Commodities

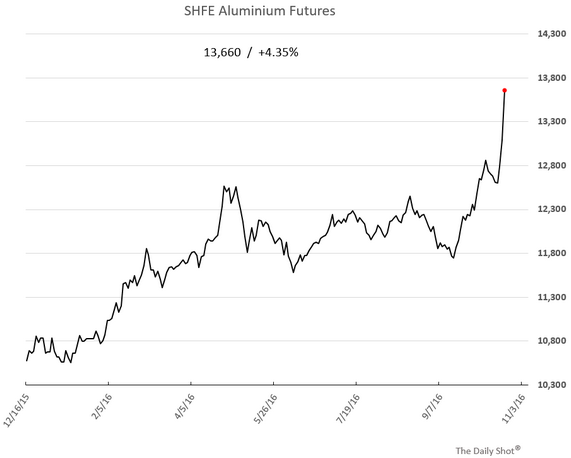

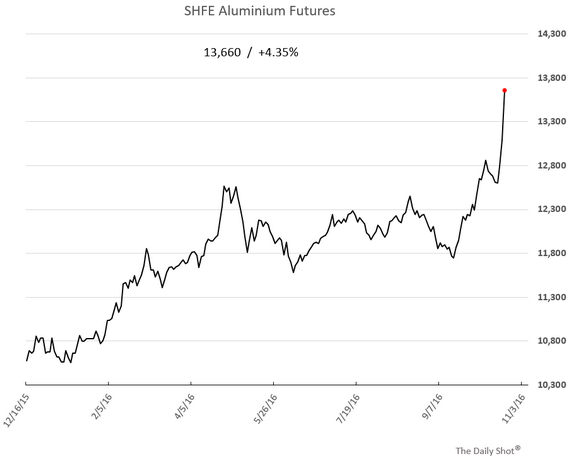

Let’s start with the commodities markets where China’s traders are taking metal futures to new highs. Aluminum prices in Shanghai go vertical.

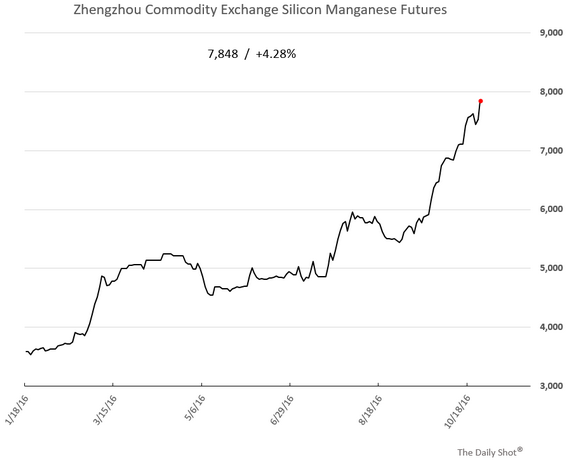

The Zhengzhou-based silicon manganese futures keep rallying.

