Greetings,

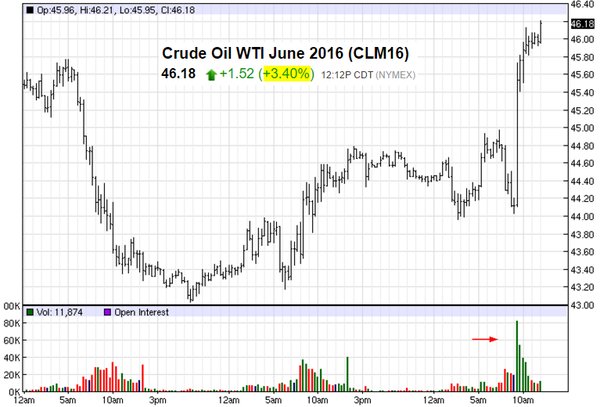

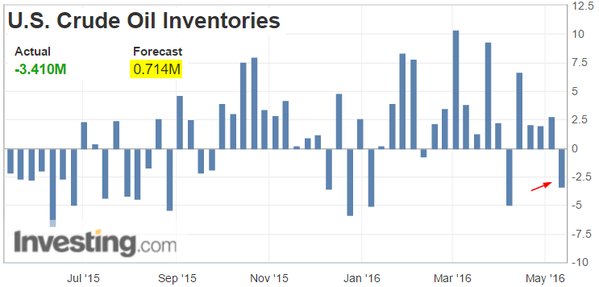

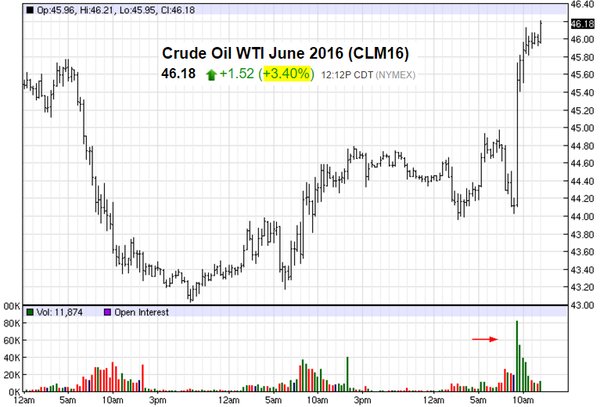

We begin with the energy markets where crude oil futures rose sharply in response to the first US inventory draw in weeks. Brent was up over 8% in two days, rising above $47/bbl.

Source: @barchart

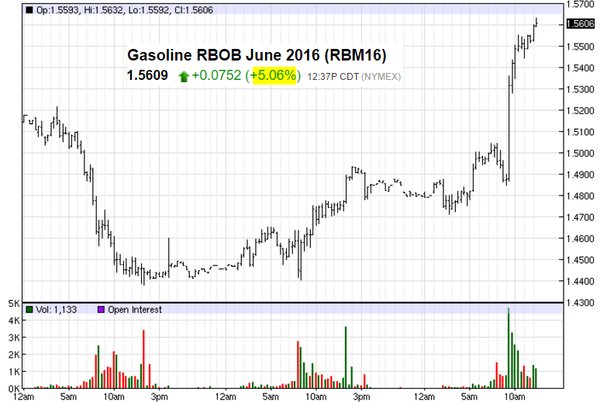

US gasoline futures rose 5% on Wednesday.

Source: @barchart

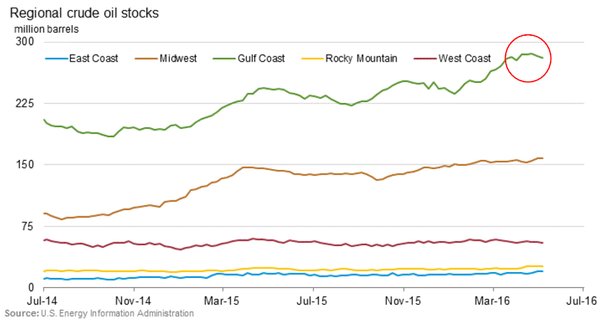

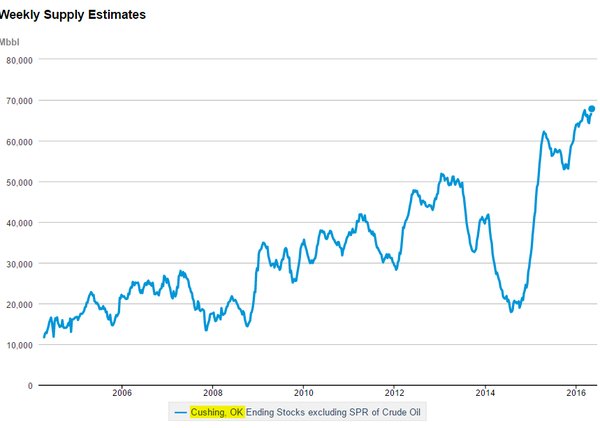

The inventory declines driving this rally took place at the Gulf Coast storage facilities. Oil in storage at Cushing, OK (the settlement hub for WTI futures), however, hit a new record.

