Values remain extended; and the market dances around shy of the S&P inflection zone, identified around the June S&P 2750 area. Today’s reaction to the Fed’s nominal rate hike, and straight-forward ‘news conference’ (see video 2), also conformed to the pattern outlined last night (up if they moved a little, then selling, then a bounce and then a renewed fade). There was little if any surprise in Chairman Powell’s remarks; and it was refreshing that he was too the point; not arcane with respect to what’s called ‘Fedspeak’.

Rates …

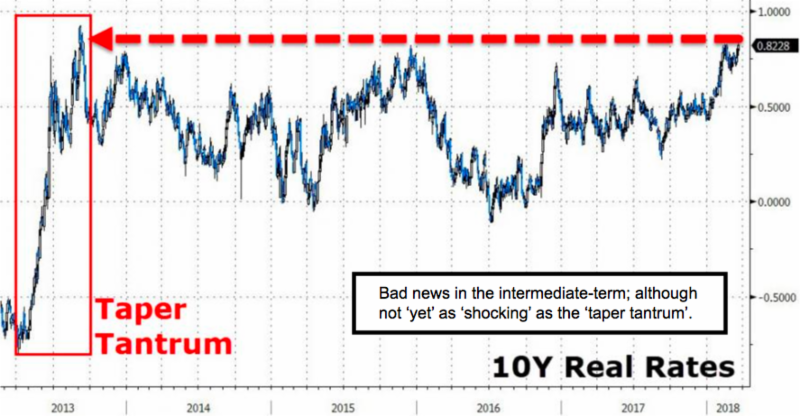

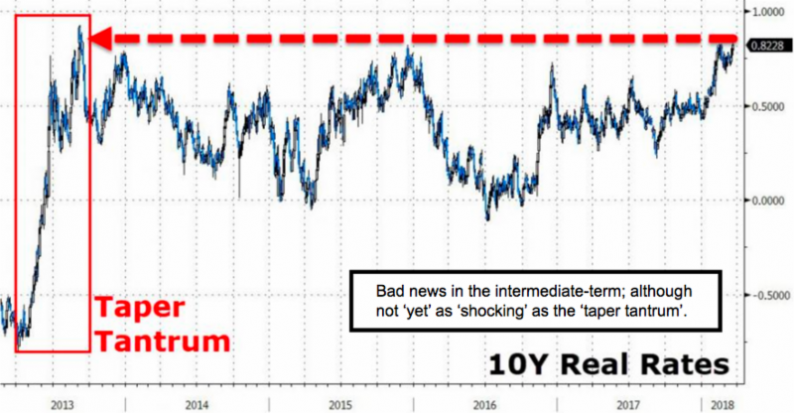

in my view made a generational bottom over the past two years and it’s amazing that analysts still debate any shift in monetary policy. In my view the Fed announced (remember the brief ‘taper tantrum’) policies to ‘take the punch-bowl away’ a couple years ago; and markets went into a stammering rotational pattern as a result in 2015-’16.

Deterioration had set-in, and hence only a ‘win’ by Donald Trump brought an S&P extension rise, ‘to the moon’ as I called for. Now I believe prices largely reflect the anticipated growth (more than is evident as of yet); and that’s why I’m more optimistic about the American economy than stocks ‘in general’ (aside particular under-the-radar speculative value-plays or a big Dow stock or two that are broadening their business base, or sectors like Oil that I’d suspected would be far stronger than naysayers suggest).

In-sum: snap-backs aside (and as outlined in last night’s video), there is a continued flirtation with bear market territory in many stocks, while the supportive action of FANG and other technology stocks underpinned the Averages ‘to a degree’. Oil stocks have been the primary sustaining area for the moment. Techs (including FB) may rebound; but just running-in a slew of after-the-fact shorts perhaps; before they become heavy again.

Daily action – surrounding a Fed rate hike and very well-balanced later remarks by Chairman Powell, was satisfactory and generally adhered to the idea about how the knee-jerk responses would go.

Now we still think they will try to push the S&P a bit higher; and perhaps try to challenge the inflection zone yet again (they did it once today right after the rate hike; then that was faded); before heavy pressures return.

Led by Oil and rebounds in some techs, including Facebook – although Zuckerberg’s apology sure does not go far enough and won’t do much to eliminate skepticism- that should run-in some shorts and then probably renew declining action. It doesn’t all have to happen in one day of course and we shall see.

Leave A Comment