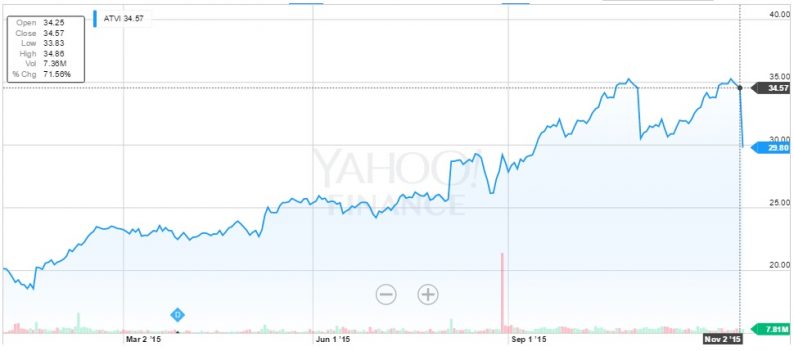

Shares of Activision Blizzard (NASDAQ:ATVI) plunged close to 3.5% on Tuesday morning following the announcement of a deal that will see the company acquire mobile gaming company King Digital (NYSE:KING) for $5.9 billion.

Shares of ATVI fell from yesterday’s close of $34.57 to about $29.80 in the early morning hours as investors showcased a pessimistic reaction to the news.

On the other hand, shares of King Digital, a company that has been struggling for form in recent quarters rallied to reflect the 16% premium on the company’s market value.

ATVI is buying KING in an all cash acquisition valued at $18 per share, which translates to 16% premium on King’s current market price, and 20% discount the IPO price of $22.50.

Why ATVI investors reacted negatively to King acquisition

King Digital has been struggling in the last few quarters as its top performing game Candy Crush Saga continues to fade in the market. The company is yet to find the perfect heirs to its fading top performers and this has raised questions over its long term future as a leading mobile game maker.

King Digital has also been facing competition from a selection of other mobile game makers including those free to download games as well as, desktop games and game consoles. Visit here for more about the rivalry in the gaming market.

One of the most common characteristics about social gaming companies is that they always come up with one or a couple top grossing games that thrust them to the limelight of the investment community. However, historically, and following in the footsteps of Zynga (NASDAQ:ZNGA), it has more than often proofed difficult to replace those games once their popularity deteriorated.

This is what is happening to King Digital as depicted by the second and third most famous games Candy Crush Soda Saga and Farm Heroes Saga, which have failed to match the achievements of breakout game Candy Crush Saga.

While King continues to increase the number of users, there is a clear slowdown in revenue growth and this is what investors are looking at. As such, Activision Blizzard’s sudden announcement of this acquisition has come as a shock, and investors are trying to evaluate its meaning with regard to the company’s long-term goals.

Leave A Comment