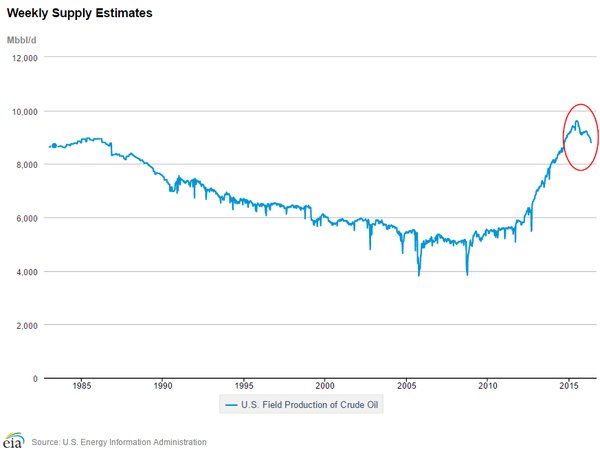

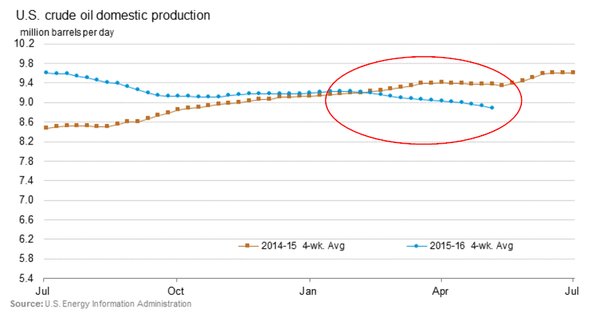

US crude oil production fell to 8.8Mbbl/d. The question now is whether firmer crude prices will slow these declines, given that a number of shale operations are profitable at these levels.

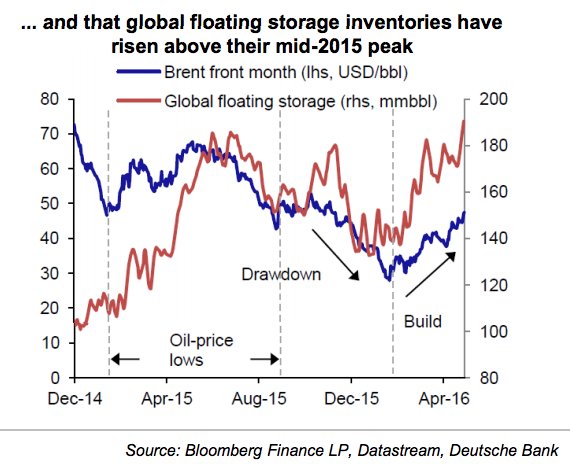

The global floating crude oil storage inventories have risen sharply. The market remains well supplied.

Source: Deutsche Bank, @joshdigga

Some are suggesting that the recent rally is a seasonal effect and declines are likely to follow. Perhaps.

Source: ?@troylocklear

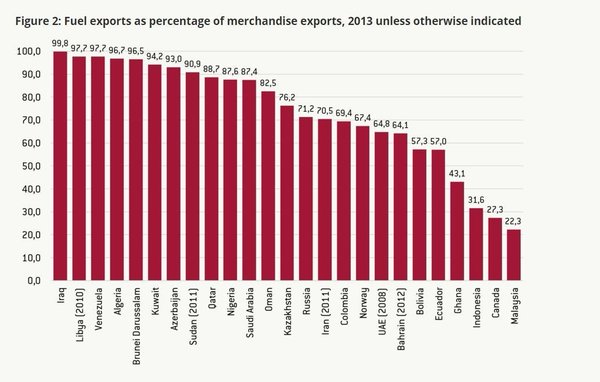

Separately, a number of nations (such as Iraq) are completely dependent on oil exports.

Source: @wef, @jsblokland

In other commodity markets, sugar futures surged nearly 5% on the day.

Source: @barchart

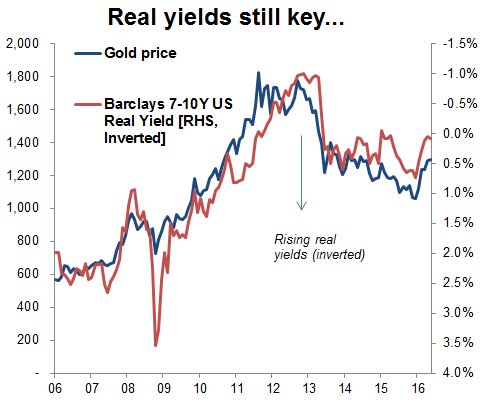

The next chart suggests that gold prices are still driven by real US rates (as one would expect).

