As U.S. tax reform takes shape, there is little doubt that it will generate deficits for a decade or more, possibility in the range of an additional $1.0-1.5 trillion.

With bond yields at historic lows and equity markets making new highs almost daily, the conventional thinking is that it will be difficult to attract bond investors unless rates rise dramatically. So often one hears the refrain that there is no value in buying a U.S. 10-year bond yielding around 2.5%. It begs the question what will happen to the Treasury market once the tax bill takes full effect. Whatever the bond duration adopted by the U.S. Treasury, the big question is: who will step up, domestically and internationally, to buy more U.S. debt?

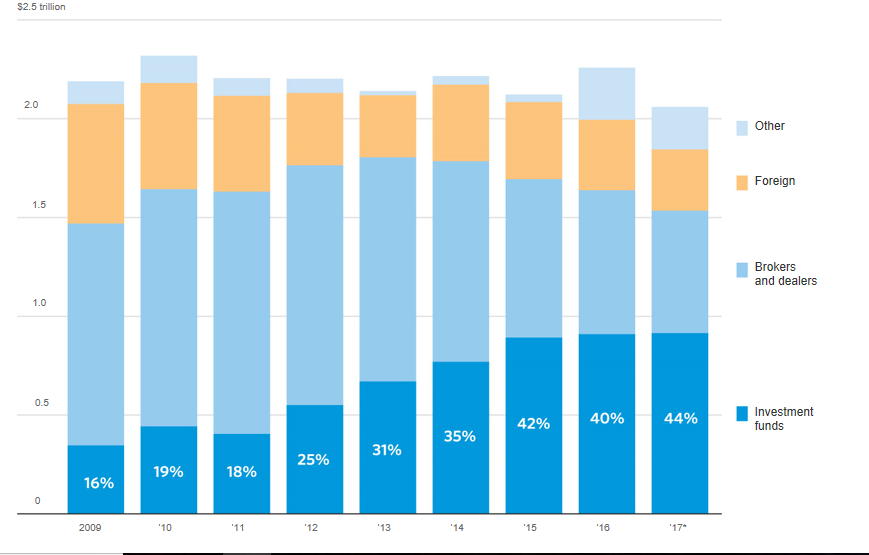

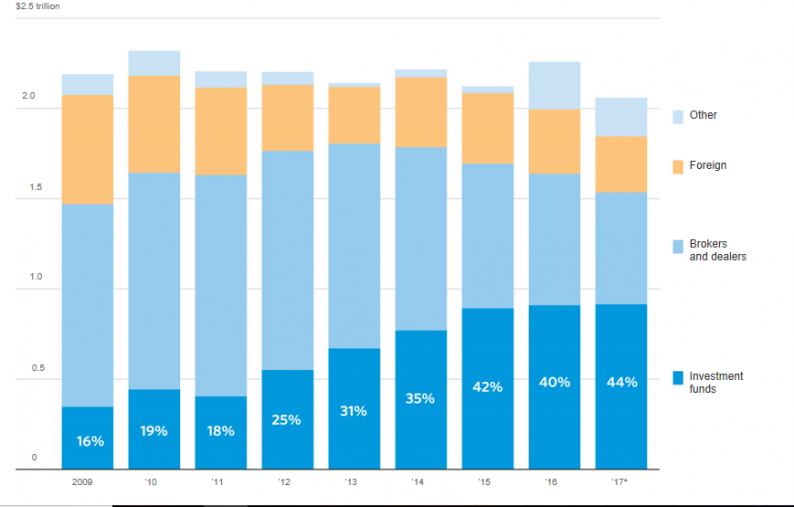

We can begin to look at this issue by examining who has bought the debt over the last decade. The U.S. government borrowing has averaged just over $2 trillion each year since 2008. Foreign government purchases, largely by China and Japan, have been steady. Given that both nations run large current account surpluses with the United States, the excess dollars accumulated must be re-cycled back into dollar-dominated assets, mostly into U.S. Treasuries. Treasuries are preferred because they offer safety and perfect liquidity. Brokers and other dealers have reduced their participation considerably because of regulatory requirements affecting trading by banks and brokerage houses in the United States; dealers no longer warehouse bonds for future trading but act basically as intermediaries.

Purchases of U.S. Treasuries Since 2009

The most interesting development in the Treasury market has been the relative increase in purchases by investment funds. Accounting for only 16% of all purchases in 2009, investment funds, largely made up of individuals, took up 44% of the new issues in 2017. So, when asked “who would buy bonds at these low rates”, the answer lies in thousands of individual investors through managed funds that have found bonds an attractive asset class.In addition, hedge funds domiciled overseas for privacy and tax reasons have also participated in bond purchases on behalf of individual investors.

Leave A Comment