Last month, all signs seemed to point towards a June interest rate hike by the US Federal Reserve. This would be the second time the US base interest rate has been raised in 2017. This will also be the first time that the Funds Rate has been hiked at least twice in a single calendar year following the 2008 global financial crises. It would also set up the market perfectly for at least another rate hike before the end of the year with chances of a couple more now higher than before.

What it means to borrowers and lenders

The implication in the credit market would be that lending rates will continue to rise to the end of the year, which then would make borrowing at fixed interest rates more attractive. But then this kind of incentive to borrowers only applies to those that have good credit scores.

Mainstream lending institutions would be cautious of borrowers with bad credit scores because even under normal circumstances, they prefer to lend to this group of people at higher interest rates.

So, this leaves the unemployed borrowers and others in that category with just one option, fast approval lenders. Online startups have seized this lending market which targets people with bad credit and while various states continue to crack the whip by drawing some new laws, these lenders could be amongst the biggest beneficiaries of more rate hikes in 2017.

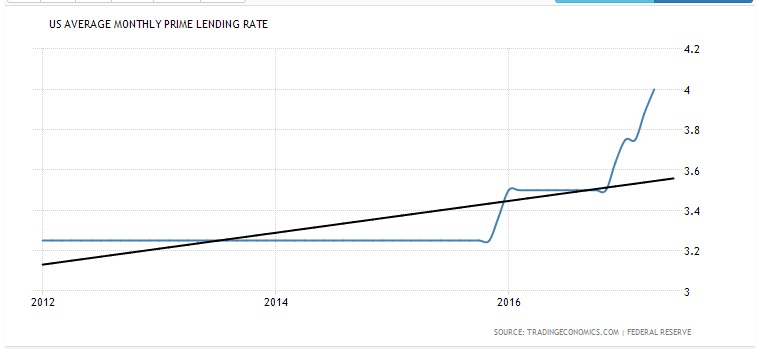

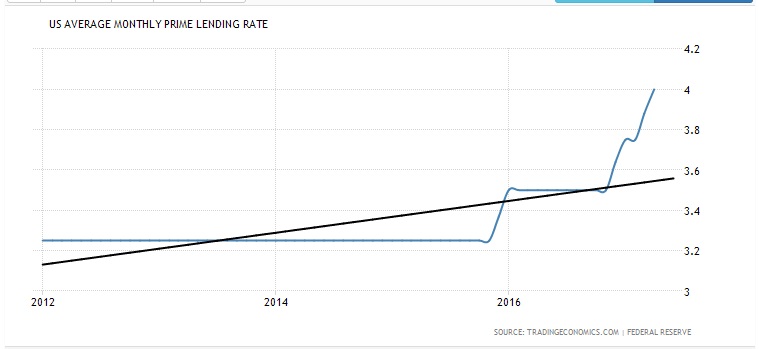

As demonstrated in the chart above, the US prime monthly lending rate has increased three times since October 2016. This corresponds with the number of rate hikes. The total increment amounts to 80 percentage points in about 18 months. It is fair to say that the increment was gradual given the length of the period. However, if another three increments were to take place over the next six-seven months, then that would result in a steeper curve.

Therefore, with a rapid increase in lending rates expected in the next few months, the credit market is set for some interesting times as the tightening continues. In fact, the overall US consumer credit dropped in April to just $8.2 billion from $19.5 billion in March following the latest rate hike.

Leave A Comment