Let’s start with several developments in Japan.

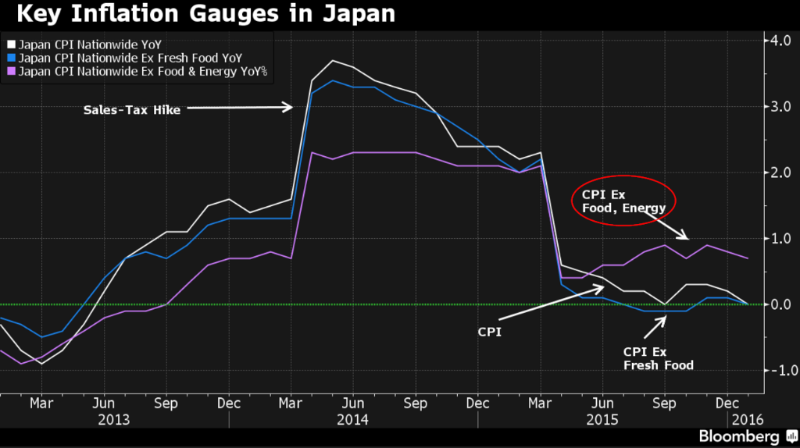

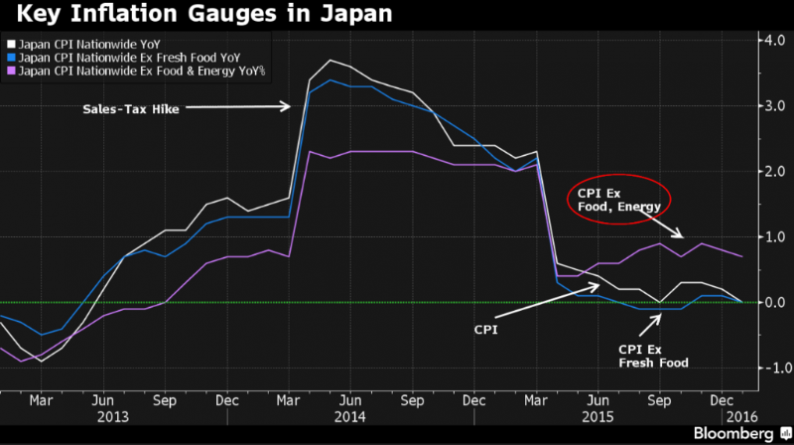

1. The BOJ’s core CPI measure disappoints, as the 2% inflation target remains elusive. The situation is further exacerbated by the recent strengthening of the yen.

Source: @business

2. The 10yr JGB yield continues to drift deeper into negative territory.

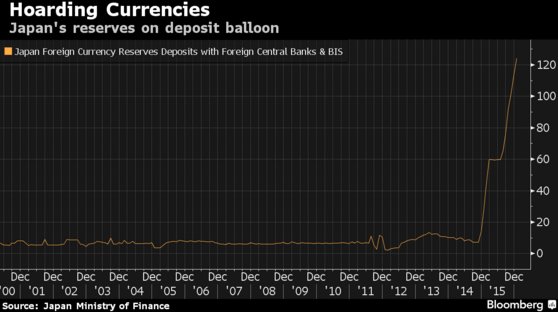

3. It seems that the Japan’s central bank had sold treasuries in response to the Fed’s rate hike – a rather naive move. Whatever the case Japan’s official accounts are now sitting on a great deal of dollar deposits.

