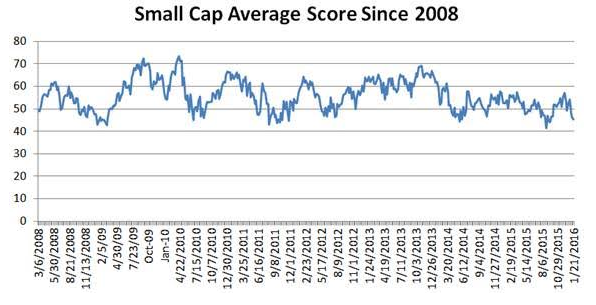

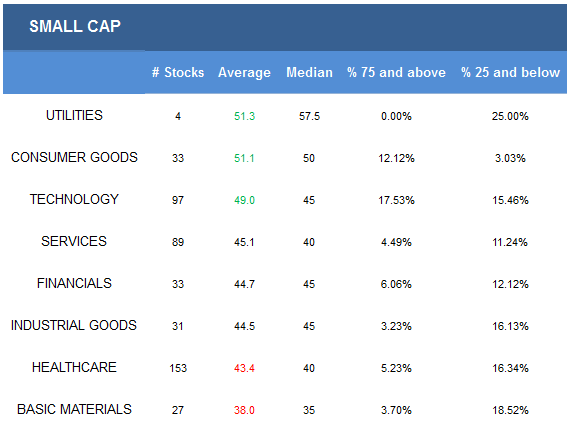

The average small cap score is 45.34 and that’s below the four week average score of 48.33. This week’s score is also within a range that has been historically a solid period to begin buying stocks again. The average small cap stock is trading -40.17% below its 52 week high, -16.28% below its 200 dma, and has 7.96 days to cover short.

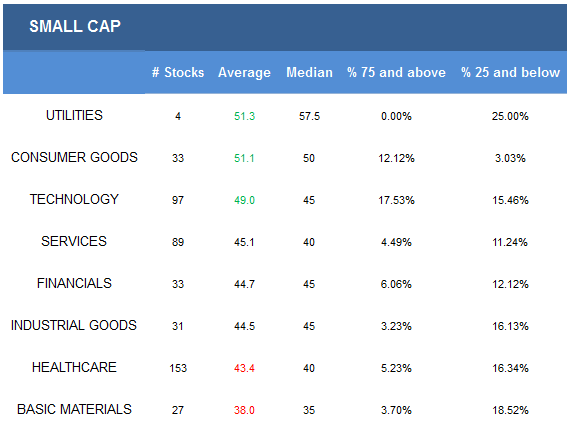

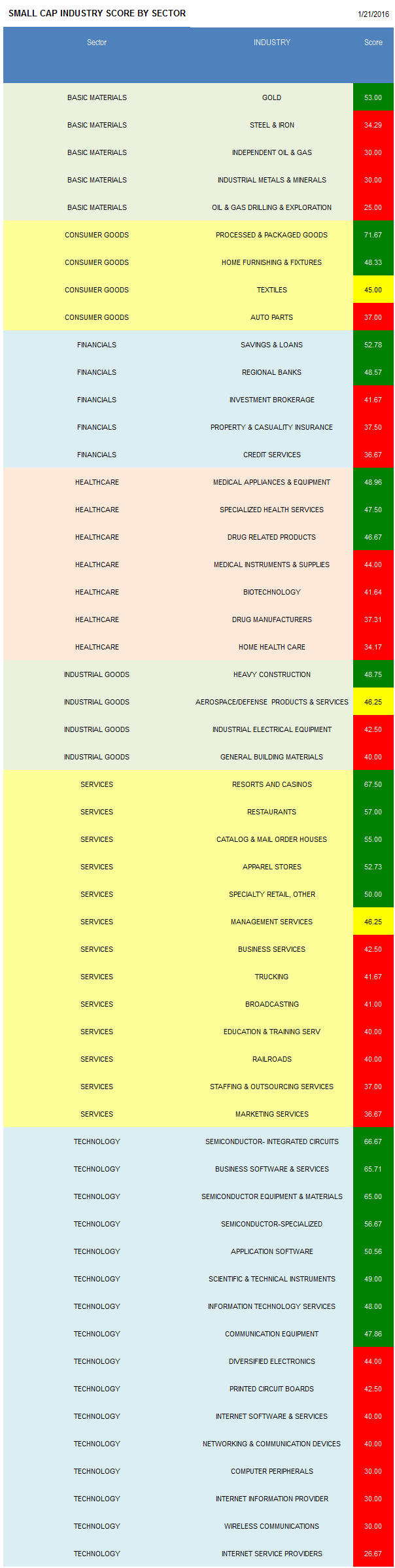

Utilities, consumer goods, and technology score best across our small cap universe. Services, financials, and industrial goods score in line. Healthcare and basics score below average.

