This is starting to feel like a repeat of the 2016 elections, financially speaking. Nervous capital exited the stock market in September/October 2016 before the elections. Gold rebounded in October 2016 as a safe-haven. Trump won, fear collapsed, and money rushed back into stocks and out of gold.

We see a similar setup this year between stocks and gold. The question is will we get the same results. I think it depends on the polls. If the Republicans maintain majorities in the House and the Senates, then yes, I think the stock market rallies sharply, and gold falters into the December rate hike. If the Democrats take the House and the Senate, then stocks may remain weak, and gold could flourish. A split House and Senate will probably produce mixed results.

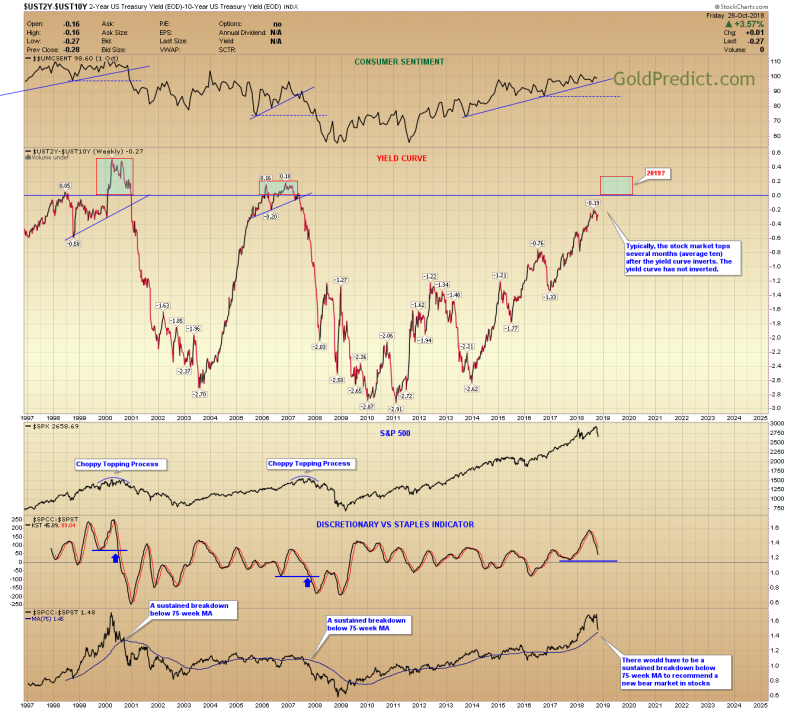

Some are calling for a new bear market in stocks. I just don’t see it yet. The yield curve hasn’t inverted, and the 10-year only reached 3.25%. I’d be stunned if that was enough to push the US into a recession with Q3 GDP growth at 3.5%. I think stocks will reach new highs next year and probably rollover in late 2019 or early 2020.

It looks like miners reached October tops on Tuesday and they may be leading metals lower. Gold could remain buoyant as a haven until the stock market begins to stabilize. Metals could spike to fresh cycle highs as we approach the elections.

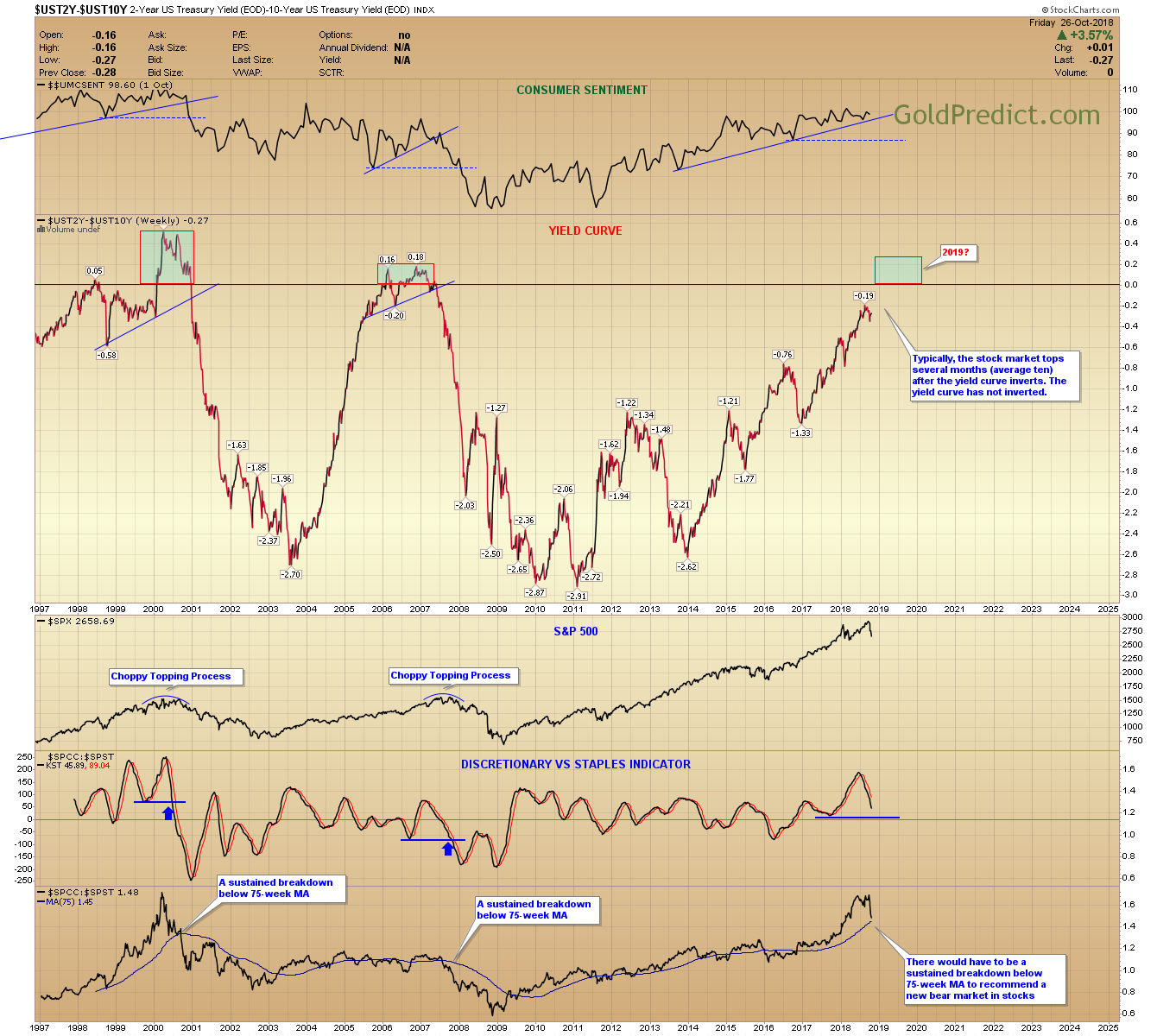

YIELD CURVE

Typically, the stock market tops several months (average ten) after the yield curve inverts. The yield curve has not inverted. Though we’ve seen a shift in the discretionary versus staples indicator (bottom indicator) the ratio remains in positive territory.

SPY

There are many similarities between now and the 2016 elections. Investors sought safety until the balance of power became clear. Then money fled gold and jumped back into stocks. I believe we will see something similar this year.

The stock market is already oversold. We have positive divergences building in the MFI and NYMO indicators. The ABC measured target suggests prices could reach the 259/260 level. However, it wouldn’t surprise me to see a spike to the longer-term trendline near 255.

Leave A Comment