What a difference a week makes. Since putting in a low at 1802.50 on February 11th, we have rallied an impressive 133 points in the ES Minis contract (S&P500 futures) to close this week at 1914. All in all the large caps (SPX) gained 2.84%, and the small caps (RUT) gained 3.91% and we are now poised to rally higher over the next month or so. We were perhaps a little early in our purchase of long positions in the stock market (see my last article here) but it hasn’t taken much time at all to recover those small losses and my original bullish thesis is still very much on track. Here are three charts that point to a rally ahead.

SENTIMENT

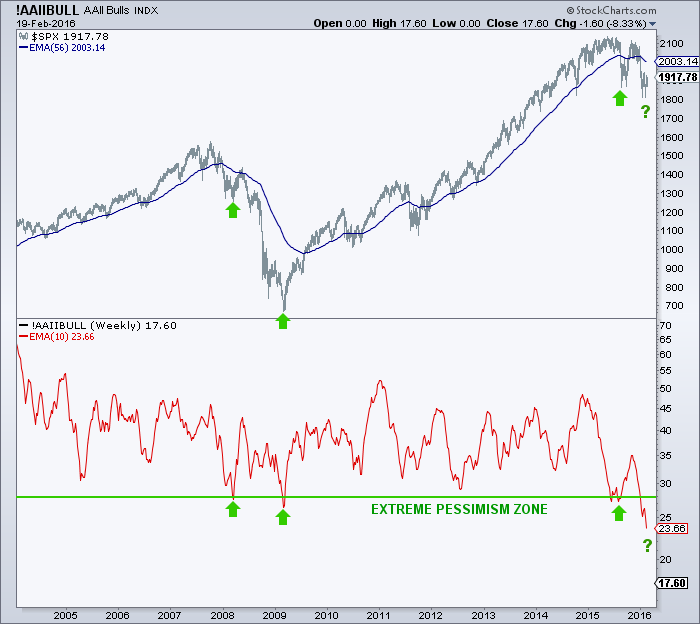

Sentiment has hit a bearish extreme recently, and all the talk in the financial media is of the S&P 500 trading down to 1600, 1500 and even 1100 – nobody is expecting a move back towards the bull market highs, and markets have a habit of doing the very thing that the least people expect.

As you may expect given the doom and gloom in the financial media, the number of AAII bulls has dwindled to very low levels in recent weeks. The actual figure comes in at 17.6%, and although this is a historically small number of bulls, we did see one lower reading in 2005. However, if we using a 10 period exponential moving average overlaid onto the data we get a slightly different picture:

We define any move below 28 as extremely pessimistic, and prior readings at this kind of level have typically resulted in some kind of bounce. The current level is the lowest in the last 10 years. Regardless of whether or not you are bullish or bearish in the big picture, you should not underestimate the power of sentiment hitting an extreme and price reversing.

APPETITE FOR RISK

Risk on and risk off tends to be described via a multitude of asset classes, but in the most simplistic of terms we can define to it just two and ask the question are investors buying more equities (SPX) or insurance (VIX) at the present time. To find the answer we plot a ratio chart of the two assets (SPX/VIX), and when the numerator is rising we can tell that stocks are more in vogue among the investing community than insurance against a decline.

Leave A Comment