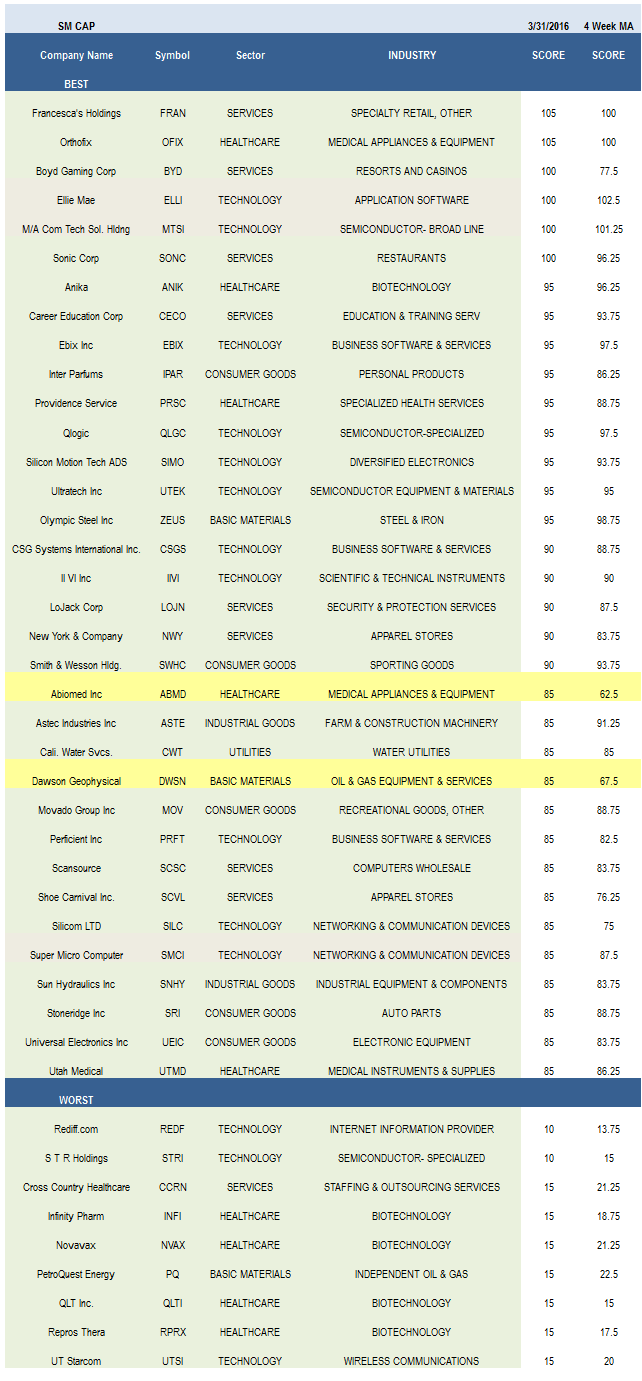

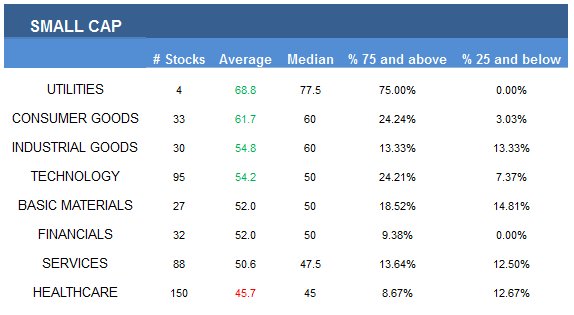

The average small cap score is 51.16 and that’s below the four week average score of 52.54. The average small cap stock in our universe is trading -36.39% below its 52 week high, -5.45% below its 200 dma, and has 8.19 days to cover held short.

