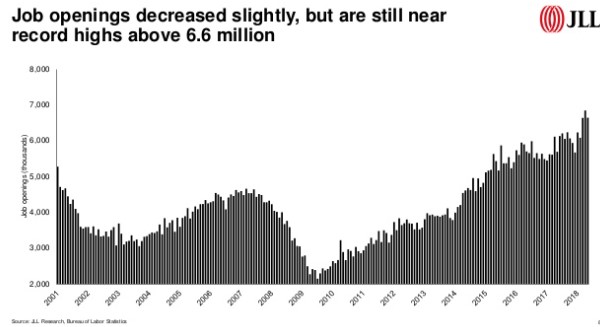

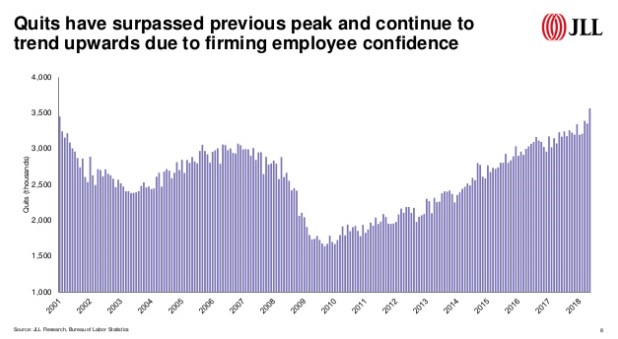

The American job market’s growth in the second quarter and into July was very strong and rather uneven.

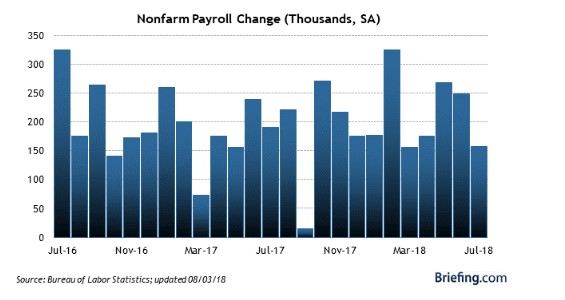

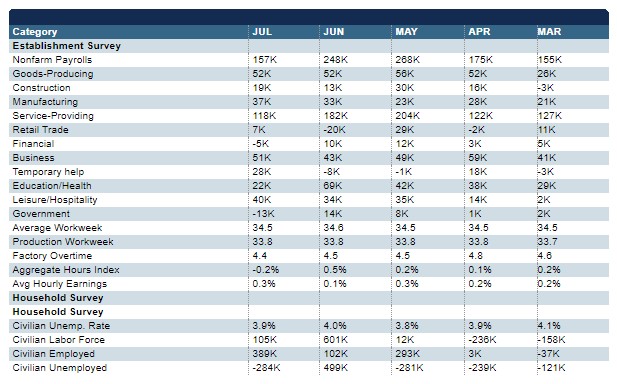

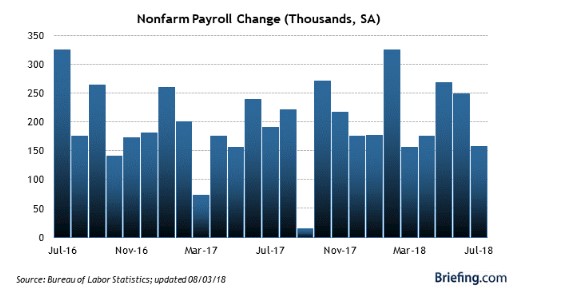

There were hefty up revisions to nonfarm payrolls in May and June, so the recently published July expansion of 157,000 should be viewed as on the tail end of a very strong performance. In general, there was not too much else that was different in the July job market report than in previous monthly releases.

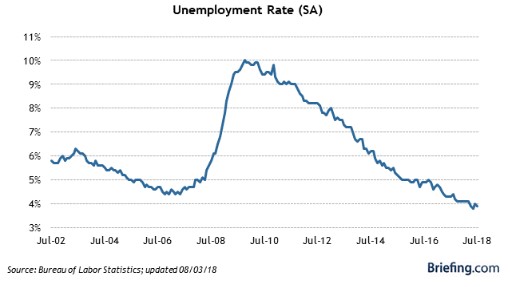

In July the unemployment rate dropped to 3.9% from 4% in June. Persons unemployed for 27 weeks or more accounted for 22.7% of the unemployed versus 23% in June. As well, the broader U6 unemployment rate, which accounts for unemployed and underemployed workers, dropped to 7.5% from 7.8% in June.

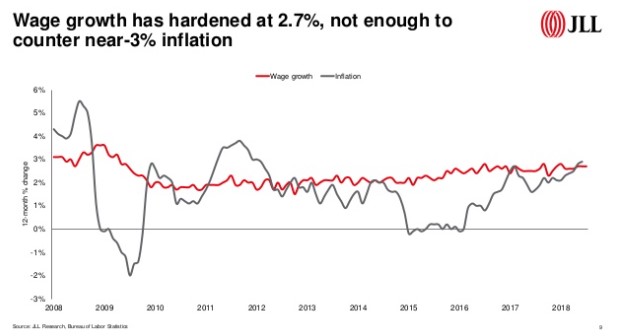

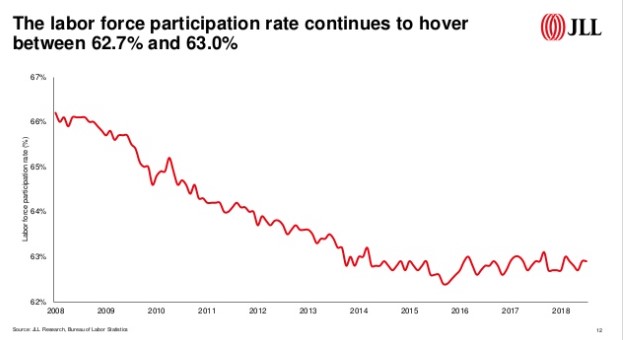

The labour force participation rate, at 62.9% in July, was unchanged from the previous month and was identical to the rate a year earlier. The employment-population ratio, which is a very important indicator of job market strength, was 60.5% in July and had increased by 0.3 percentage points over the year. The closely watched average hourly earnings rose 0.26% in July, which translated into a 2.7% increase over twelve months. The twelve-month increase in June was also 2.7%.

In conclusion, the roughly fully employed U.S. economy is still creating many new payroll jobs, and wage inflation has remained steady at 2.7%, implying an underlying inflation rate at least one percentage point lower. In other words, the Goldilocks job market is still alive and well in the United States.

The U.S. Job Market Growth Slowed In July Following A String Of Faster Monthly Growth Rates

Leave A Comment