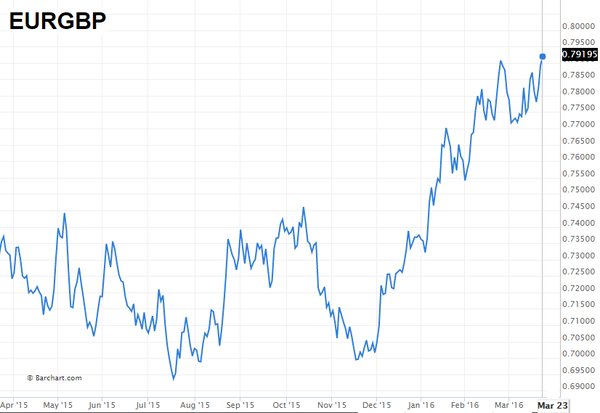

Let’s begin with the UK where a higher risk of Brexit is now being priced into the markets. Once again, the Brussels attack made a “yes” vote on Brexit more probable.

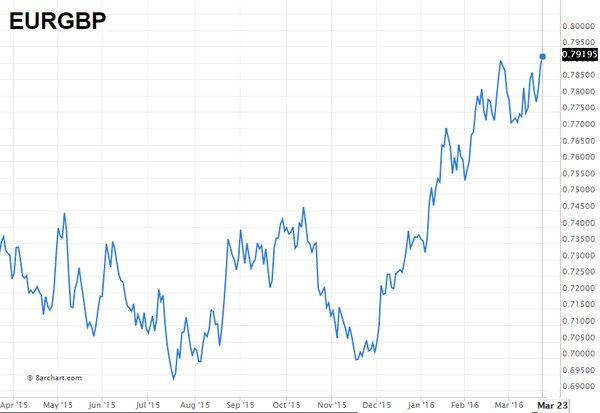

1. The euro-sterling exchange rose to the highest level in over a year (pound fell vs. the euro).

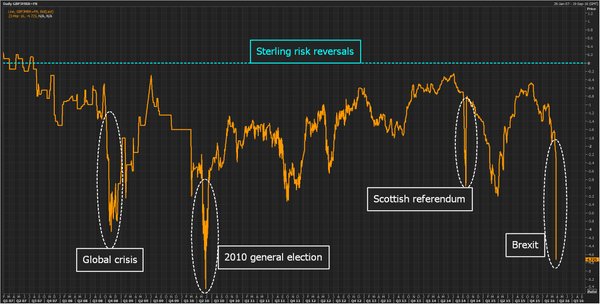

2. The British pound 3-month implied volatility jumped to a 6-year high – above the Scottish independence referendum (2014).

Source: @valuewalk

3. Sterling risk reversals fell sharply (this shows increased preference for GBP puts vs. calls).

Source: ?@ReutersJamie, X-axis: Q1-2007 – Q3-2016 (Reuters really needs to do something about their axis labeling).

4. We even see an increase in the UK sovereign CDS spreads. The default probability is of course tiny, but it shows that market participants are becoming more concerned.

Source: @Schuldensuehner, X-axis: Oct 2014 – April 2016

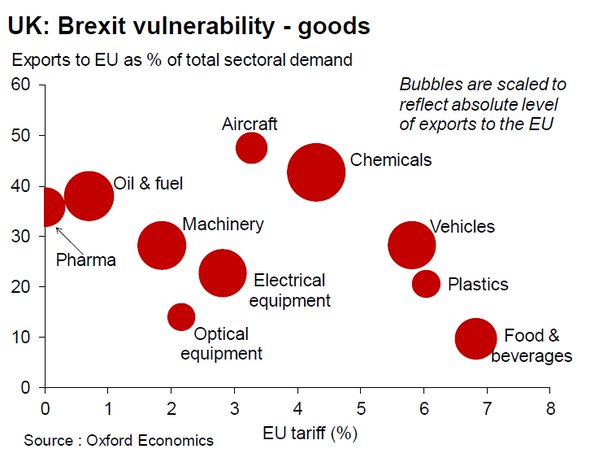

5. Here are the UK sectors that look vulnerable to Brexit, which will result in EU tariffs on UK products.

Source: @OxfordEconomics

Next, we look at some developments in the Eurozone.

1. Is the euro too expensive given the US – Eurozone rate differential? The real rate (inflation adjusted) differential, however, is not nearly as great.

Source: @MorganStanley

2. We now see negative corporate bond yields for some shorter-maturity bonds. Amazing. Thanks Mario!

Source: @markets

3. Prime real-estate yields are expected to decline as well, following corporate yields lower (property values will rise).

Source: ?@CapEconProperty

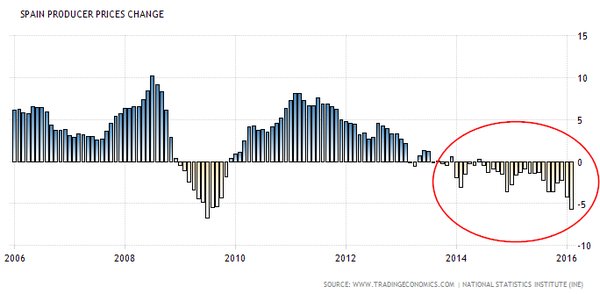

Separately, Spain’s PPI hit another post-2009 low as deflation risks remain.

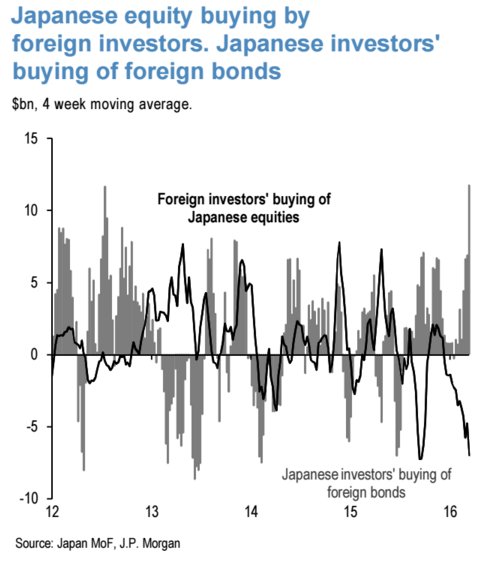

Switching to Japan, we see domestic investors buying foreign bonds to escape negative rates. At the same time, foreigners are selling Japanese shares. Neither seems to push the yen materially lower.

Source: JPMorgan

Separately, Mitsui, a huge Japanese firm with a significant focus on materials/commodities, saw its first loss in 70 years on writedowns. Shares gave up 8% immediately.

Leave A Comment