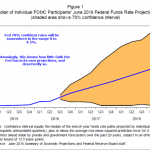

Tomorrow is Fed day. Metals and Miners near-term outlook hinges on their decision. The previous rate hikes supported prices after an initial drop. But, those rate hikes were 12-months apart. Therefore, it is unclear how metals will react this time around.

Markets are anticipating a rate. However, what they will be looking for is forward guidance and changes to the dot plot. If the Fed takes an aggressive stance, proposing another hike in June metals could get spooked. If their posture is weak and indecisive metals and miners could stabilize. Of course, these are just my opinions – markets don’t always behave as expected.

-US DOLLAR- The dollar tested the 50-day EMA and may be attempting to turn higher. Prices could retest the December high if tomorrow’s Fed decision supports prices.

-GOLD- Still no sign of a swing low and prices could drop sharply after the FED announcement. How sharply depends on future rate hike expectations. If the FED comes out aggressive..indicating another hike in June, prices could weaken further.

-SILVER- Silver also closed below yesterday’s black candle showing continued weakness. The last rate hike resulted in prices dropping a $1.00 the following day. Prices are at the same level they were before the December announcement. It’s impossible to say what will happen. Nonetheless, if prices break below support at $15.68, we could see significant selling pressure unleashed.

-GDX- Senior miners tested the 10-day EMA and failed. Prices could be setting up for sharp decline similar to the December rate hike day.

-GDXJ- Prices rallied 4-days off the $32.66 low and closed above the 10-day EMA. Technically that’s enough to verify a counter-trend rally, albeit very shallow. It’s impossible to predict what will happen tomorrow, but a sharp decline is certainly possible.

Leave A Comment