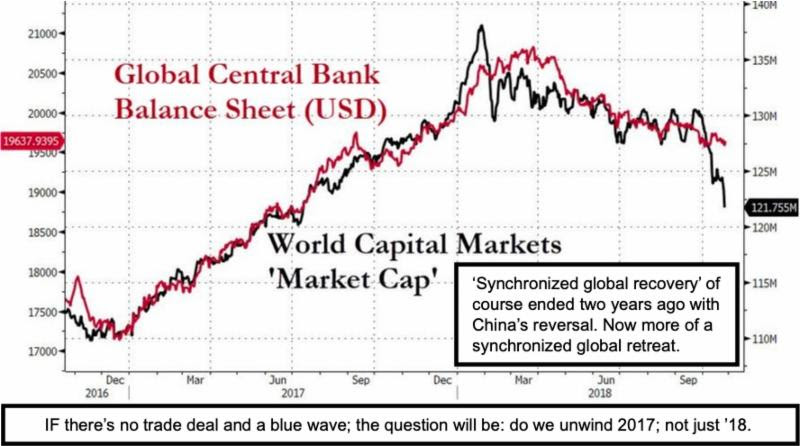

‘Price Discovery’ amidst more sober assessments of forward prospects is on the surface what this overall market decline is described fundamentally as being about. In reality this ‘exploration’ about valuation has been ongoing since the ‘end’ of the Trump-victory rally as nailed back in late January. And its approached was telegraphed by a clear monetary policy progression.

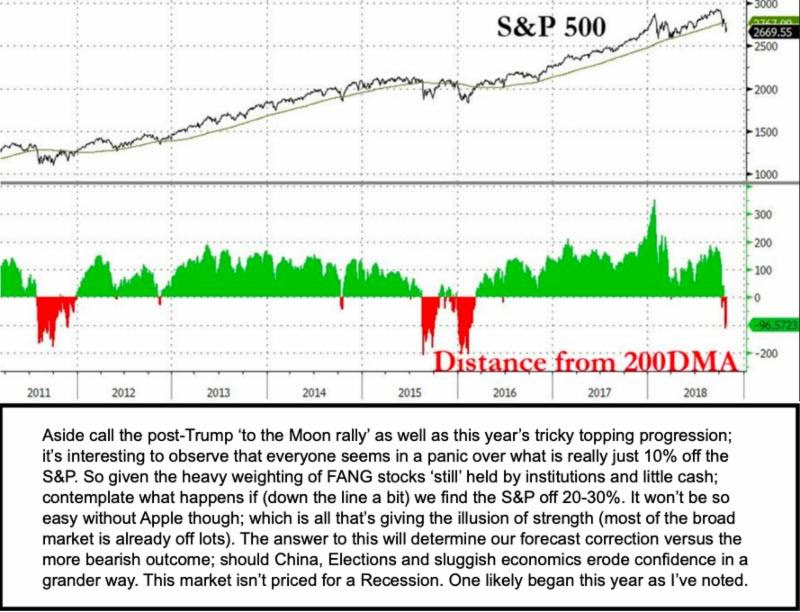

That matters, because while ‘the Street’ keeps seeking out new ‘leadership’, or ponders what happened to the horses that got ’em to the high levels, the reality is quite different. The broad herd of ‘horses’ has been correcting most of the year; while as you know (because I’ve assessed and charted realities in this regard for many months) the ‘narrow’ group of FANG+ stocks typically provided illusions of strength allowing upward cycle ‘charades’ to persist.

Now, as everyone talks about ‘the big scare’; the reality is things indeed are changed; the perception about the year ahead, even if ‘good’, is not ‘robust’ to the dreams of the greedy buyers into strength we warned about this year. Plus there are domestic ‘known unknowns’ that will factor into November.

And ironically, as rash emotions overtake the misplaced enthusiasm seen in so many firms (and media) this year against a ‘distributional backdrop’ they pretended didn’t exist, what we have are a broader majority of stocks nearer decent valuations, aside emotional liquidations, because they’ve corrected in a ‘rolling Bear Market’ since late January. But the macro picture suggests greater volatility persists; hence ‘bottom fishers’ should be very cautious. I’d rather ‘pay a bit more’ for a stock once a technical low is established, than try to guess where that base might form. Same for the S&P incidentally.

Now, we are not only closer to a ‘Recession’ than most think; because if it’s designated as such, an irony there is that will be near lows for many stocks that (as noted) already declined 10-20% or more over the past 9 months. Of course my interest is gradually accumulating value, by nibbling once we get a semblance of a washout, somehow tested by the several ways a market’s able to demonstrate a low. So far that is still pending.

Leave A Comment