Most readers know what I’m going to say. World oil supply flows from three big geographic regions: North America, Russia, and the Middle East. Two-thirds of that supply is consumed by OCED members U.S., Japan, Korea, Germany and the rest of Europe. Throughout the past several decades, world oil supply/demand looked like this:

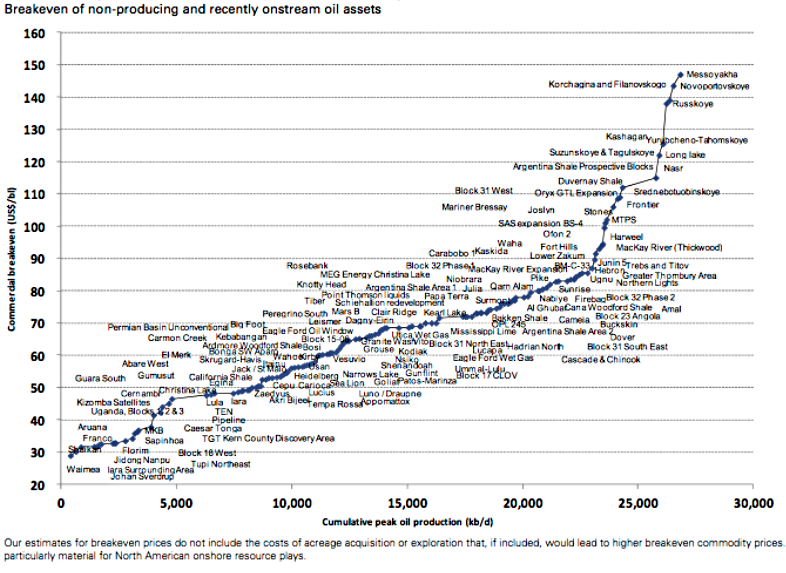

High prices boosted supply in the United States from unconventional plays in North Dakota, Texas Eagle Ford and Permian, Oklahoma Mississippian Lime, Colorado Niobrara, and Canadian heavy bitumen. We began to brag about “energy independence” in North America. Then the bottom fell out — not only for shale frackers, but globally. This Goldman Sachs chart shows the estimated break-even for worldwide oil assets:

Bottom line: No one can profitably produce oil at $30 bbl. Mega projects like Kashagan won’t make a penny of profit under $125. Bakken shale needs $70 to survive. So the first takeaway is more layoffs, capex cuts, consolidation, and likelihood of HY defaults in the shale space. Whiting and Continental are in a world of hurt, suspended frac ops. Imagine what that’s done to the oil service sector led by Baker Hughes and Halliburton.

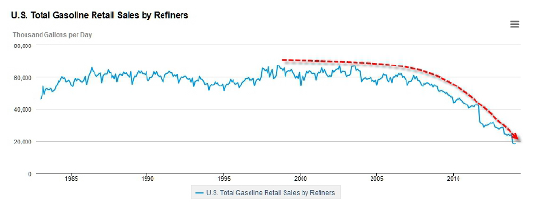

My friend Dominic Frisby at Moneyweek thinks there’s a buying opportunity in small caps. I doubt it. The basic problem is collapsed demand for gasoline:

I won’t try to guess the equilibrium price for U.S. gasoline. Most retailers live or die on their convenience store food and drink sales. Gas could be $1 or $3, and it would still be a struggle to keep their doors open. Major brands quit the retail market years ago. No profit in it. The refining business suffered a similar retrenchment, partly on regulatory burdens, but mostly because their ROI outlook evaporated. No matter which segment of the supply chain you investigate, oil is dead. Super-tankers are parked full of oil offshore Galveston and others are taking the long way around South Africa instead of using the fast route through Suez. Cushing is full to the brim. Folks are talking about building more storage for unwanted oil.

Leave A Comment