Greetings,

Let’s start with the US employment report which beat consensus on Friday: 242K new jobs were created vs. 190K expected. This should, at least for now, alleviate any concerns about the US slipping into a recession. Here are some notable trends from Friday’s Department of Labor report.

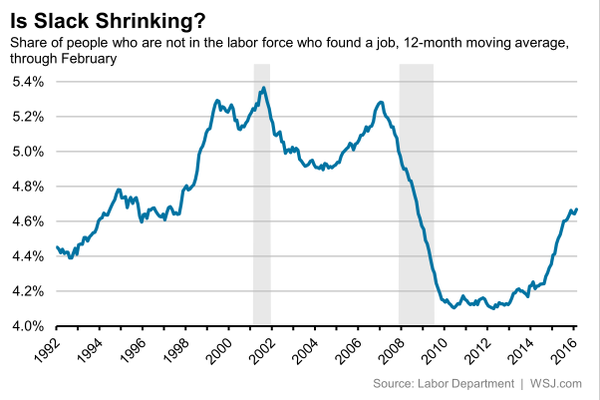

1. US labor force participation seems to be stabilizing. The second chart below shows US employment-to-population ratio.

There is clear evidence of more people entering the workforce and fewer dropping out.

2. The average duration of unemployment no longer seems to be declining and remains significantly above the pre-recession highs. Other data suggest that those who recently became unemployed quickly find a job but those who have been unemployed for a while are struggling.

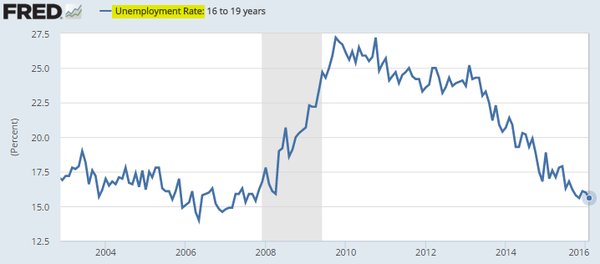

3. US youth unemployment is at pre-recession levels although participation remains relatively low.

4. African American youth unemployment is the lowest in 16 years, although still unacceptably high.

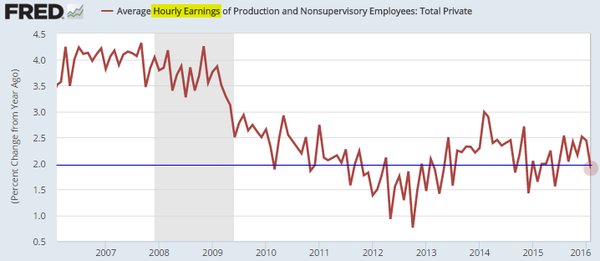

5. US wage growth remains anchored around 2% per year. One explanation for the persistently tepid wage growth is the new entrants into labor force (#1 above). Whatever the case, there is still no significant evidence of wage pressures on a national level.

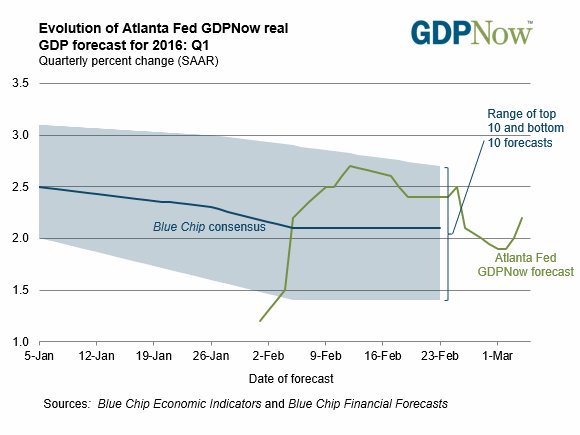

The Atlanta Fed GDP tracker rose in response to the jobs report (the index is quite sensitive to labor markets). It is now roughly in line with analysts’ forecasts of just over 2%.

Treasuries got hit twice last week: once with the better-than-expected ISM manufacturing report and then again after the payrolls report. Chart shows the 5-yr note futures.

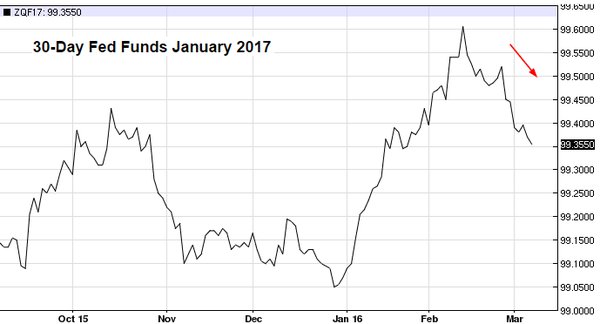

Fed Funds futures declined as well, with the market now expecting the next rate hike in November.

In other US economic developments, US exports have been the weakest since 2011. The chart shows exports vs. the US dollar index (DXY). Note that the dollar is the reason behind falling US exports. Politicians can debate trade all they want, but its the dollar strength that often determines American firms’ ability to compete.

Leave A Comment