A country’s savings rate is important indicator from a macroeconomic perspective. A higher saving tends to strengthen the economy over the long run, and a short-term change in the saving rate could signal that either a recession or an economic expansion in the offing.

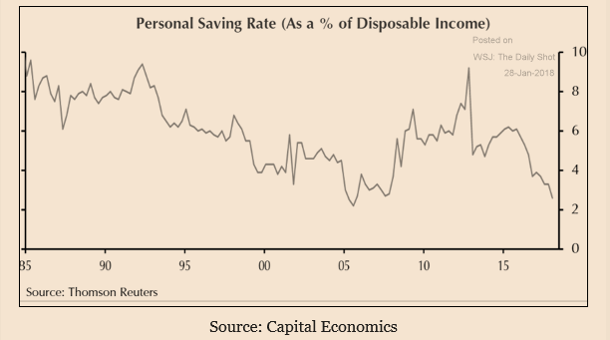

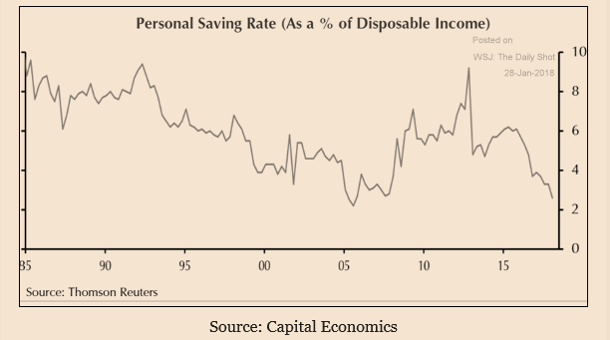

While most economists expect U.S. consumer spending to be strong in 2018, nonetheless it is difficult to imagine how robust consumer spending can persist given that the savings as a percentage of disposable income is at a decade low.

In recent years, the personal saving rate in the United States has fallen sharply, and it is now at a very low level compared to U.S. historical experience or to the savings behavior of many other industrialized countries.

In December of 2017, the personal savings rate dropped from to 2.4% from 2.5% in the previous month. The latest monthly personal savings rate is at its lowest level since 2005, underscoring the notion that consumers might be saving less because they are feeling better about their job/income and wealth prospects.

Indeed, one plausible explanation behind a low savings rate and strong consumer spending is the so-called “wealth effect.” This occurs when the growth in the real value of assets stimulates consumer spending and a reduction in the savings rate.

But the total amount a country is saving is still very different from how much an individual working-age person should be saving for retirement. A high country personal saving rate doesn’t necessarily mean that individuals are saving enough for retirement nor does a low national saving rate mean they’re saving too little.

Leave A Comment