Leave A Comment