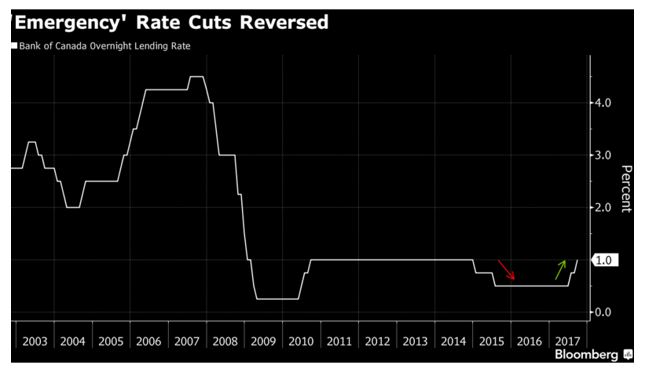

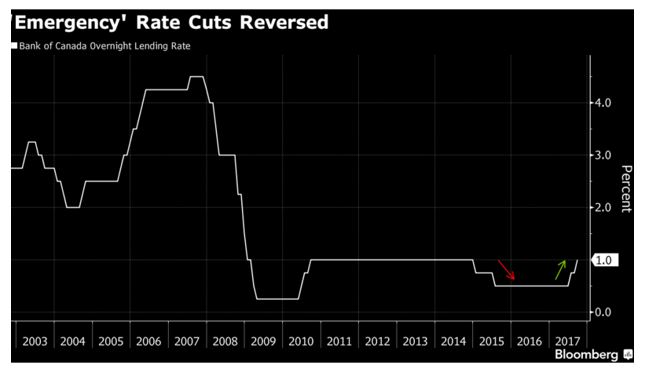

It is not by change that economists were divided as to whether the Bank of Canada would hike its policy rate, and for good reason. While the Bank, indeed, did raise the overnight rate by a ¼ of point to 1% today, the accompanying statement was similar to that of the proverbial“ two-handed economist”.

Initially, the Bank cut the rate twice in 2015 as an emergency measure in response to the collapse of oil prices in late 2014. The Bank was quick to label these cuts as necessary to bring relief to an economy that was hard hit. Now, the Bank believes that such emergency measures are no longer needed.

Let’s look at two-handed nature of the Bank statement.

On the One Hand. The Bank stated that “recent economic data have been stronger than expected, supporting the Bank’s view that growth in Canada is becoming more broadly-based and self- sustaining.…[citing] There has also been more widespread strength in business investment and in exports…. and [that] global economic expansion is becoming more synchronous”.

However, in contrast, the Bank’s own forecasts in the July Monetary Policy Report (MPR) anticipates that growth in 2018 and 2019 will be less than 2%, a far cry from the recent performance pushing up against 4%.

On the Other Hand.To begin with, the Bank stresses that “there remains some excess capacity in Canada’s labour market, and wage and price pressures are still more subdued than historical relationships would suggest, as observed in some other advanced economies.” This begs the question of why tighten monetary policy when there is no threat of inflation and inflationary expectations remain well in check.[1]

Furthermore, the Bank makes it quite clear that there are downside risks to the economy. It cites that “significant geopolitical risks and uncertainties around international trade and fiscal policies remain, leading to a weaker US dollar against many major currencies.” In other words, exports stand to lose should the Canadian dollar continue to strengthen, putting the optimistic growth scenario at considerable risk.

Leave A Comment