Oil markets have whipsawed in recent weeks. Prior to the November 30 meeting of OPEC countries and Russia in Vienna, Austria, there was serious doubt about OPEC’s ability to cut production.

For starters, OPEC member countries in Saudi Arabia, Iraq, Iran, Nigeria, Venezuela, and others often have diverging objectives. Iran has only recently been readmitted into the international fold, and it is determined to ramp up production and maximise revenues from oil. Saudi Arabia and Iran are regional foes, and consensus between these two countries is often difficult to come by.

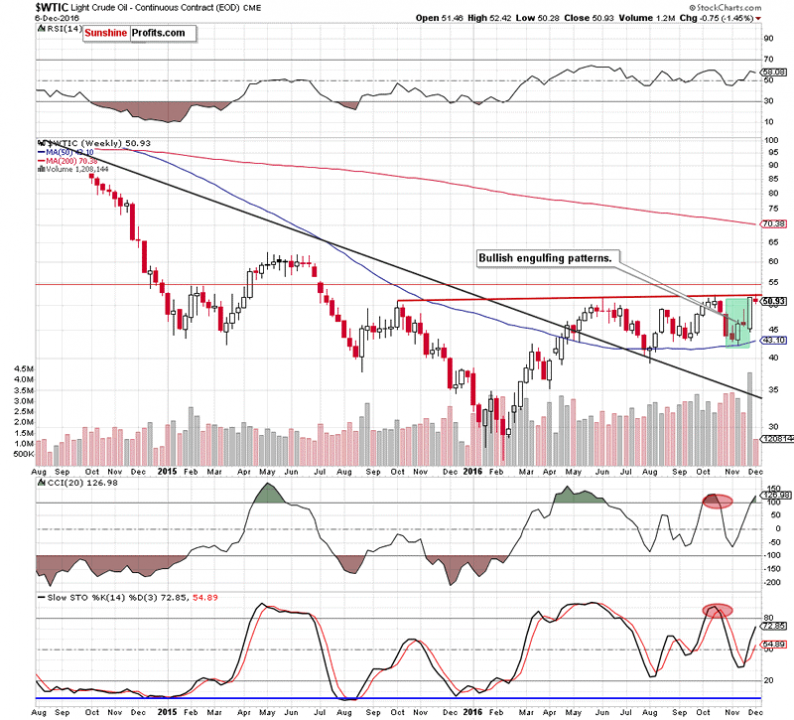

Nonetheless, OPEC announced that member countries had agreed in principle to cut production by some 1.2 million barrels per day. This is a significant milestone given that no agreement on production cuts has been brokered for years. Markets reacted as expected: the oil price rose and global indices roared to life.

The Nymex Paradigm Sets the Stage for Binary Options Traders

The oil market, like so many other commodities markets, is subject to locked-in contracts. In other words, sales for coming months are now locked in at approximately $50 + per barrel of crude oil.

Companies don’t want to be paying more for crude oil if the price rises, but at the same time, they don’t want to be selling crude oil for less if the OPEC deal falls apart at the seam. They are effectively hedging their bets with massive contracts extending well into 2017. This is evident at top binary options brokers where traders are following the Nymex paradigm and placing call options on crude oil. The optimism in oil prices is seen in the volume of trading to lock in deals. This hedging philosophy will obviously have the effect of flattening out the futures curve for crude oil.

Thus, we will ultimately see downward pressure being exerted on the crude oil market in 2017. OPEC on its own is incapable of manipulating the oil price significantly. It needs Russia and WTI crude oil producers to cooperate to raise the price of crude oil.

Leave A Comment