Market Outlook

This is July options expiration week and Jeff Hirsch in a recent Almanac Trader article talked about how since 1982, the Friday of options expiration week has a bearish bias for DJIA declining 18 times in 35 years with two unchanged years, 1991 and 1995. On Friday the average loss is a significant 0.29% for DJIA and 0.31% for S&P 500. Nasdaq’s record is even weaker, down 21 of 35 years with an average loss of 0.46%. DJIA posts the best full-week performance, up 22 of 35 with an average 0.41% gain.

The week after options expiration also leans bearish for S&P 500 and Nasdaq over the longer-term with average losses. In recent years the track record had been improving until 2015’s across the board, greater than 2% loss. Some investors remain encouraged by this year’s record highs for the Dow, the S&P 500 and the Nasdaq. However, others fret about the level of valuations. The Trump administration’s ability (or lack thereof) to move forward on health care and tax policy remains at the forefront of many investors’ minds and is having a significant impact on sentiment. Other factors playing roles are earnings, concerns about the possibility of a pullback in stock prices and interest rates/monetary policy.

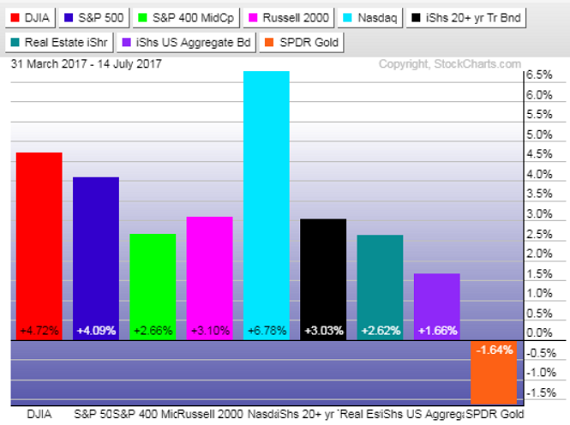

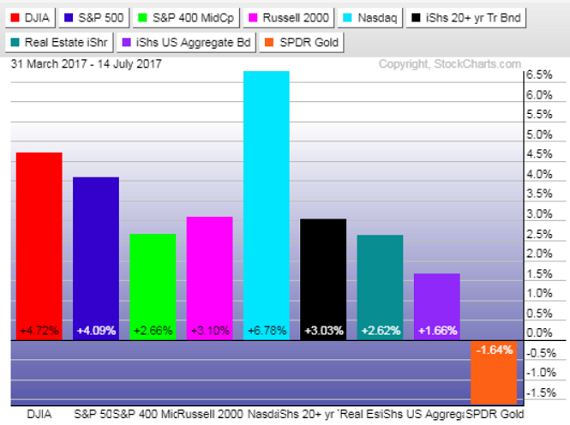

The updated graph below shows that with exception of gold, all the major asset classes are higher since the beginning of the second quarter. Low-interest rates and a growing domestic economy depressed ‘risk-off’ assets like gold and boosted riskier equity investments.

Leave A Comment