TM editors’ note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

One of the more interesting and under followed biotechs in the market just announced the official plans to start a major Phase III clinical trial for a drug that has an increasingly unmet need. The best part about VBI Vaccines (VBIV) is that the company already has the vaccine approved in multiple markets and has several other drug candidates in the pipeline.

Despite the generally positive prospects for vaccine approval, the stock traded near the lows until the start of 2017. The recent pullback to $4.74 leaves investors with an opportunity to buy the stock with a market cap of only $200 million and some compelling catalysts for a higher stock price.

Phase III Catalyst

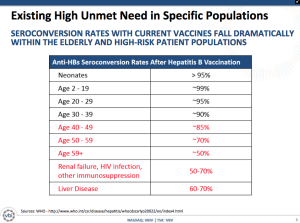

On July 11, VBI Vaccines announced the intent to run two concurrent Phase III trials in the U.S., Canada, and Europe to show that Sci-B-Vac is a third-generation hepatitis B vaccine that can safely meet the needs of patients that aren’t met by the current Hepatitis B vaccines. Hepatitis B is currently seen as a managed disease by existing approved vaccines, but those vaccines are increasingly failing to meet the needs of high-risk people such as elderly and diabetics.

The reality is that not only are large populations not vaccinated, but also an increasingly significant population is encountering seroconversion rates that fall dramatically. People over 59 and ones with liver disease or renal failure are seeing rates down at only 50%.

The company is proposing two concurrent Phase III studies for approximately 4,800 adults over an expected duration of 15 months. The trials include PROTECT to prove the safety and immunogenicity of Sci-B-Vac with an ultimate objective of demonstrating superiority of the seroprotection rates and CONSTANT for a lot-to-lot consistency study with a secondary objective of evaluating the speed to seroprotection. The clinical trials will have the following details:

Leave A Comment