Financial markets are considered a forward-looking discounting mechanism. It means they anticipate future events and that current market prices discount or reflect all available information about present and potential events. The markets are, therefore, leading indicators of fundamental and economic data.

In the stock market, it is all about expectations. Analysts and investors estimate future corporate earnings/profits. Participants express their views on the market, and thus on the economy as well, with their investment decisions. The stock market, therefore, leads economic activity. It peaks and troughs ahead of the economy, usually about six to nine months earlier.

Consumer-driven economy

The consumer is a vital component of the U.S. economy. Personal consumption expenditures (PCE), i.e. consumer spending, is the largest segment of the GDP, making up almost 70% of the total. Thus, economic growth is very dependent on the consumer.

Housing and retail are key industry groups or sub-sectors within the consumer sector. Home equity value heavily affects consumer spending. Retail sales comprise about one-third of GDP. Analyzing the price performances of company stocks in these two industries can give valuable clues to consumer spending.

Indexes of housing and retail stocks are reliable indicators for the two markets. They measure consumer confidence or the attitude the consumers have towards the stock market and the economy. If the indexes are rising, it suggests consumers feel optimistic about the current state and outlook for the US stock market/economy. Vice versa if the indices are falling.

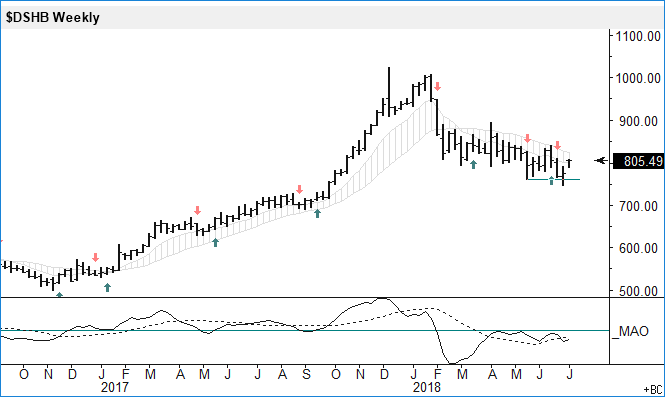

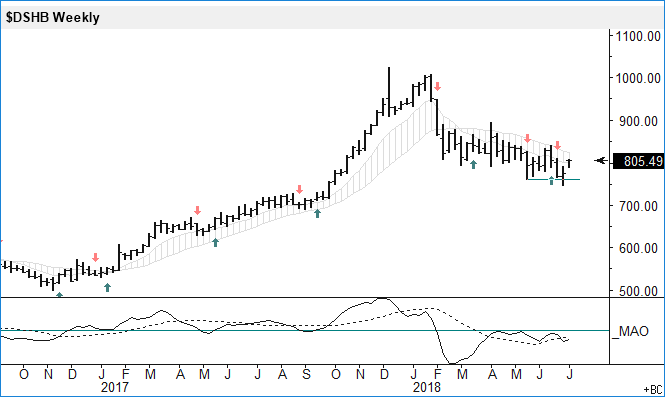

Earlier I showed a monthly chart of the Housing Index ($HGX). Now I show weekly charts of the DJ Home Construction Index ($DSHB) and the S&P 500 Retailing Index ($SRLX). The former has been falling this year. I still consider the longer-term trend to be up if $DSHB stays above 761.

$SRLX, on the other hand, is up 27% for the year and the trend is clearly to the upside, which is very bullish for the broad market and the economy in general.

Leave A Comment