Source: ?@Callum_Thomas

Now let’s shift to China where we are tracking the following trends.

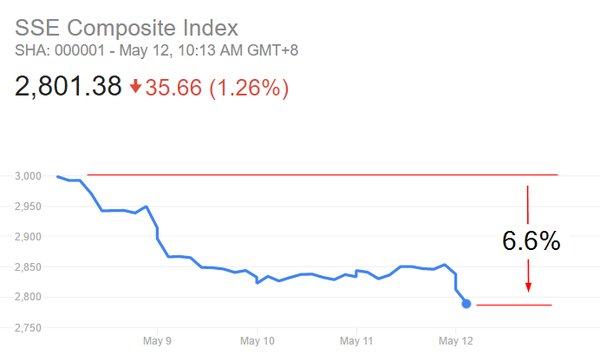

1. The nation’s stock market remains under pressure.

Source: Google

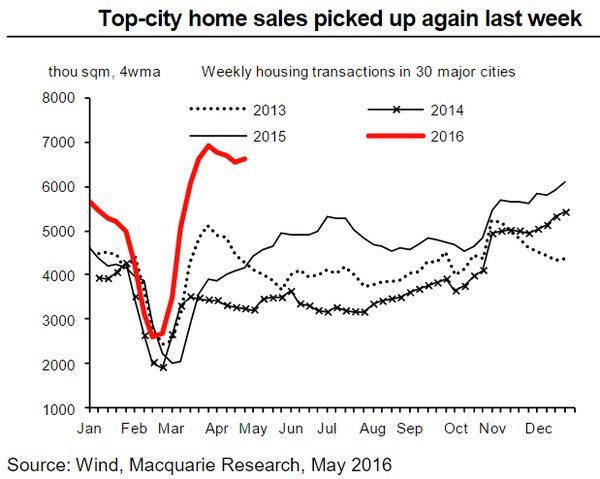

2. Brisk home sales in top cities continue.

Source: Macquarie

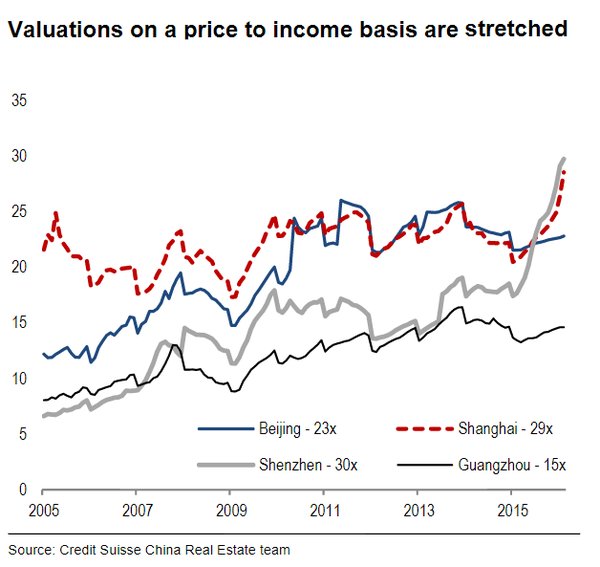

3. Price-to-income ratios on Chinese residential properties show frothy valuations in major metro areas.

Source: Credit Suisse

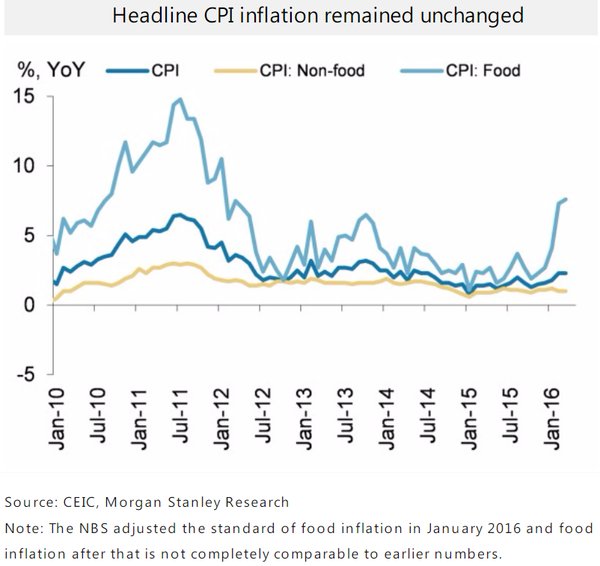

4. China’s headline CPI has been all about pork prices lately. CPI ex-food remains quite low.

Source: Morgan Stanley

Source: @fastFT

As an aside, US pork prices are firming up as well.

Source: @barchart

It’s worth noting that as Taiwan inaugurates the new government, the China-Taiwan tensions will escalate.

Source: Reuters

Leave A Comment