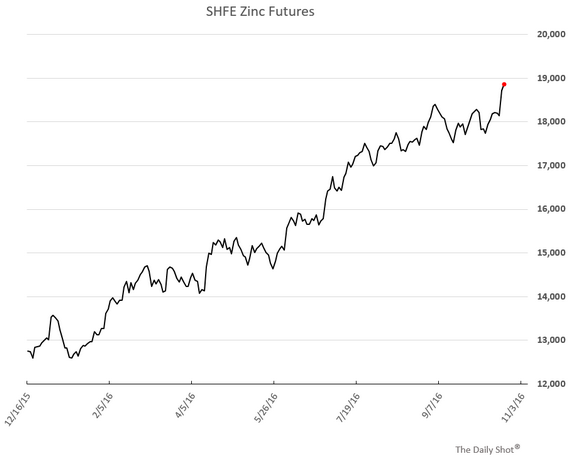

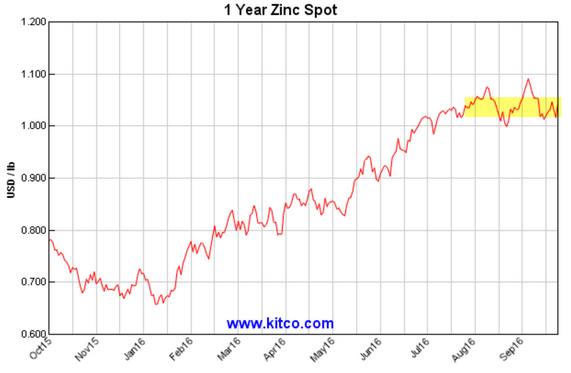

And the Shanghai zinc futures are grinding higher as well.

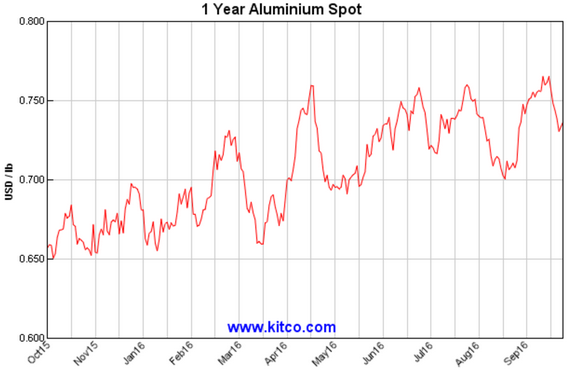

It’s worth noting that cash prices for some of these commodities, while stable, don’t show nearly as much of an increase. Here are aluminum and zinc spot prices.

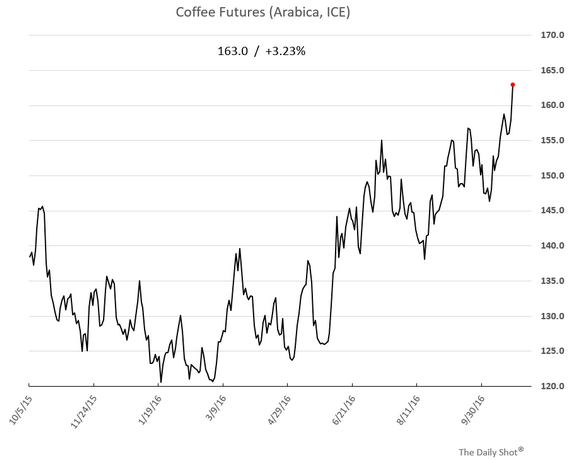

1. In other commodity developments, wholesale coffee prices keep rising.

Source: Bloomberg.com; Read full article

Source: ICE

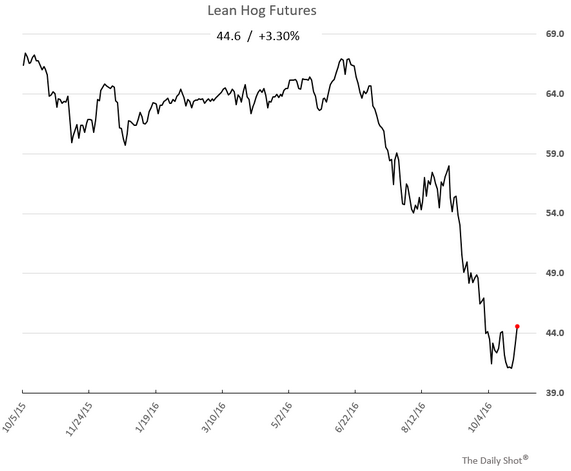

2. Looks like “bacon deflation” is over for now as hog prices turn higher.

3. Jewelry demand in India and China has declined, suggesting downward pressure on gold.

On the other hand, Goldman suggests that the renminbi weakness may push China’s investors into gold to preserve the value of their assets in dollar terms.

