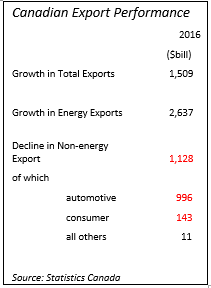

While the headlines suggest that Canada’s merchandise trade is back on track after recording a surplus of nearly C$ 1 billion in December 2016, looking at the year overall, the export sector continues to fall short of expectations. Canadian government officials are cheering for a bounce in non-energy exports to fill the hole created by the collapse of energy prices since 2014. But 2016 seems to be yet another year of disappointments (Chart 1).

Chart 1

Exports grew by over C$1.5 billion in the year with energy exports growing faster than total exports. The downfall occurred with non-energy exports which declined by C$1.2 billion, lead principally by the fall off in the automotive sector. Even the energy sector performance is illusionary, as energy prices advanced by 16.0 per cent, energy-export volumes fell 0.6 per cent. While the boost in energy prices is most welcome, there is no substitute for greater market penetration and that continues to plague the Canadian industry.

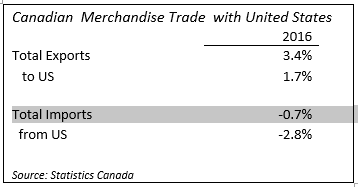

Canadian exports worldwide have performed relatively well and grew by 3.4 per cent last year. Regionally, however, export growth into United States, slowed to just 1.7 per cent. Imports declined in 2016, due in large measure to the slowdown in the domestic economy (see Chart 2)

Chart 2

Why is the Bank of Canada so worried about export sector? Firstly, the Canadian dollar is currently at recent high (USD/CDN=1.30). Without a weakening of the Loonie non-energy exporters will continue to struggle. Secondly, and perhaps the most worrisome, is that Canada has a huge cloud of protectionism hanging over its head. Currency issues have a way of resolving themselves usually satisfactory in the market place, but political forces that drive protectionism rarely have a satisfactory outcome. While Canada-U.S. trade flows are relatively in balance, the prospect of re-writing the NAFTA agreement causes considerable angst, most notably, among the automotive and agricultural industries.

Leave A Comment