“On December 22, 2017, Donald Trump signed into law the biggest tax overhaul since the Tax Reform Act of 1986. The new tax law makes substantial changes to the rates and bases of both the individual and corporate income taxes, most prominently cutting the maximum corporate income tax rate to 21 percent, redesigning international tax rules, and providing a deduction for pass-through income.” (Brookings, Effects of the Tax Cuts and Jobs Act: A preliminary analysis, June 14, 2018.)

U.S. corporate profits soared 16.1% year over year in the second quarter, boosted by the Republican tax cuts and 4.1% real annual rate of growth. The lowered U.S. corporate tax rate was signed into law last year, and as the Wall Street Journal points out, “taxes paid by U.S. companies in the quarter were down 33 percent from a year earlier, according to the government data, or more than $100 billion at an annual rate.”

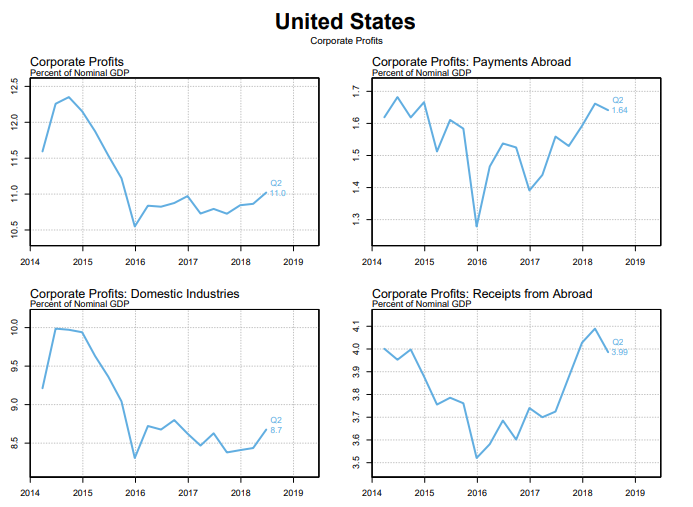

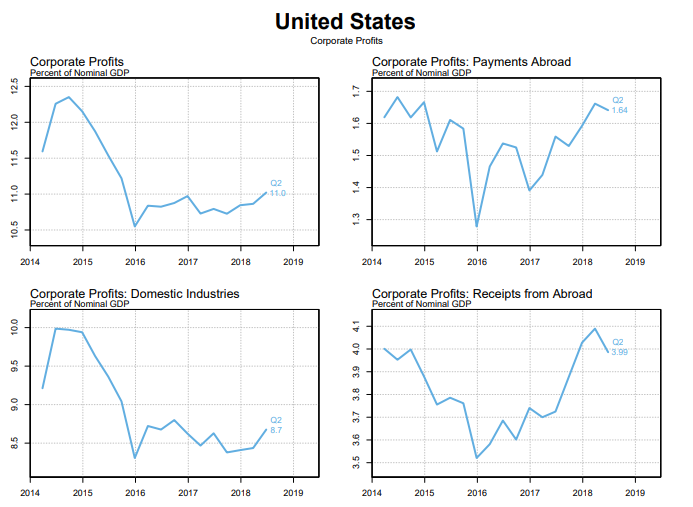

Indeed, as the following chart indicates, corporate profits as a percent of GDP are at a three-year high. Corporate profits receipts from abroad are trending at about 4% of GDP, as the new tax laws encourages repatriation of external profits.

Leave A Comment