Source: @markets

4. Japan’s population has officially started to decline as the nation faces daunting demographic challenges.

Source: the Guardian

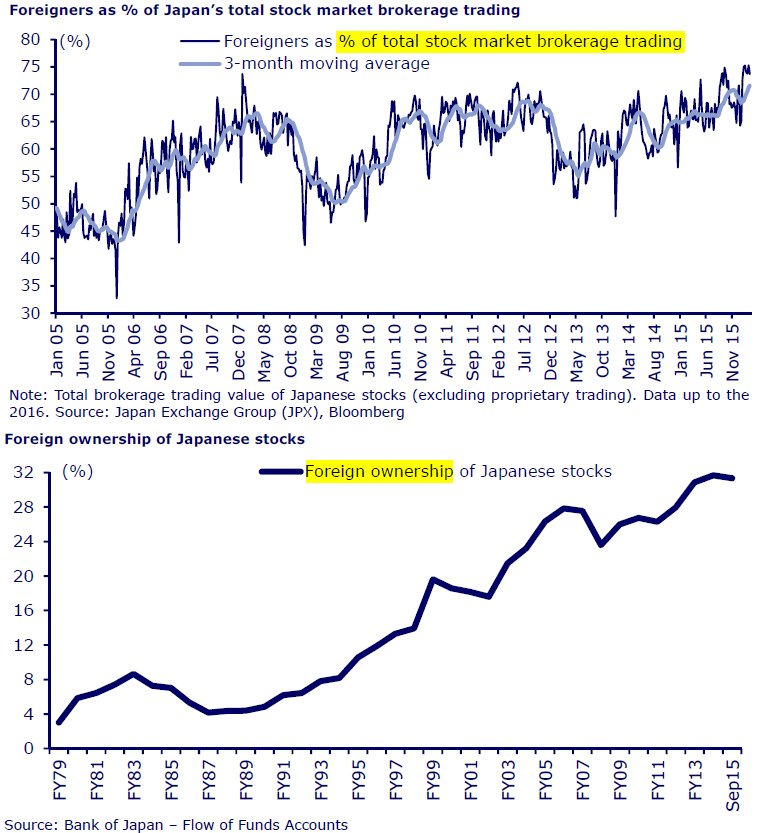

5. Foreigners dominate Japan’s equity markets.

Source: CLSA – GREED & fear

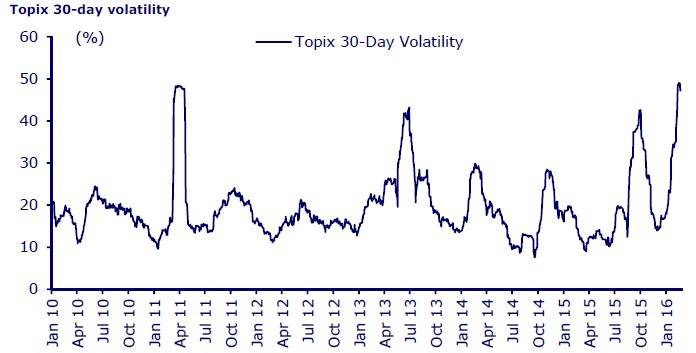

That’s why the recent international market jitters were exacerbated in Japan, with volatility spiking to levels not seen since the Fukushima Daiichi nuclear disaster.

Source: CLSA – GREED & fear

Now let’s look at several items in the Eurozone.

1. The 5yr German government bond yield hits record low as the ECB stimulus expansion approaches.

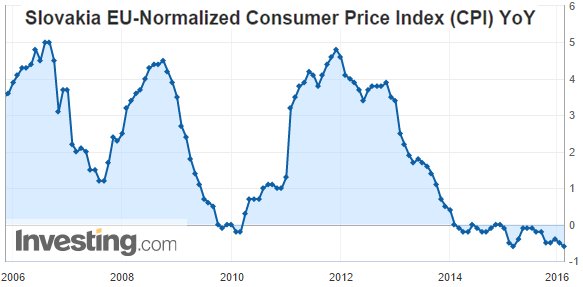

2. Related to the above, deflation remains a concern in several member states. Here is Slovakia’s CPI.

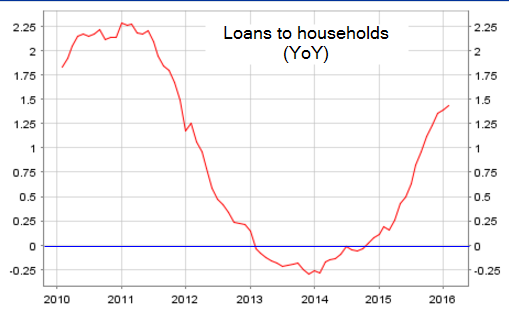

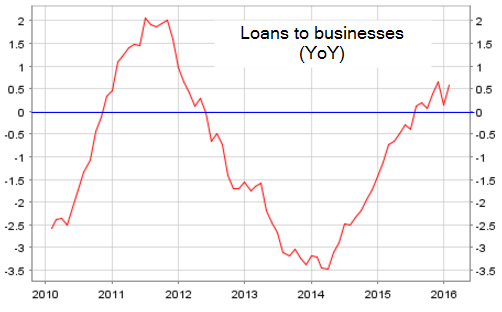

3. Credit expansion in the Eurozone remains tepid but thus far loan balances continue to rise. Will the recent selloff in the banking sector dampen this nascent recovery as banks limit balance sheet usage?

Source: ECB

Source: ECB

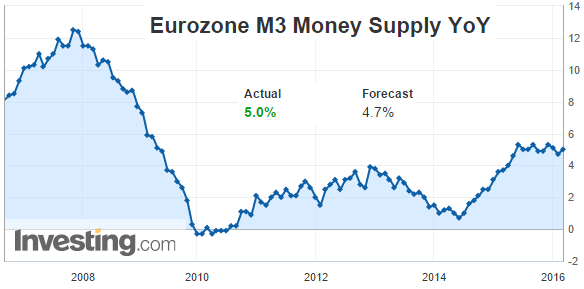

The best indicator pointing to continuing credit expansion in the Eurozone is the broad money supply – which grew a bit faster than expected. The March report on loans and money supply will be crucial because it will tell us if the banking system is once again retrenching.

Elsewhere in Europe we see Switzerland’s industrial production, orders contract. The Swiss franc’s strength is creating significant headwinds for growth.

Leave A Comment