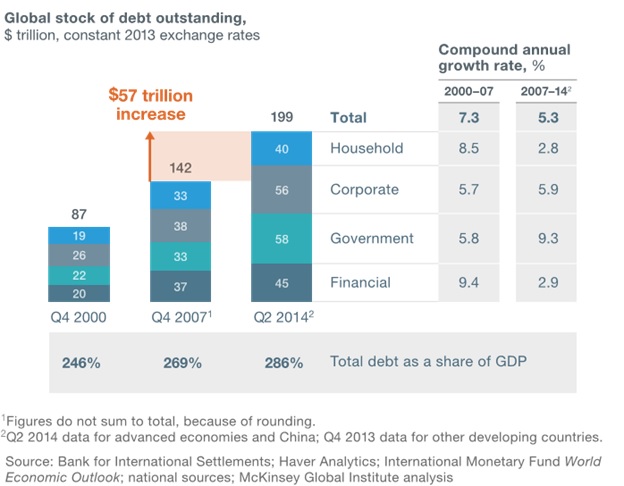

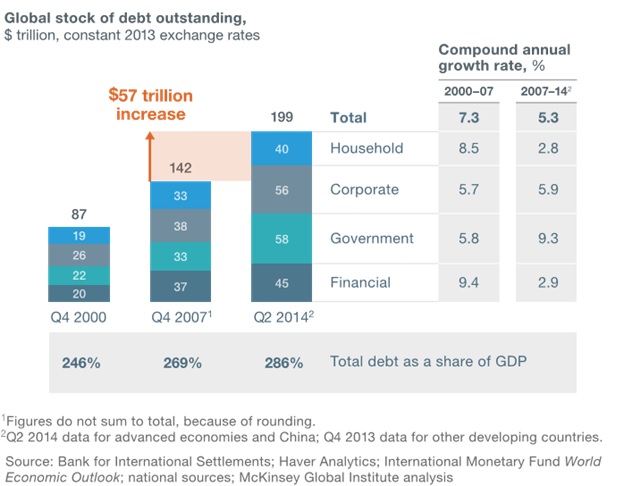

The major global economies have had a staggering debt of $199 trillion as of Q2 of 2014. The most recent figures will be closer to $230 trillion because, after 2014, the ECB, Japan and China have all resorted to ‘massive monetary easing’ programs while the US debt continues to escalate, with every passing second.The total debt, as a percentage of GDP, stood at 286%; the latest numbers will prove to be much worse.

The Wold Economy Reset is how this will begin

All forms of madness must eventually come to an end, and the current economic madness has started with the decline of both base metals and crude oil prices. The Central Banks are not able to prop growth or inflation. I have referred to the world economies resetting in the past as ‘The Global Reset’ and it is currently underway and the equity markets have jumped on the bandwagon along with other asset classes which are plummeting, rapidly.

The 2007 ‘financial crisis’ was due to easy monetary policy by the Fed

The Fed sowed the seeds of the financial crisis of 2007 by lowering interest rates from 6.5 %, in May of 2000, to 1% in June of 2003. Lower interest rates, as well as easy credit, have encouraged investors to pump money into the housing markets and consequently, prices of houses soared. The banks leveraged their balance sheets to unmanageable levels and continued to extend reckless lending. Lehman Brothers had a leverage ratio of 31 while Bear Sterns had a leverage ratio of 36, which resulted in their collapses.

The Fed sought to solve the problem of high leverage by implementing even higher leverage

Every crisis is an opportunity to correct the unbalanced system, which will lead to years of instability. However, the brilliant minds of those at the Fed, sought to solve the problem of ‘high leverage’ by means of implementing even higher leverage. They just transferred the leverage, from the private players, onto their own books, and surprisingly the major global Central Banks followed them, in this madness.

Leave A Comment