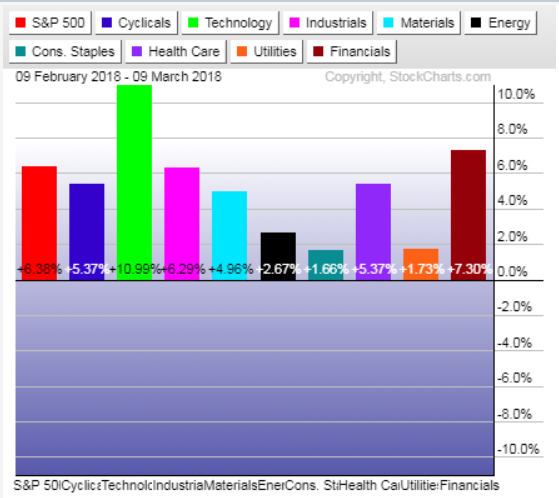

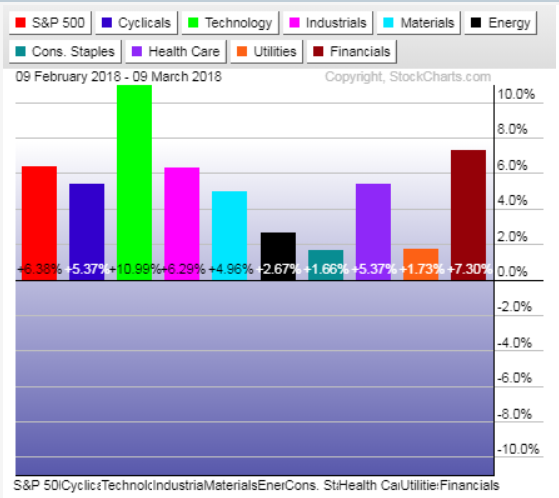

The updated graph below confirms the market is in full recovery mode from the recent correction. All S&P sectors are up over the past month being led by technology stocks as usual. Plus, March is usually one of the more profitable months for stocks.

Paul Hickey, the co-founder of Bespoke Investment Group, told CNBC that, since 1983, the S&P 500 has posted an average gain of 1.46% in March. During the current bull market, the index has performed even better in that month, with an average gain of 2.95%, he notes. When March showed a gain, the average advance was 3.6%. Investors have been fixated on inflation and last Friday job number reported an average hourly earnings miss to quell inflation fears.

The long-term bull market remains in place after the recent correction which provided and an opportunity to “buy the dip”. Market direction is starting to display a propensity to change instantaneously so hedging strategies are appropriate in this environment. Especially with Quadruple Witching day coming up this Friday which often generates increased trading volume and volatility.

Leave A Comment