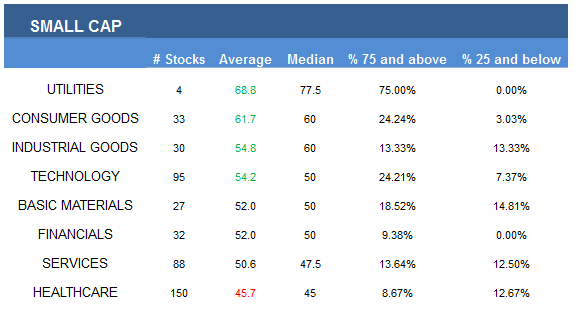

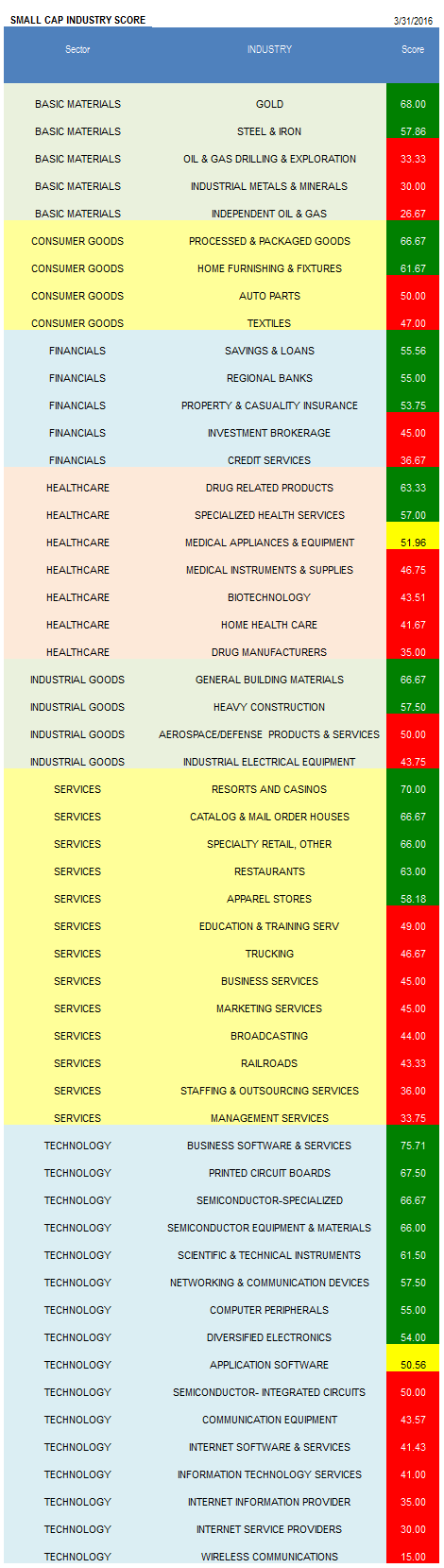

Utilities, consumer goods, industrial goods, and technology stocks score best. Basics, financials, and services score in line. Healthcare scores below average. Scores will shift to reflect second quarter seasonality next week.

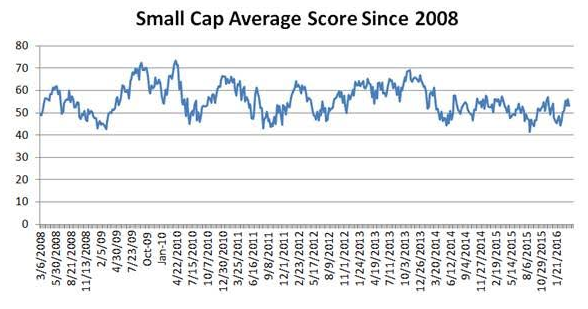

The following chart shows historical small cap scores since the Great Recession.

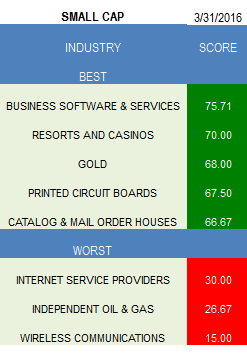

The best small cap industry is business software (EBIX, CSGS, PRFT). Resorts & casinos (BYD, PENN), gold (GSS, DRD), printed circuit boards (BHE, SANM, MFLX), and catalogs (NSIT) also score high.

Gold and steel & iron (ZEUS, ROCK) are strongest in basic materials. Processed & packaged goods (BDBD, MGPI) and home furnishings (ETH) are best in consumer. S&Ls (NWBI, OCFC, FBC), regional banks (CFNL), and P&C insurers (UFCS) can be bought in financials. The top healthcare baskets are drug related products (MTEX) and specialized health services (PRSC). General building materials (NCS) and heavy construction (GVA) are strongest scoring in industrial goods. In services, concentrate on resorts/casinos, catalogs, and specialty retailers (FRAN, HZO). Business software, printed circuit boards, and specialized semiconductor (QLGC) are high scoring in technology.

Leave A Comment