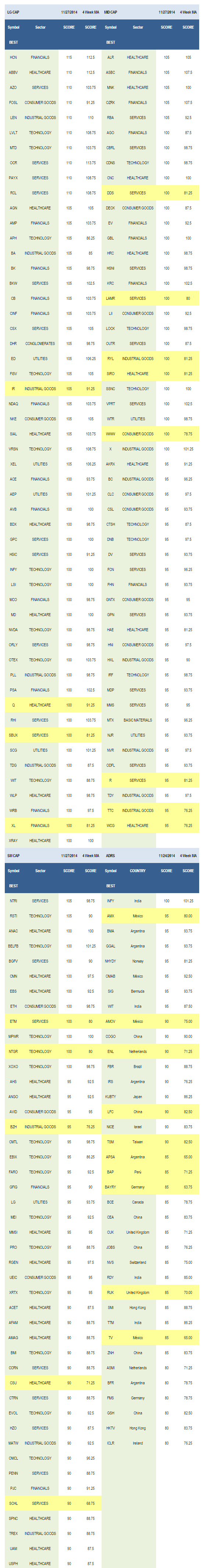

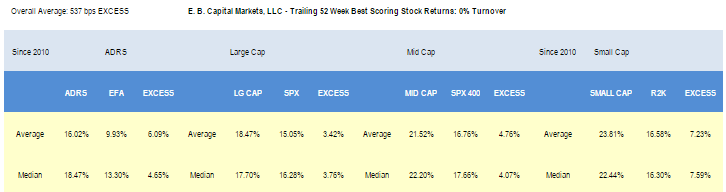

Top scoring weekly returns: Buy and Hold 1 Year

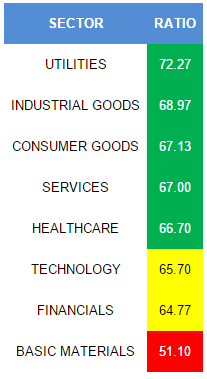

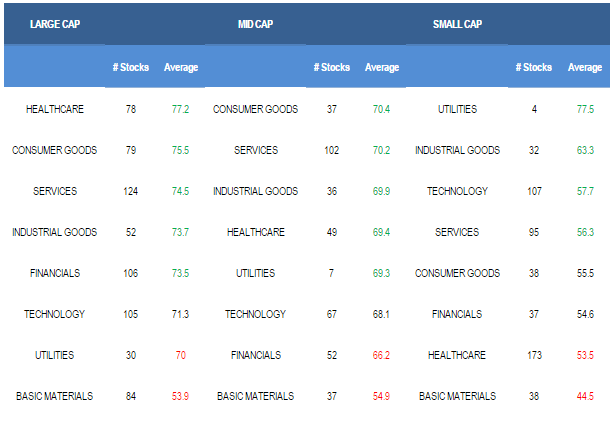

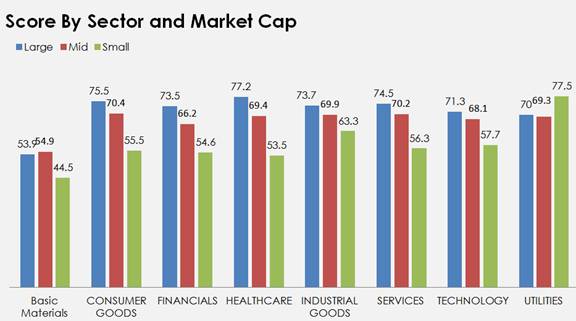

Utilities and industrial goods are the two best scoring sectors. Consumer goods, services, and healthcare also score above average. Tilt toward small cap stocks across utilities. In industrial goods, focus on large cap stocks. In consumer goods and healthcare concentrate on large and mid cap stocks, rather than small cap stocks.

Technology and financial stocks score in line. Large and mid cap stocks in both of these baskets score better than small cap stocks. Basic materials stocks score below average — stay stock and industry specific

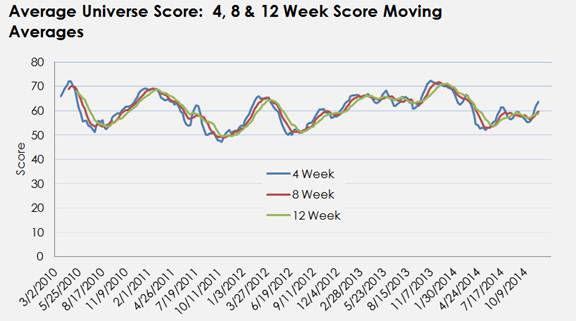

The next chart shows historical four, eight, and 12 week moving average score back to 2010.

