We begin with the UK where the Bank of England struck a decisively dovish tone.

Source: WSJ

The Federal Reserve now stands alone among the major developed economies in its quixotic quest to “normalize” monetary policy. More on this shortly. The British pound got hammered on this dovish news from the Bank of England.

Source: barchart

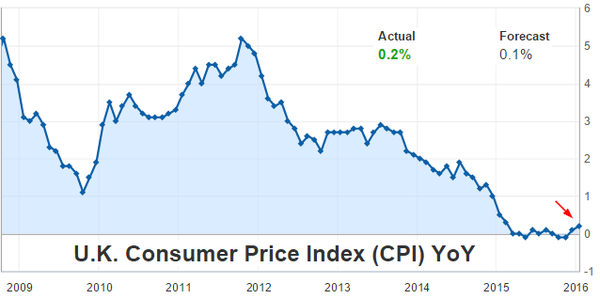

Carney wants to see inflation continue to stabilize (chart below) and a weaker pound should help offset the effects of falling oil prices.

Source: Investing.com

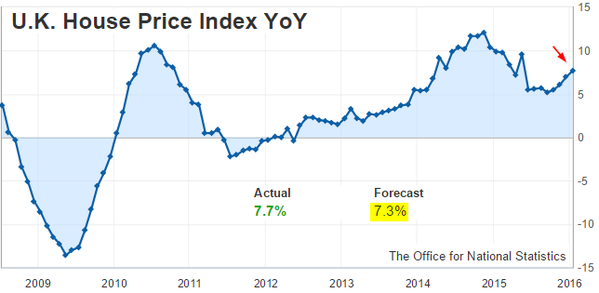

UK house price appreciation has accelerated recently and in a more “normal” environment the BoE would be paying attention. However, given the disinflationary pressures elsewhere, this now looks inconsequential for the BOE’s policy decision.

Source: Investing.com

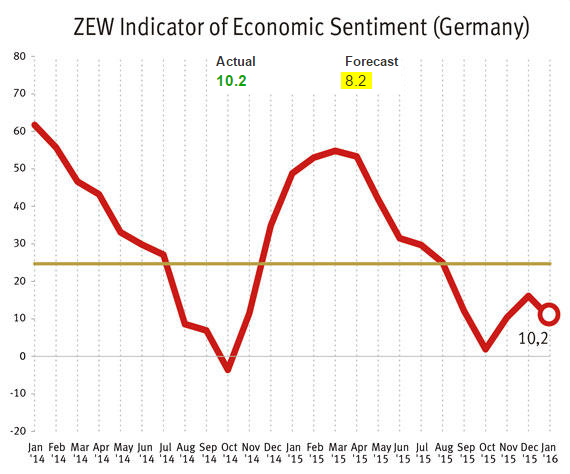

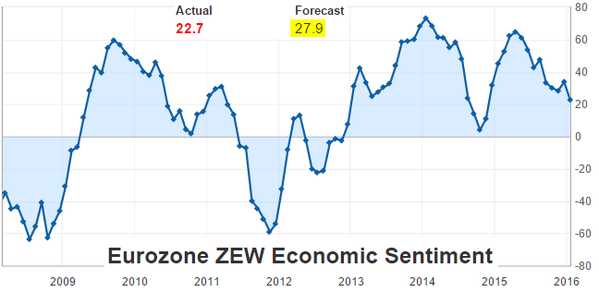

Continuing with Europe, the latest ZEW report shows softer economic sentiment in Germany and the Eurozone as a whole.

Source: ZEW

The ZEW index for the Eurozone in particular was materially below consensus, suggesting the region’s growth is facing new headwinds.

Source: ZEW, Investing.com

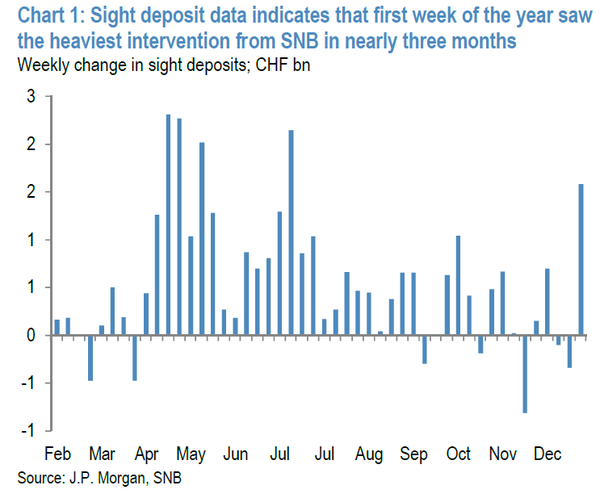

The Swiss National Bank has been quite busy this year as risk aversion increased demand for Swiss francs. The central bank had to intervene again to keep the Swiss currency from appreciating too much. That probably mans its balance sheet continues to expand – with the largest asset being the euro.

Source: @MatsGlettenberg, JPMorgan

Now let’s look at China again.

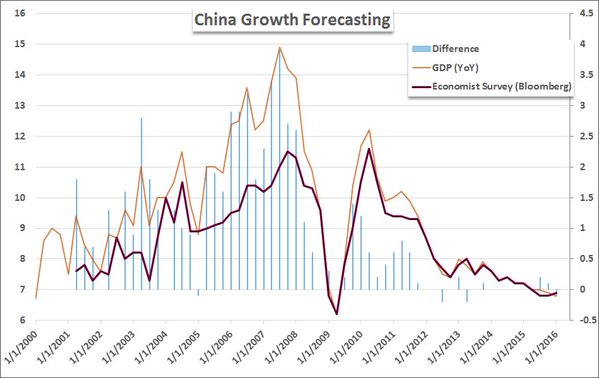

1. Forecasting China’s GDP growth has become quite easy as growth volatility has been “smoothed” out.

Source: @JohnKicklighter

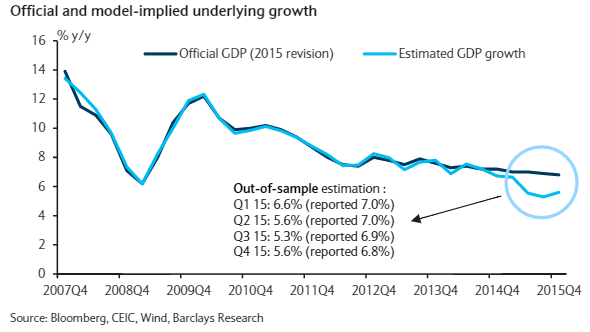

2. Barclays China GDP tracker has the Q4 growth rate at 5.6% vs. 6.8% reported. While diverging materially from the official figures, it does not indicate a “hard landing”.

Source: Barclays Research

3. China’s steel production posted its first year-over-year decline in 25 years.

Leave A Comment