A slightly more sober performance by markets as ‘Quadruple Expiration‘ has wrapped up, is being telegraphed, and likely looms immediately ahead. Of course markets will ponder the Fed rate increase (essentially discounted in terms of actual Treasury moves) and talk about tariff-related prospects.

However, it may well be both allocations’ (the restructured ETF’s) deadline impacts (Monday is the first trading day after the mandated changes) and a realization that more concerns about what happens after midterms, may actually be impediments to excess enthusiasm going forward.

With that said, the charts won’t answer how midterms will go; although on the surface the market behaves ‘as if’ the business and tax policy ‘boat’ is not going to be rocked. Of course the market doesn’t know this.

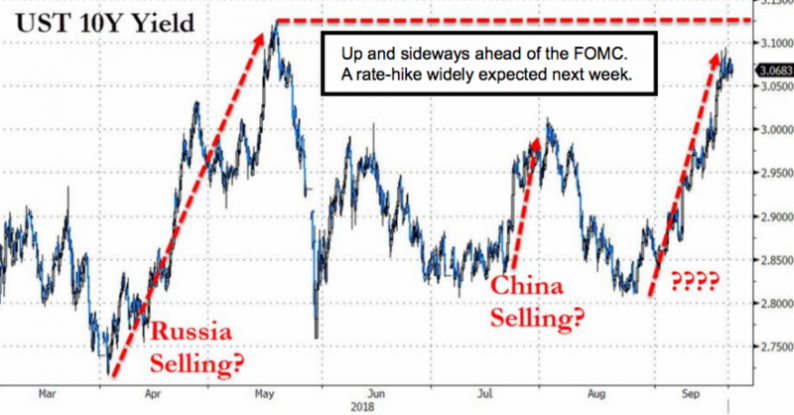

We’re through a Quadruple Expiration and historic as well as beta-building re-Allocation process and that should have markets aware that recent upside was partially a function of those non-recurring events. In a sense it puts us more on edge about the prospects of correction. China waited until Saturday to withdraw their lower-level delegations, which had been sent to Washington (earlier they had downgraded it to a mid-level or less-authoritative team). Now they rescinded these talks altogether, but of course that can change with the winds depending on Trump’s response. It goes without saying that dialing back trade tensions matters.

Daily action has not really enhanced investor enthusiasm as pundits in many cases suggest but rather has allowed markets to advance within the context of ‘uncertainty’. For many months I’ve believed that while shakes, or even corrections, could occur from a number of presumed concerns out there; that the primary trend was not really at risk (hence no general huge liquidation of core holdings, and definitely no short-selling).

Leave A Comment