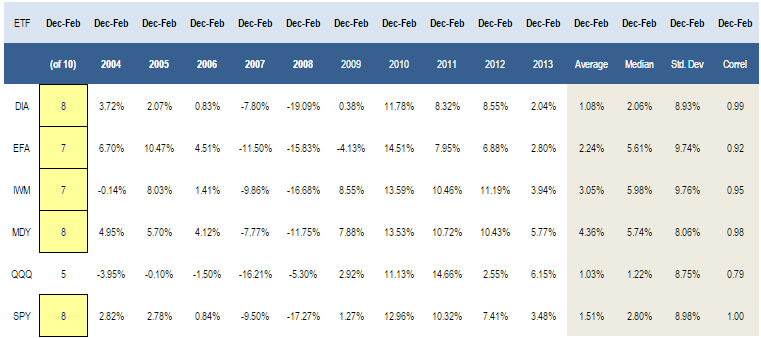

The DJ30, S&P 400 mid cap, and S&P 500 offer the best seasonality for the three months beginning December 1st and ending February 28th. The Nasdaq 100 has been a coin flip over the past decade.

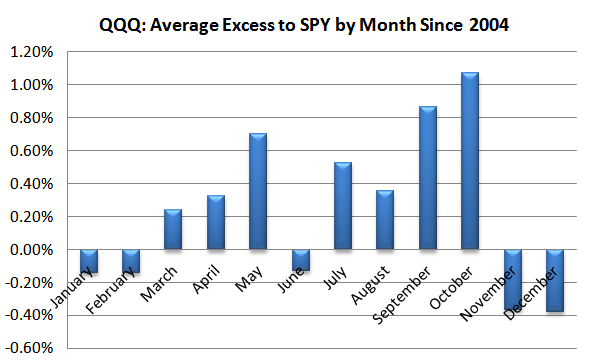

The following chart shows the Nasdaq 100’s average over or under performance to the SPY by month over the past decade.

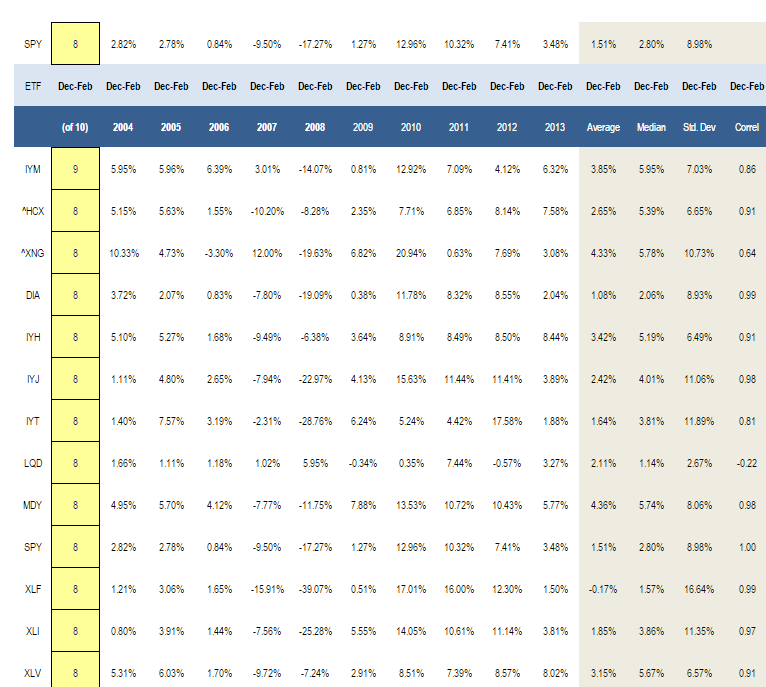

The following table shows the strongest seasonal market, sector, or industry ETFs for the coming three month period. It will be particularly interesting to watch basic materials given that the IYM has gained in the period in nine of the past 10 years. Healthcare, industrials, transports, and financials have also been solid performers.