Source: Bloomberg.com; Read full article

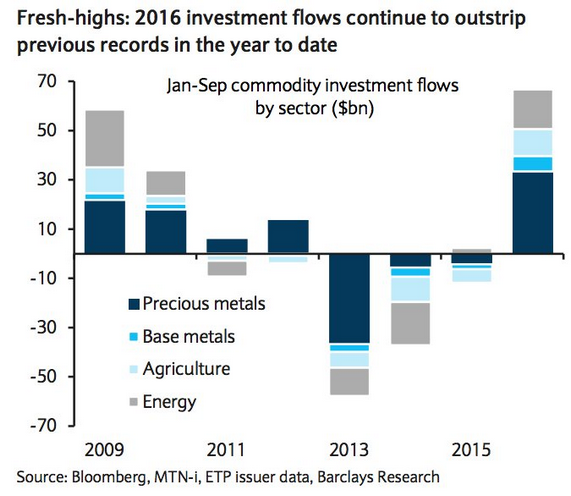

4. Overall flows into commodities have been quite high this year. A bet against inflation?

Source: Barclays, @NickatFP, @joshdigga

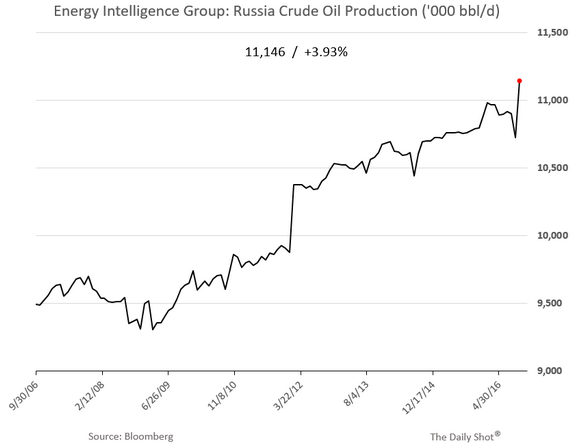

5. In the energy markets, Russian crude production jumped as new projects became operational (discussed earlier). Analysts remain skeptical about the November Russia/OPEC production “cuts.”

Credit

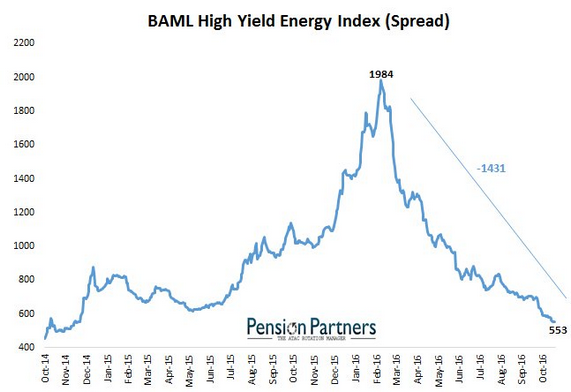

1. Speaking of oil, energy HY bonds have seen a spectacular decline in spreads since the peak back in February.

Source: @MktOutperform

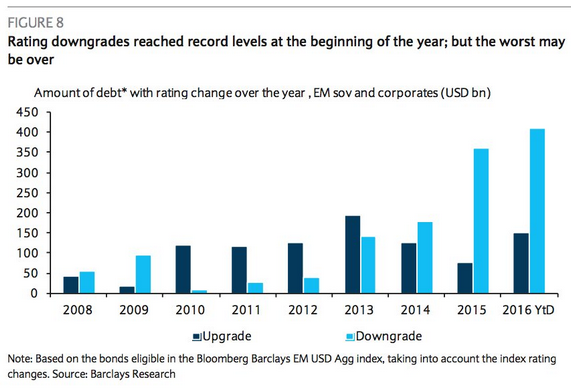

2. According to Barclays, the worst may be over for emerging market bond downgrades.

Source: Barclays, @NickatFP, @joshdigga

Emerging Markets

1. Brazil’s short-term rates rose as the central bank remains a bit more hawkish than was priced into the market. The bank said in its minutes that it is concerned about the recent pause in the slowdown of services prices. That means the rate cuts are not going to be as aggressive as some had expected.

Leave A Comment