Greetings,

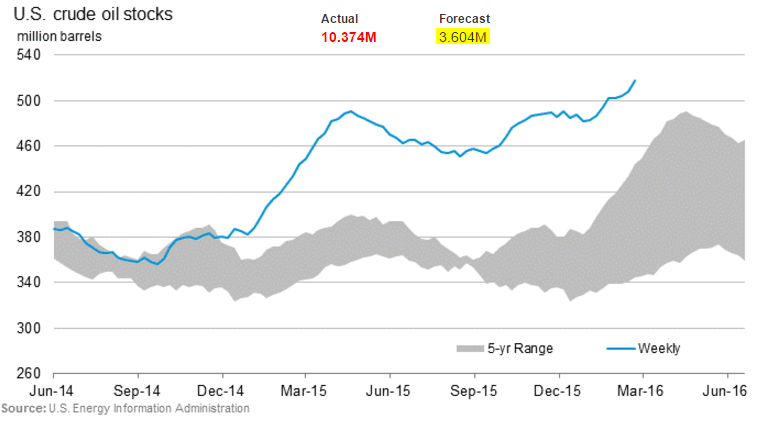

This morning we want to start with the energy markets where the latest US Department of Energy report confirmed yesterday’s API data regarding another large oil inventory build.

1. US total crude oil inventory reached a new post-1939 high. The second chart shows the inventory level in terms of days of supply. This increase was materially larger than expected.

2. Oil inventories at Cushing, OK (WTI futures settlement hub) hit another record. The increase was also higher than forecast.

The markets shrugged off this development, as WTI futures approach $35/bbl.

Source: Investing.com

3. One development that was a bit surprising is the selloff in crude oil storage futures – especially given all the inventory build. Are the markets betting on US production falling off quickly?

Source: barchart

4. Indeed, US oil production is finally declining, albeit very gradually.

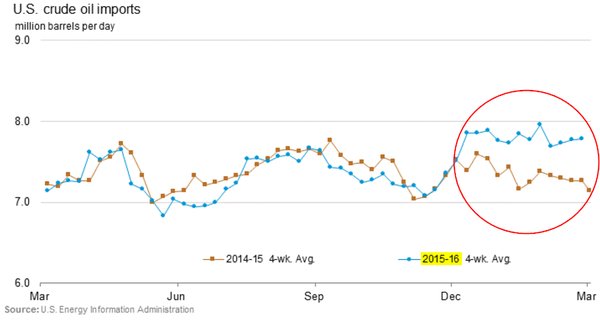

5. US crude oil imports remain elevated relative to last year. This has to be frustrating for US oil producers as some refiners tap foreign cargos rather than drawing on domestic supplies.

6. US distillates inventories (heating oil, diesel) are above the 5-year range. The inventory level is also shown in terms of days of supply.

Distillates demand remains quite weak relative to last year. There is some debate as to how much of this is weather-related vs. economic weakness.

While many dismiss the weather as a factor, it’s important to note that the El Nino driven warm weather patterns have significantly cut demand for heating fuel. Apparently February has been the warmest month on record relative to historical averages.

Source: Anthony Watts

7. Warmer temperature is in fact the main reason why the US natural gas gave up another 4.25% on the day. The last time we saw natural gas prices this low, Bill Clinton was in the White House.

Source: barchart

8. US coal carloadings fell to the lowest level on record – very few firms are shipping coal via rail these days. Of course given the cheap natural gas (above) why would you?

Leave A Comment