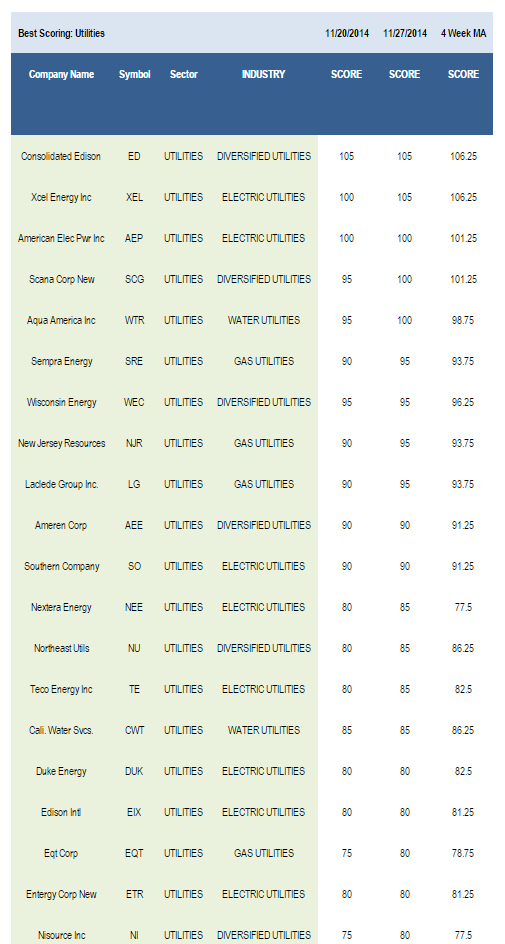

UTILITIES

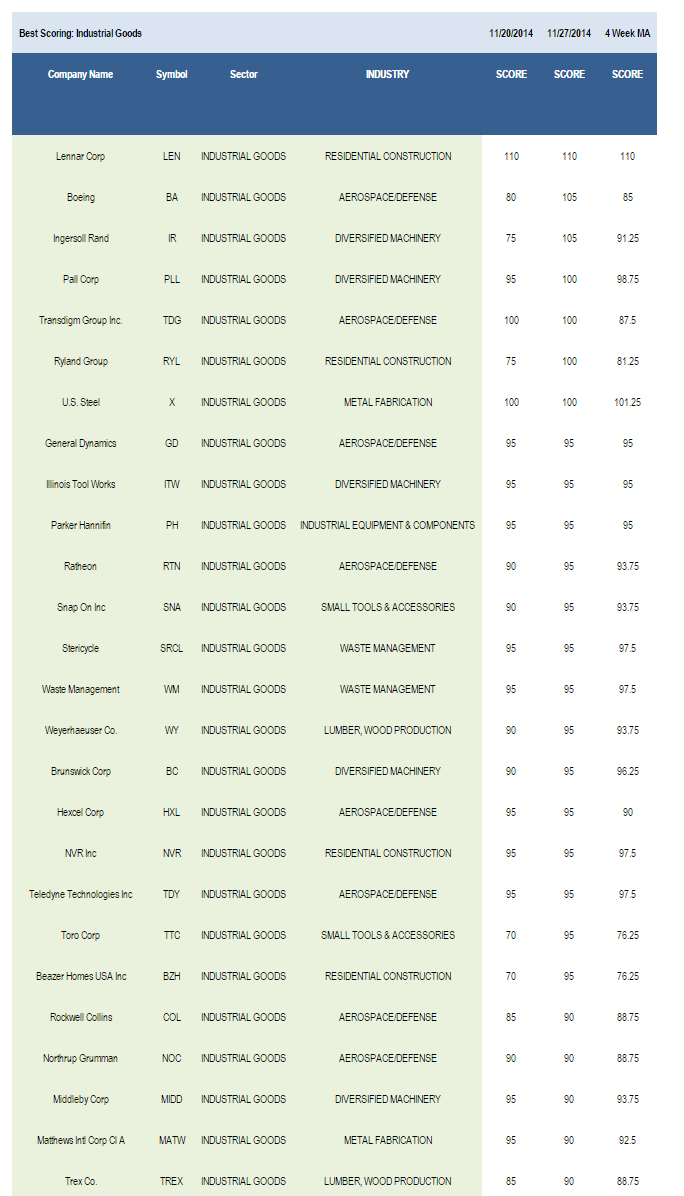

INDUSTRIAL GOODS

CONSUMER GOODS

