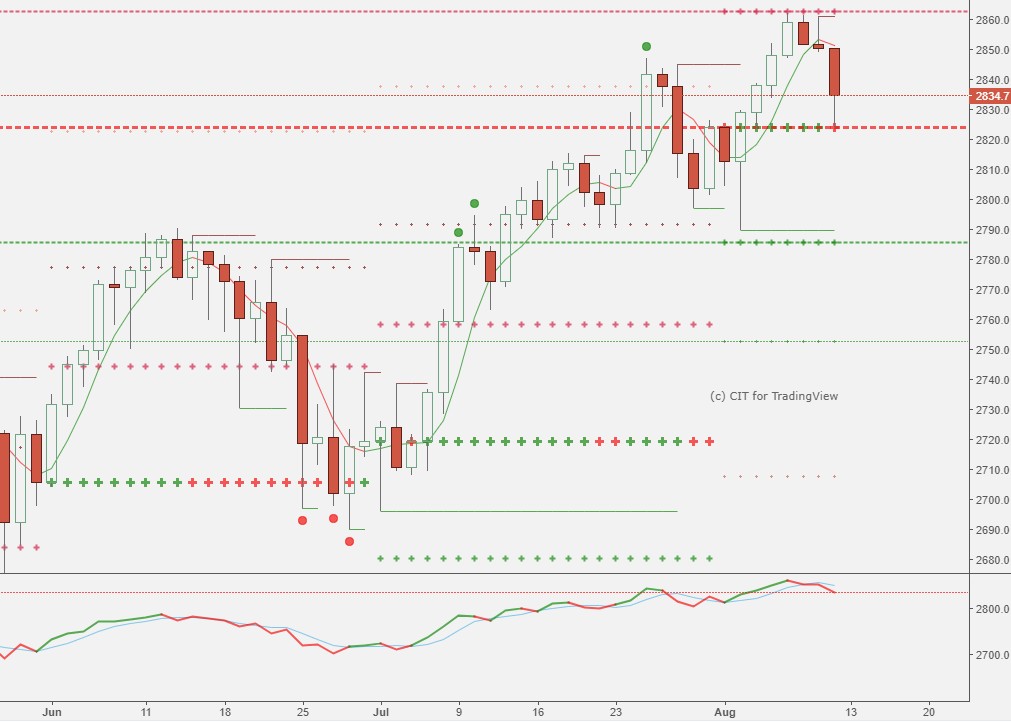

We’ve mentioned before that the SPX has a tendency to move within well-defined technical levels, and this proved to be the case last week as well. After reaching the CIT Pivot R1 level, the futures retreated and found support at the monthly CIT Pivot level. These will remain the key levels to watch next week for signs of swing reversal or continuation (2823.5 – 2852):

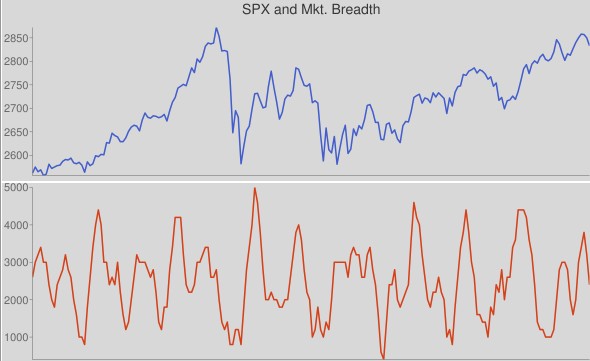

Market breadth started deteriorating on the 8th, and is currently 1-2 days away from getting oversold:

Here are the monthly CIT pivots for SPX.

Pivot: 2825, S1 – 2787, S2 – 2750; R1 – 2862, R2 – 2900

According to OddsTrader, the projected trading range for next week for SPX is 2800-2888.

Oil found support at the projected low target and staged a reversal.

The projected trading range for oil for next week is 64.5 – 69.5.

GOLD traded flat just above our low target but remains in a downtrend.

The projected trading range for gold for next week is 1192 – 1230.

Our long-term target for gold remains 950.

