We all live in Missouri this morning, perhaps not Ohio or Kansas where voters yesterday left tight races. Missouri is the show-me state where you have to prove the facts before you trade them. The summer lull continues with less news continuing to support risk. The take-aways from economic data were 1) China trade isn’t yet hurt by the US tariffs – though imports are likely higher in anticipation of them. 2) Japan economic outlook is weak and BOJ talk of hiking rates seems far-off market. 3) Spanish and French economic data point to slowing growth. The global synchronized growth that start 2018 has become splintered and we live with idiosyncratic markets allowing traders to win but for the noise of central bankers and politicians. Here is the overnight list:

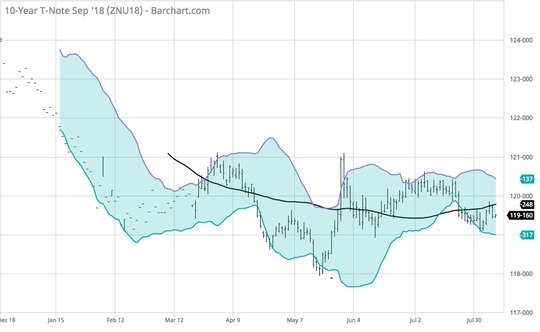

We are now in a “show-me” phase for markets to believe in bad news. The China trade data are not weak enough to give much credibility to the worst-case scenarios prices for a global trade war. However, there are plenty of other fears like inflation and growth out there that remain in play. The UK continues to lead the pain trade for FX with GBP at new yearly lows with 1.2750 in play again while NZD holds the G10 lead into the RBNZ meeting today. For most, the lack of big movements leave open hopes for carry trades, selling volatility and playing with bulls in equities. The only problem is in US rates where 3% 10Y looks vulnerable – particularly given Trump tweets for 5% GDP and the 10Y $26bn sale today. Time to go back to old school bond trading and look at the September futures – the skinny range looks set for a breakout.

Question for the Day: Do the OECD composite leading indicators matter? The OECD August CLI reports out and it show easing growth momentum in Canada, Europe – with Germany, France and Italy slowing – along with the UK. There is stable growth in the US and Japan. China and India are gaining while Brazil and Russia easing. Does any of this matter to markets today? Probably not but it highlights the risks for Europe into a ECB potential taper and the tantrum that could follow may be troublesome for the world and politics again.

Leave A Comment