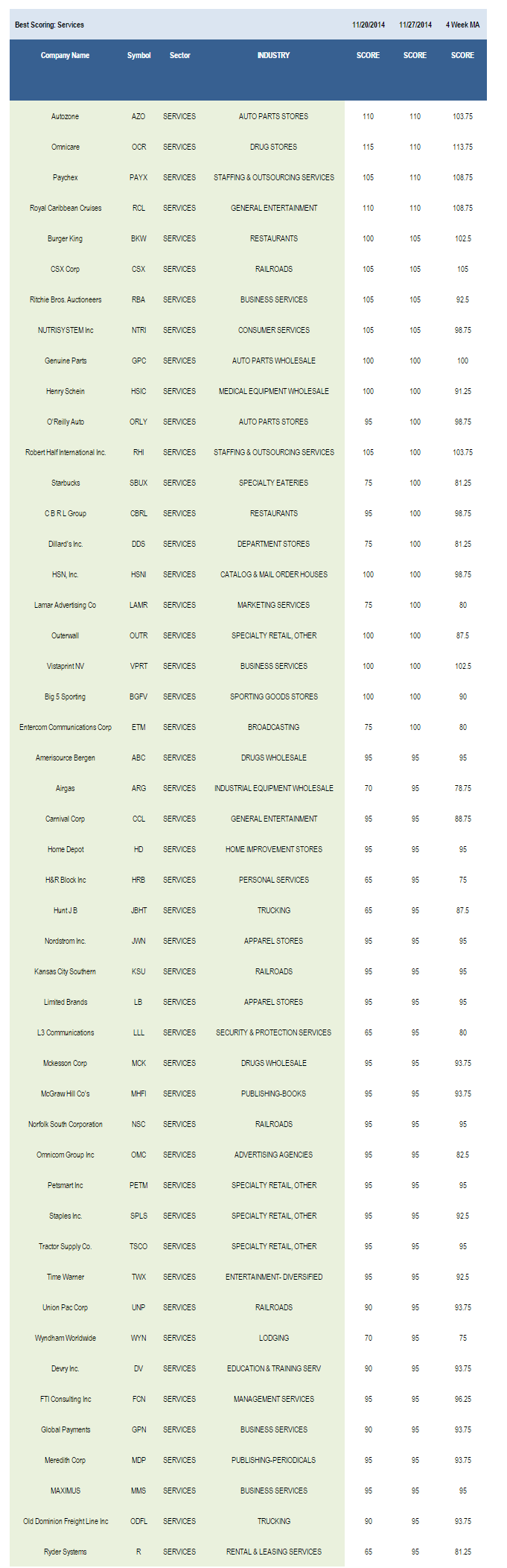

SERVICES

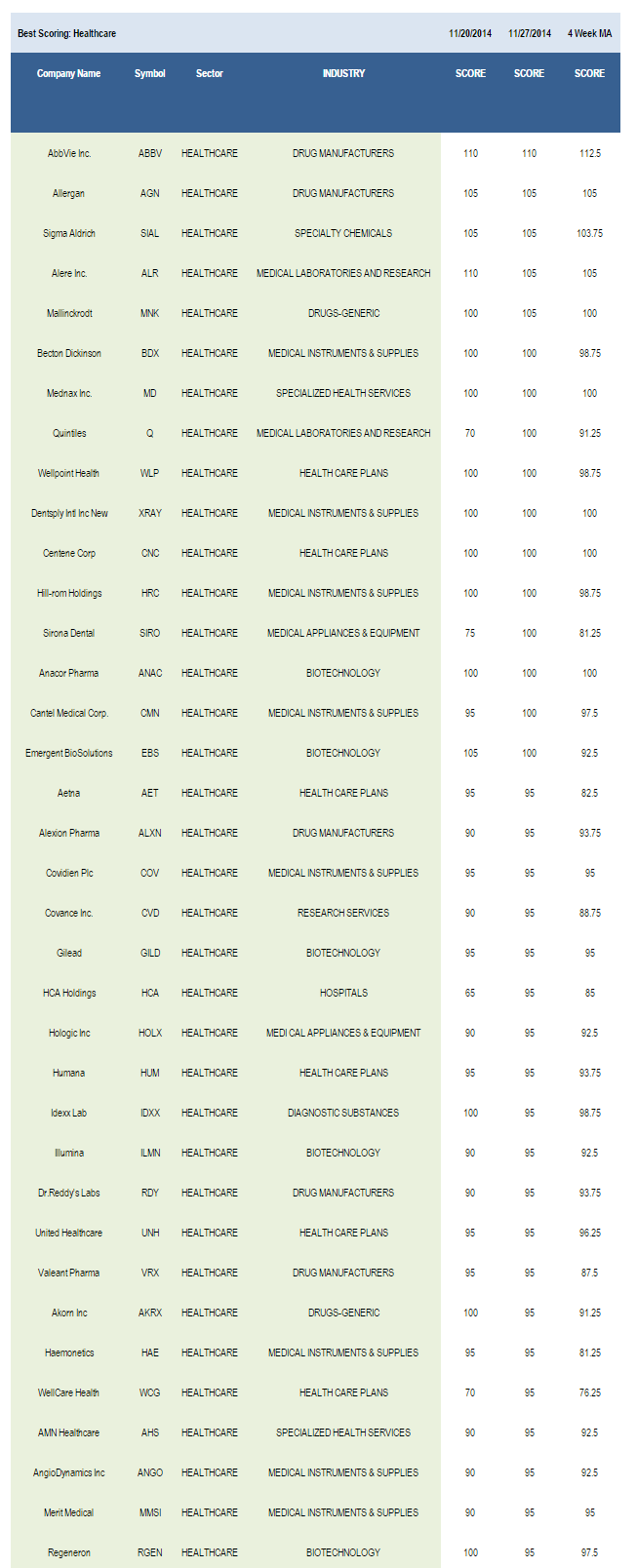

HEALTHCARE

TOP SCORING

Leave A Comment