Market Outlook

March is actually a pretty good month. February on average is the third-worst-performing month for the S&P 500 going back to 1945, as Sam Stovall, chief investment strategist at CFRA, mentioned on CNBC. Since that year, the S&P 500 Index has been up 66% of the time in March. Paul Hickey, the co-founder of Bespoke Investment Group, told CNBC that, since 1983, the S&P 500 has posted an average gain of 1.46% in March. During the current bull market, the index has performed even better in that month, with an average gain of 2.95%, he notes. Looking at 90 years of market history, from 1928 through 2017, the S&P 500 was up 61% of the time in March, according to Yardeni Research, Inc. When March showed a gain, the average advance was 3.6%. When it incurred a loss, the average decline was 3.4%. Overall, March posted an average gain of 0.6% during those 90 years.

This year, the S&P 500 rose by 5.6% in January and fell by 3.9% in February, for a year-to-date gain of 1.5%. Hickey tells CNBC that, when we’ve had an up January and a down February, there was an average decline of 0.81% in March. But his sample size is small, with just five years out of the last 35 following this pattern. Nonetheless, Hickey is optimistic that the market may rise this March. “Coming into the year, sentiment was really strong. In January, it got even stronger. The pullback in February was a sort of reality check, and that brought people’s expectations back to reality. That’s helpful,” he told CNBC.

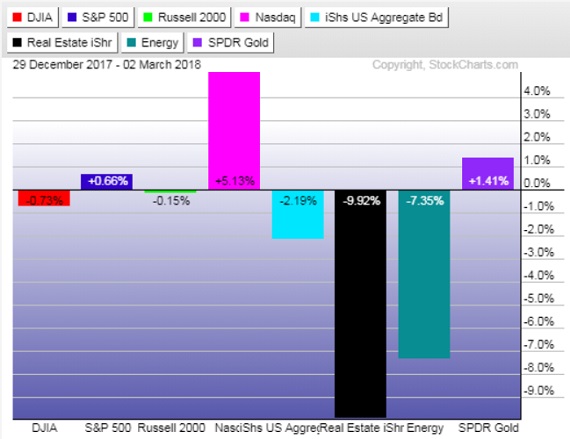

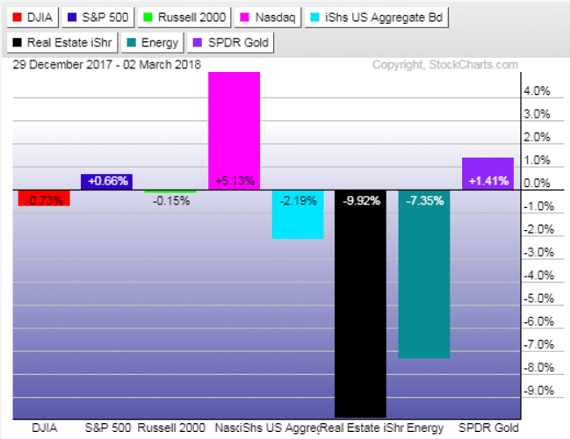

In the graph below, as they have over the past few years’ tech stocks are basically the only bright spot in the equity universe for the first quarter. Interest rate sensitive sectors like bonds and real estate are suffering from higher interest rates. Energy stocks are being hurt by excessive crude oil inventories and a higher dollar.

Leave A Comment