If the US/China trade war was the cause of the October selling, then the start of November has more to go as this narrative turns to deal making. The relief rally back in risk assets is the first chapter of the last week but not the full story for the month ahead.

We have moved into a post-modern Goldilocks fairy-tale for policy and economics. We no longer believe in buying the bottom but in selling the top. The week ahead brings the US mid-term elections – expected to deliver gridlock; the RBA, RBNZ and FOMC rate decisions – all expected on hold – and a host of important data starting with Services PMIs and ending with Chinese inflation and trade reports – all expected to show slowing global growth and less price pressures.

Interest rates are the bogeyman for the straight shot higher in equities. Markets want to believe in the relief trade but need constant reassurances that inflation remains tame, that policy shifts gradual and growth continues at target, all of which requires a bounce for Europe, Japan and China into 4Q. US growth and its divergence is a complicated issue as well given that FOMC hikes need to be met with higher real growth and improving productivity to keep margins robust.

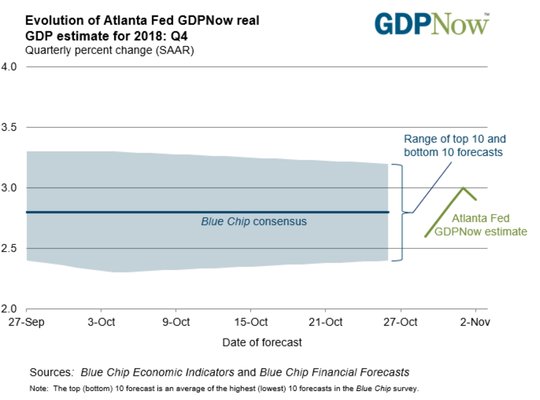

Markets closed Friday with insufficient momentum to hold the equity bounce and we had little positive news to support markets further over the weekend, leaving us vulnerable to more harsh language about politics and policy driving prices into Monday. The early snapshots for 4Q growth are not bullish enough to hold the present relief trade either, but perhaps this changes with the heavy news agenda ahead. Relief by its definition is temporary.

What Happened over the Weekend?

The US weekend focus was on the upcoming mid-term elections – the most expensive in history at an estimated $5.2 billion in spending for the House and Senate races.

Question for the Week Ahead: Is this the peak?

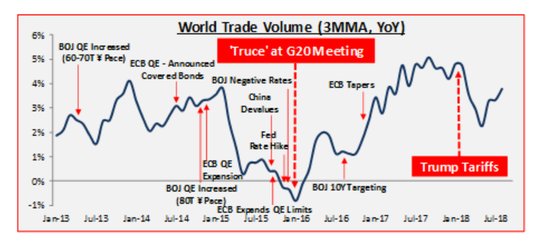

The focus on turning points for markets remains essential with many wary of the price action as we have shifted from buying dips to selling rallies. The idea of a top to the cycle drives much of the fear trade. Peak political and trade fears, peak earnings, peak growth, peak rate fears – these are the worries that dominated the last week even as equities globally bounced back with the US/China getting a majority of credit for turning markets as global trade has weakened since Trump talked tariffs and this has moved throughout emerging and developed markets.

So, the key worry in the next week will be to prove that US/China deal hopes are real. Many of the cynics argue that Trump will change his language after the Tuesday vote. The President told reporters Friday, “We’ll make a deal with China, and I think it will be a very fair deal for everybody.” The November 30 meeting of Xi/Trump at the Argentina G20 meetings has become an event risk for markets.

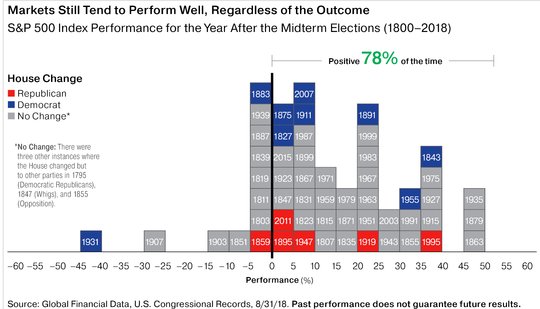

The second issue will be to see the November 6 election results and the market reactions. Current RealClear Politics polls show a House just slightly controlled by the Democrats and a Senate still barely in Republican control. The reaction of markets to this result is expected to be one of relief. Historically midterm elections have not had a major impact on the financial markets or provided reasons for investors to make major changes to their investment plans.

The third issue is US earnings for 3Q but more importantly the outlook for 4Q and beyond.The 3Q earnings are beating expectations at 24.9% but stocks have little to show for it.This is how Factset sees the outlooks:

The fourth issue is the Fed – as its meets next Thursday – and its decision for December is expected to be telegraphed in its statement. The risks of a December hike are about 75% – something that means the FOMC will need to change wording to not see it increase to 90% in the next few weeks.

Leave A Comment