Small cap buy points typically occur when scores get below 50.

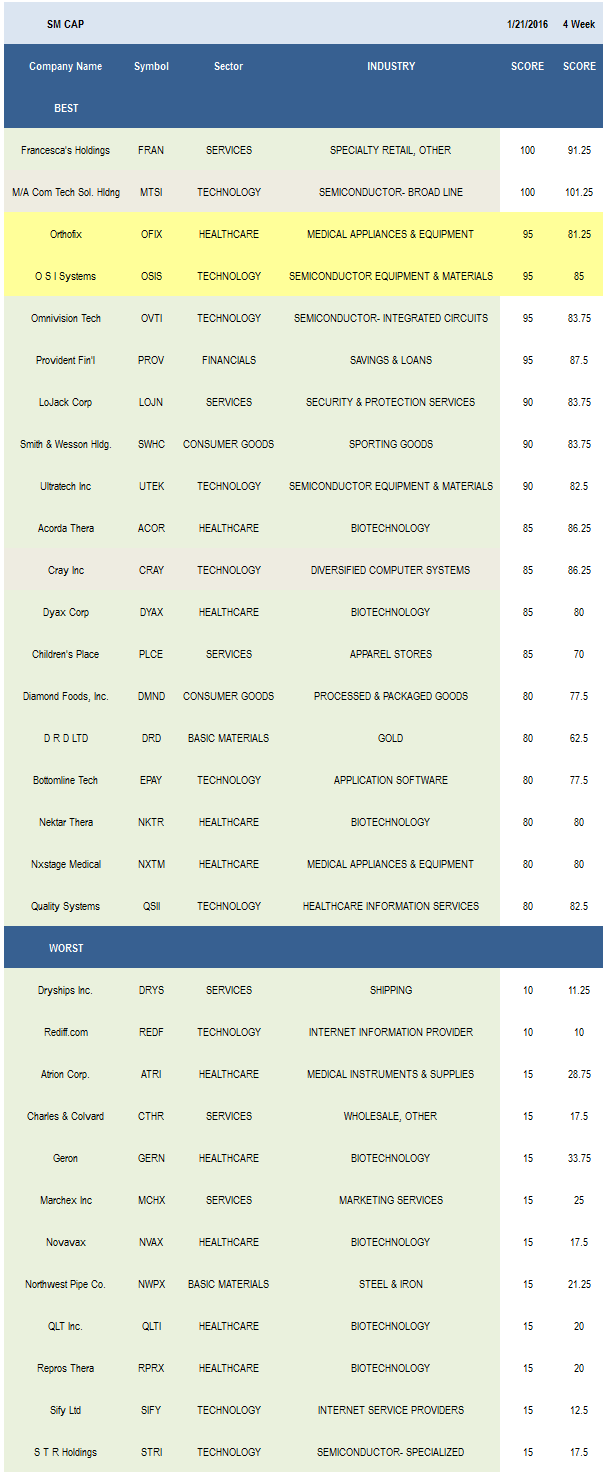

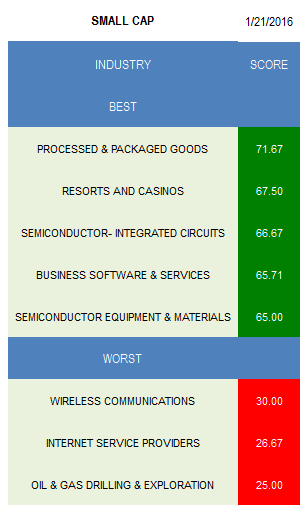

The best scoring small cap industry is processed & packaged goods (DMND, BDBD). Three technology industries rank in the top five industries this week: semi ICs (OVTI), business software (TSYS, EBIX, PRFT), and semi equipment (OSIS, UTEK). Resorts & casinos (MCRI, CNTY, BYD) can also be bought.

In basics, only gold stocks (DRD, HMY) score above average. Processed & packaged goods and home furnishings (SCSS) score above average in consumer goods. The top financials groups are S&Ls (PROV, NWBI, BRKL) and regional banks (CFNL). In healthcare, buy medical appliances (OFIX, NXTM), specialized health services (PRSC), and drug related products (NAII). Heavy construction (GVA) is the only industrials basket with an above average score. Resorts & casinos, restaurants (SONC, BJRI), and catalogs (FLWS) are top scoring in services. Semi ICs, business software, and semi equipment are the strongest scoring technology groups.

Leave A Comment