Varying dynamics inhibited the market’s ability to challenge highs over the week just past; especially for the Dow Industrials, which never moved as firmly as the S&P; which of course is ‘capitalization rather than price’, in terms of how it’s weighed.

Channeling the various arguments, I tended to be skeptical of conventional linear technical views that simply carry the S&P straight-line higher. To me that was non-thinking straight-edge optimism; oblivious to all actual facts. In the early days of financial TV I emphasized charts because the expeditious dissemination of factual information was not as swift or readily available sometimes so you looked for hints in what I’d termed ‘price and pattern behavior’. I still do that; but now sometimes facts or reports (whether really meaningful or not) appear before price reflects it.

Tiny LightPath was an example the other day, when it broke out technically a day before an early preliminary quarterly report that actually wasn’t surprising, aside an admission of ‘lead time’ concerns; a response to ‘too much’ new business perhaps (ultimately a good sign). I would think Elon Musk’s airborne ‘Tweet’ about a potential LBO was a big stock example; and in that case one that might have violated procedures.

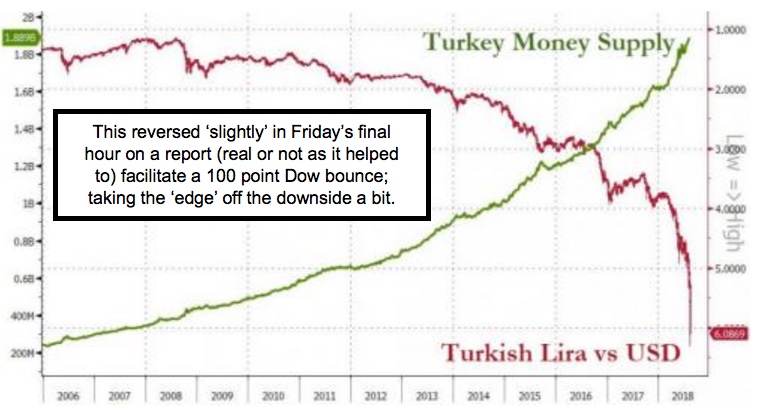

Then there’s something else to contend with besides ‘trade’: Turks in Ankara encouraging converting Lira into Gold (who would; not Erdogan I bet ); Russians threatening ‘economic warfare’ if new sanctions come forth from Washington; China playing ‘hardball’ instead of using wisdom to sort out the situation; and now Trump pressuring Turkey a bit more, with the doubling of tariffs on Turkish steel & aluminum.

Turkey it seems lives on foreign borrowings. I might mention that Deutsche Bank is down yet again; because systemic risk in Turkey affects them as the primary EU bank doing business there.

Leave A Comment