Upheaval conditions are neither magic, nor tragic for investors, at the same time the persistence of cheer-leading or resistance to realities by so many, was almost mystical. Most have acknowledged declines (how can they not?), but few saw the handwriting on the wall, even though that was not well-concealed, during preceding (desperate) ‘Hail Mary’ rallies. And fewer yet (in all humility) called for the market to ‘go to the moon’ if Trump ‘won’, but from January warned it’s not going to interstellar space.

And even now they fail to see the sensitivities of this market to news of a negative or ‘hopeful’ tone. What they shouldn’t miss is the long-ongoing monetary shift, which has triggered (as we’ve mentioned a few times) the rise in Libor and shifted credit market conditions beyond whether the US Fed (or other central banks), remain mild-mannered in their official hikes, as so far all major nations (and EU) have continued their gentle touch. I am going to touch on our new Fed Chairman’s philosophy, versus those of his predecessors, in tonight’s quite long main video.

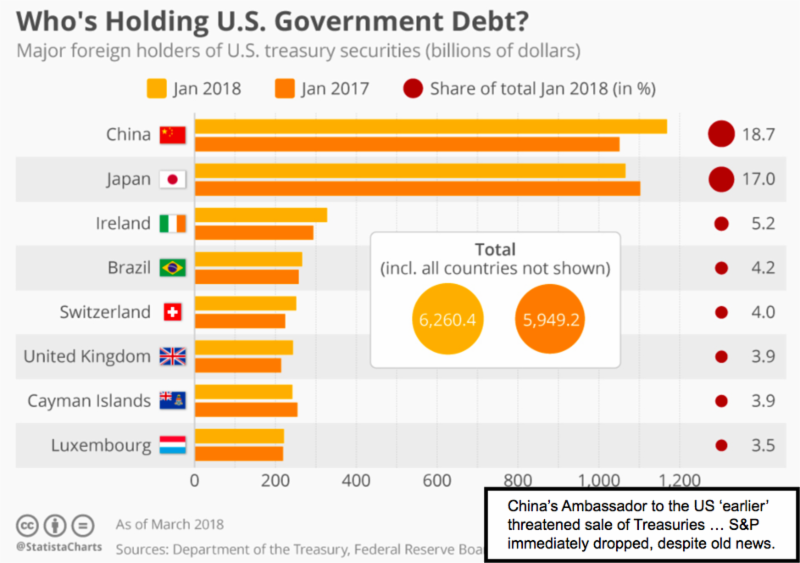

What bothers me most here, is not the erratic behavior related to tariffs, or even the prospect of a rally, ‘should’ successful trade negotiations be concluded with South Korea, Japan, the EU or even China itself. Actually I’ve long felt (and now other countries grasp that too, which makes it just a bit tougher to banter with) a ‘”Let’s make a deal’ approach dominated the intentions of this administration. And it should but I don’t believe we will (or should) back off as other Presidents did, from pursuing the neglected real needs to revitalize and spur growth in America’s. Chinese retaliation is a concern, but don’t forget we are their indispensable trading partner.

I even think that this weekend’s threats against Taiwan are superfluous, as imagine what happens if they actually tried to attack and the U.S. Fleet resumed cruising between Quimoy and Matsu (island); like the old days. Not only does China not want conflict with us, their financial structure is ‘at risk’ of collapse without us. Yes that’s why they want to consolidate in the region with less U.S. dependence, but they’re nowhere near that yet.

Supply-Chain is the ‘choke point’

It’s really essential, even if the shorter-term will be negatively impacted by shifting manufacturing and formerly-outsourced services, back here. I realize most complain about that, but it’s near-term earnings dislocation concerns largely without the vision to look beyond the horizon. So sure, one of the main issues (and that can impact almost everyone, even firms that won’t be targeted by China no matter what) is forward ‘supply-chain’ challenges.

Leave A Comment