The EIA has just released its production numbers for crude oil and natural gas. We think there are a few things that are worth noting about this report, given the recent price action we have seen in crude oil and natural gas prices:

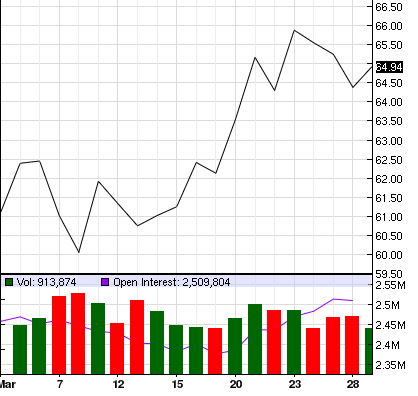

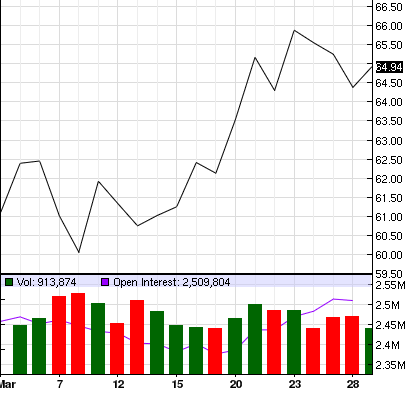

As you can see, prices are beginning to rebound to close out the month. As we enter April however, we may see some pressure given that production has risen.

U.S. crude production rose by 6,000 barrels per day (bpd) in January to 9.964 million barrels per day, the Energy Information Administration said in a monthly report on Friday.

The agency revised the December report up by 9,000 barrels to 9.958 million bpd. The gains were driven by a rise in offshore production, which rose 5 percent to 1.62 million bpd from 1.55 million bpd.

Production decreased modestly in the major oil-producing states of Texas and Alaska, while North Dakota’s production rose slightly to 1.16 million bpd a day, EIA said.

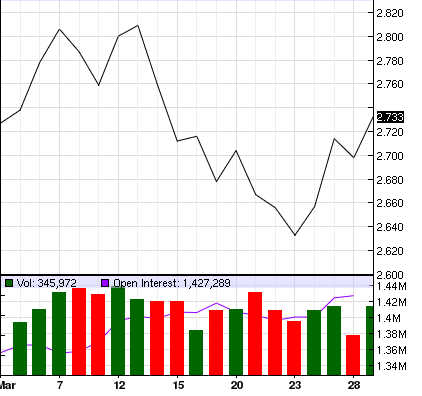

What about Natural gas, which has had so many concerns over supply being plentiful?

Well, U.S. natural gas production in the lower 48 states dipped by 1.4 percent to 86 billion cubic feet per day (bcfd) in January, though that still represented a 9.9 percent increase from a year ago, according to EIA’s monthly production report. Production fell by 2.8 percent in Texas, the top natural gas producer, to 22 bcfd, and was also lower in Pennsylvania and Louisiana.

Production in Oklahoma rose to 7.51 bcfd, a new record for that state, the third biggest producer in the lower 48.

As we move forward, we will be closely watching these production reports, and will further be keeping an eye on the weekly supply reports put out. A cold winter certainly helped, but natural gas stocks are not going to start moving until natural gas gets back over $3. Oil prices above $60, but even more so above $70, are sufficient for the bottom line of most oil companies.

Leave A Comment