The first sign of trouble occurred earlier in August when the Turkish lira sank heavily and all eyes shifted to trade and capital flows in the emerging markets (EM). Fears mounted that other EMs, such as Brazil, India, Indonesia, and Russia would experience significant currency devaluations that would set off a chain reaction that would hit the currency and credit markets in the advanced nations. So far, we have witnessed a currency crisis familiar from the past. The Chinese yuan is off nearly 10% from the highs of the year as the Chinese authorities manage their response to the Trump-lead trade war. The Brazilian real is down by 18% (YTD), the Russian ruble by 20% (YTD), the Indian rupee by 10% (YTD), and the Pakistan rupee by 17%(YTD), necessitating a call to the IMF for help.

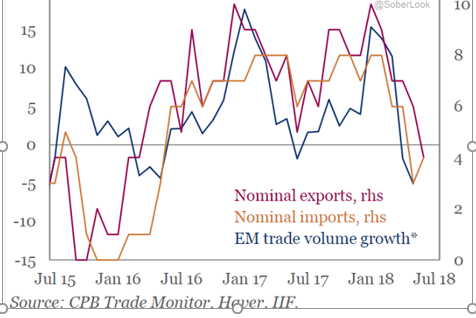

Despite these major currency re-alignments, the EMs’ trade performance is clearly heading in the wrong direction (Figure 1). Both nominal exports and imports have been on a downward slope since the beginning of the year and are in negative territory today; volumes have also contracted. Some of the reasons for this poor trade performance can be traced to a drop in major commodities (e.g. copper), a rise in trade barriers and continued underperformance in many advanced countries (e.g. EU, U.K. and Japan).

Figure 1 EM trade Performance 2015-18

A nation cannot tolerate a decline in its trade performance and simultaneously an outflow of capital for long before its economy becomes unstable, ultimately, leading to full-blown currency and credit market crisis, such as we are seeing today in Turkey and Venezuela. Both debt and equity markets saw portfolio outflows, led by Asia with an $8 billion drop and Africa and the Middle East with a $4.7 billion outflow in May, alone. (Figure 2).

Figure 2 EM Capital Flows

As the Institute for International Finance reports:

No single driver of outflows from EM assets stands out. Instead, a combination of factors appears to be at work: idiosyncratic domestic strains such as funding pressures in Argentina… and renewed U.S. tariff threats and retaliatory actions; and political uncertainty in Italy and Spain… and the risk of upward pressure on the USD—in response to rising U.S. interest rates.

Leave A Comment