The forex universe sprang back to life reflecting USD strength in almost every G6 pair, the only exception being USDCHF which continues trading within the 0.985 – 1.00 range for the fourth month in a row.

USDJPY remained on a sell signal, and the CIT Oscillator is nearing oversold levels.

The projected trading range for USDJPY for next week is 110 – 112.

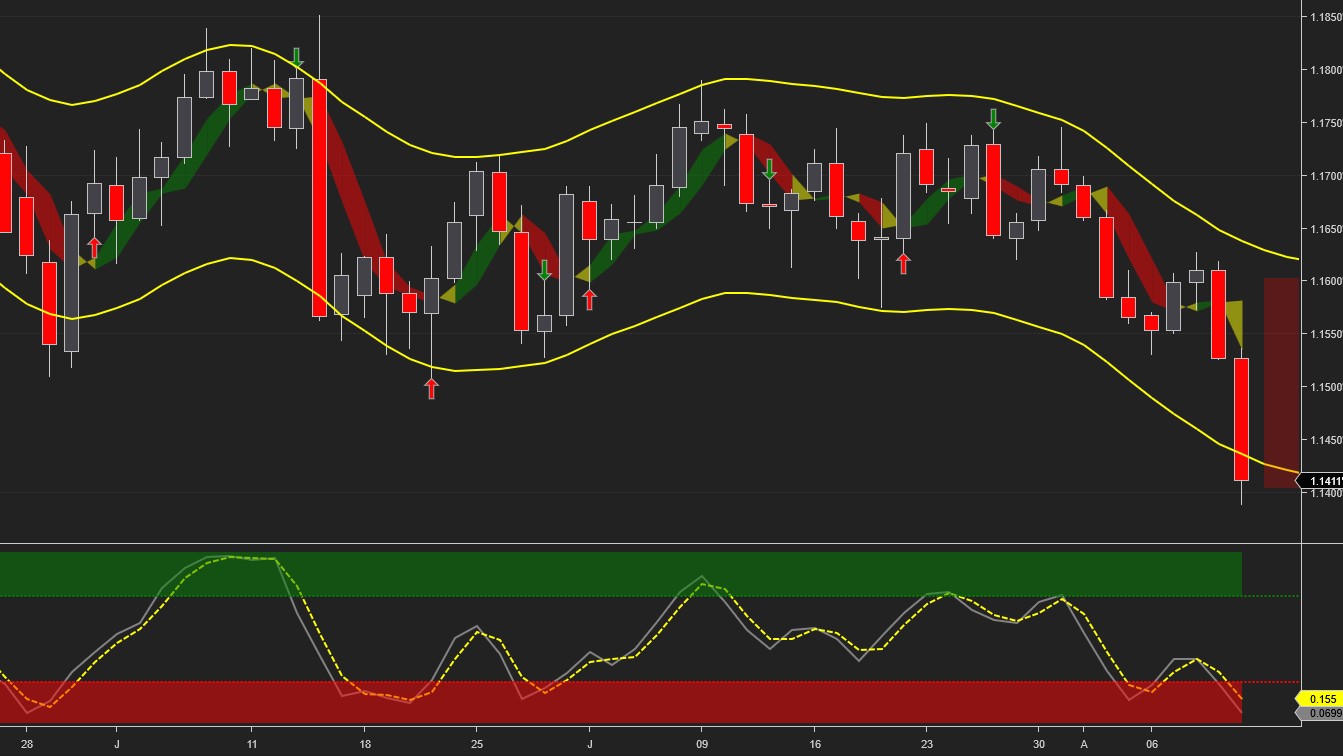

EURUSD remained on a sell signal, and sliced through support and the low target projection.

The CIT Oscillator is in oversold territory, which usually precedes a counter-trend swing.

The projected trading range for EURUSD for next week is 1.14 – 1.16.

?

The GBPUSD downtrend continued, slicing through support and our low target.

The CIT Oscillator has reached oversold levels, and a technical bounce is expected.

The projected trading range for GBPUSD for next week is 126.5 – 129.5.

Leave A Comment