The horror of wildfires in the US and globally continues. There is no containment when climate change drives droughts and the tinder of dry forests finds the frailty of human judgment. So too for the markets today. The crisis in emerging markets is not contained even as the TRY gained back to 5.8830 early at the open following headlines that Turkey is doubling US tariffs.

The currency is up 3% to 6.15 now after a court in Turkey rejected US pleas to end Pastor Brunson’s house arrest. So TRY is not enough to spread cheer across emerging markets. Start with Indonesia where the central bank hikes 25bps to 5.5% – the fourth hike since May – as the IDR fell 1% at the open bringing another round of intervention. The BI Governor Warjiyo noted, “The reason for the rate hike is to maintain the attractiveness of our domestic financial market, in that we want yields… to remain attractive despite rising risk premiums and that could trigger inflows.” Continue onto China where the CNY fixed lower and the housing prices rose but the stock market fell. CNY wobbles after weaker data yesterday. Move then to South Africa where the ZAR is off over 3% and focus is on its politics hitting stocks and bonds, weaker metals prices hitting its current account. There is little room for EM to hide today and the pain trade outside of Turkey belies the containment arguments from yesterday. So we are in a risk-off mood and that puts the USD back into the spotlight with the data today looking more important than usual as it will drive FOMC reactions. The risk for 98 US dollar index returns.

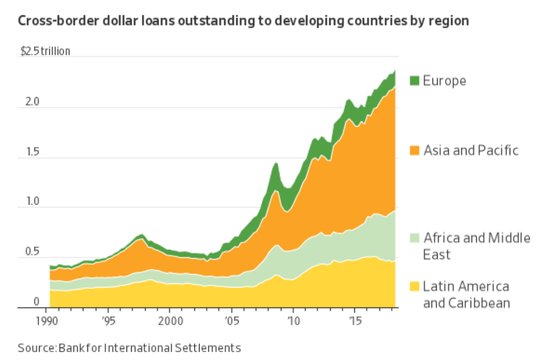

Question for the Day: What can stop the EM pain trade? There are 3 things blamed for the current crisis in EM – 1) FOMC rate hikes, 2) US trade tariffs and sanctions, 3) Position overhangs. The positions have been washed out but the last month of July brought some bargain buyers than are now getting burned. The FOMC rate hikes are likely to continue and that is the first driver that needs some reversal to help EM – so data ahead matters. The USD borrowing abroad is mostly in Asia and that puts China as key.

As for the race to the bottom – the fact that ARS and TRY are the leaders isn’t a surprise – but that ZAR and INR are next maybe worth considering. The ZAR pain trade is linked to more than C/A and real rates. This is about global demand, links back to China and the trade stories about cars and Platinum/Palladium. Markets are not going to stop looking for more pain until we see good news about trade, Fed hikes and we get that final capitulation moment – one that is more than 7.3 in TRY.

Leave A Comment