The return on capital matters more than return of capital today. Celebrations around Italian debt downgrades being less painful (in other words not junk status) that is the first driver, joy over China re-leveraging the other as shares there jump the most in 3-years up over 4%. The news isn’t all easy, however, as AUD slips back to near the yearly lows on politics as PM Morrison looks likely to lose his parliamentary majority post the Wentworth by-election. In the UK, GBP is lower as PM May faces a full rebellion of pro-Brexit Tories with EUR/GBP watching the 200-day at .8835. The data was sparse overnight but important to consider as the Japan FSR highlights real estate risks, as China house prices jump again, as the Bundesbank downplays the auto sector 3Q pullback and as the EU shows primary budget surpluses in 2017 everywhere but the periphery (and with Germany beating Greece in the surplus game). This isn’t the stuff that sparks growth, putting ECB policy decisions as central for the forecast and for the week ahead. The EUR bounce up into the EU open stalls with BTPs finding a limit to the joy of not being junk. The risk moods are tempered by the geopolitical clouds from the US/Russia nuclear treaty unwind and the ongoing Saudi/Khashoggi crisis, but the overarching driver for risk remains 3Q earnings and that brings 158 companies in the US S&P500 this week. For those trading on a quiet Monday, the AUD/JPY maybe the currency pair to watch as it captures the commodity/China growth hopes along with carry trade support against the fear about debt and politics. Watch 79 for risk downshifts and 82 for clear signals of a bigger rally.

Question for the Day: Are markets to be manipulated or feared? There is a larger problem at play as the FOMC and others race to normalize rates and return market correlations to the old rules – bonds up, stocks down or vice-versa. The trust in markets post 2008 has never been lower and the manipulation of markets by central bankers and government never higher. The Chinese actions over Friday are still the case in point – with a bold squeeze of shorts driving out the fears about stocks and perhaps pushing back on the debt doubts behind it. The trust in markets is worth thinking about and the Mark Carney Speech last Friday at the New York Economic Club worth reading. He highlights the three lies of finance: 1) This time is different, 2) Markets are always clear, 3) Markets are moral.

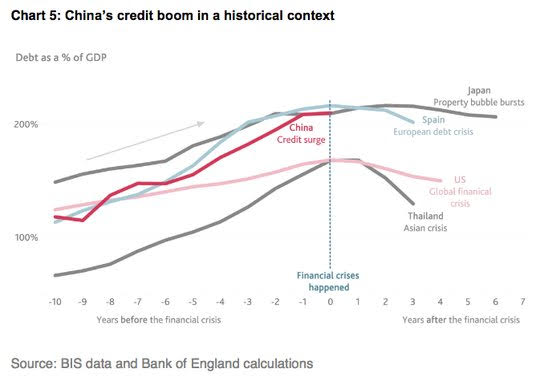

Specific to China, Carney notes the following: For example, while China’s economic miracle over the past three decades has been extraordinary, its post-crisis performance has increasingly relied on a large build-up of debt and an associated explosion of shadow banking. The non-bank finance sector has increased from around 10% of GDP a decade ago to over 100% now, with developments echoing thosein the pre-crisis US such as off-balance sheet vehicles with large maturity mismatches, sharp increases in repo-financing, and large contingent liabilities of borrowers and banks. The Chinese authorities recognize that “this time may not be different” and have begun taking measures to manage the risks.

Leave A Comment