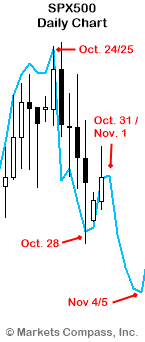

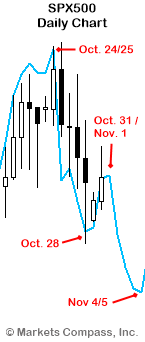

Our proprietary short-term forecasting models have predicted that US equity markets would decline from Oct. 24th/25th through Nov. 4th/5th as per the chart below.

The blue line is our short-term forecast plotted directly onto the daily SPX500 chart. The forecast is truly forward-looking and does not repaint based on how markets behave. As a matter of fact, market behavior is what changes according to our forecast, which is what anyone would expect from a true forecast.

We also took a bearish position in the market by buying the 214.50 SPY put options on Monday, Oct. 24th expiring on Friday, Oct. 28th, which is the end of the first leg of the decline as indicated by our forecast. That resulted in 122% in profits on that first leg over those four days.

We are now well into the exhaustion phase of that rebound from Friday and US equities should soon commence their second leg of the decline through the remainder of this week.

Leave A Comment