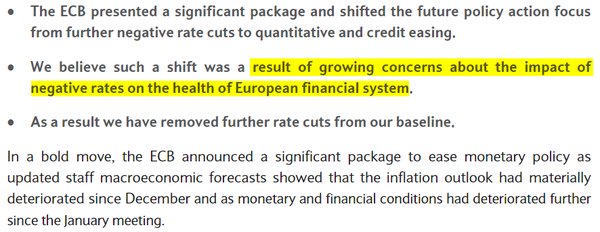

Once again we start with the Eurozone where analysts have focused on the rationale behind Draghi’s statement: “we don’t anticipate that it will be necessary to reduce rates further”. As discussed on Friday, Draghi’s ending of a further push into negative rates was meant to safeguard the financial system. Negative rates on reserve balances (which are rising due to QE) will hurt bank profitability and shake investor confidence – something we saw after the BOJ’s move.

Source: Barclays

On Friday the markets rewarded Draghi’s statement on negative rates by bidding up bank shares.

Source: Google

Here is the Italian bank share index.

The CoCo (contingent convertible notes) index yield fell further as the financial sector stabilizes. By the way, it’s unclear at this point if this market will survive in its current form, given what has transpired recently (particularly with respect to Deutsche Bank). The European Commission is trying to clarify some rules around coupon payments on this paper. More on the topic later.

Source: @SoberLook

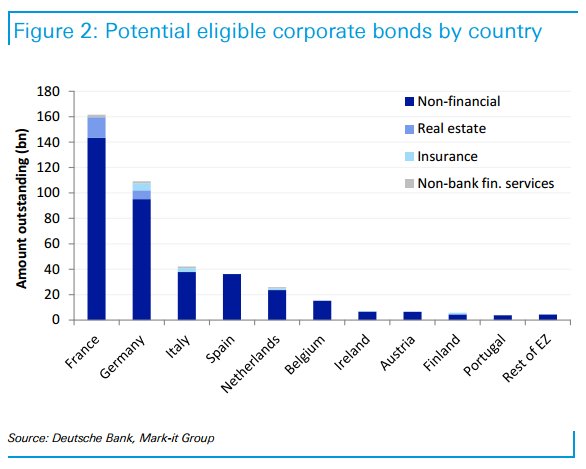

What about the ECB’s push into the corporate bond market? Non-bank financials have the greatest investment grade bond balances outstanding and will therefore benefit the most from the new program.

Source: HSBC

The next chart shows ECB-eligible non-bank corporate paper (investment-grade) by country.

Source: @tracyalloway, Deutsche Bank

What do banks think about the ECB’s credit easing efforts? They seem to view TLTRO (cheap financing for banks in return for lending to smaller firms and households) as being more effective than QE.

Source: @Fmirw

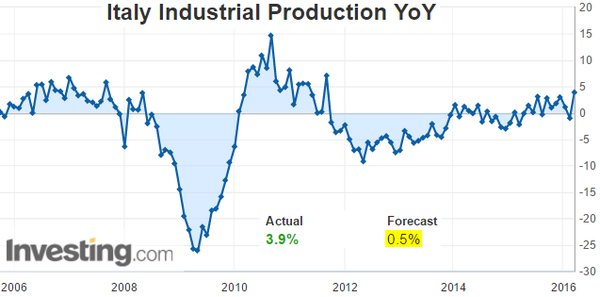

In other Eurozone developments, Italy showed surprisingly strong growth in industrial output. Will the GDP growth follow?

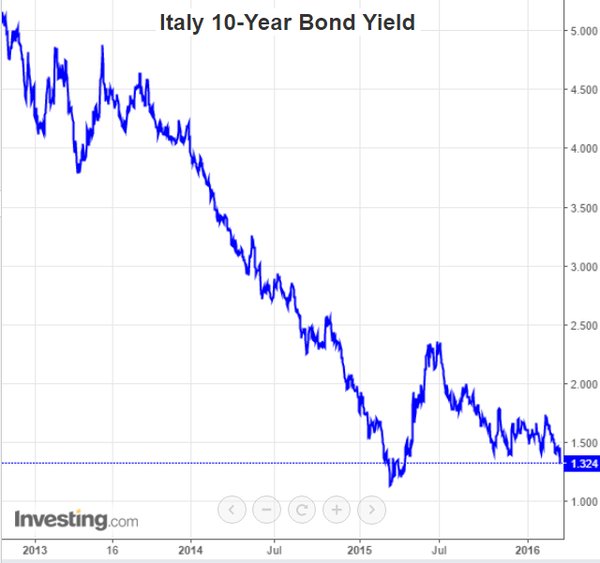

And here is Italian 10-year government bond yield approaching last year’s lows.

In fact Italy just issued 3-year government notes at negative yield. All is well.

Source: ?@tracyalloway

In Germany the anti-refugee backlash is translating into political victories for right-wing populist politicians. Will this have broader implications for the Eurozone and Germany’s leadership?

Source: The Spectator

Elsewhere in Europe, Romania is struggling with deepening deflation, its first in more than 25 years. This demonstrates that deflationary risks around the world persist.

Leave A Comment