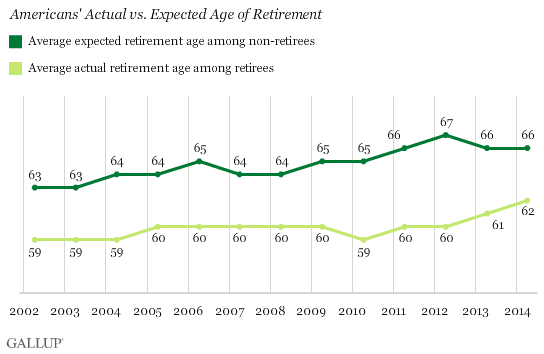

The average retirement age in the United States is 62. The average expectedretirement age is 66.

Both the real and expected retirement age has slowly trended upwards, as the image below shows:

This is the opposite of what should be happening in an investment-savvy and productive first-world country.

You’d think that the retirement age would trend down as we become more productive… But that has not occurred.

The truth is, some people retire much earlier than their 60’s. Many people are retiring in their 50’s, 40’s, and even 30’s in some cases. The reality is you don’t have to be rich to retire early – you must be disciplined and invest wisely, however.

What makes me hopeful is that both discipline and wise investing is teachable. I would love to see the average retirement age in the United States (and everywhere else for that matter) to fall far lower than 62.

What Does Retirement Mean?

First off, lets define retirement. It doesn’t mean sitting on the couch all day every day. Retirement means you are financially free to live the life you’ve chosen. Simply put, retirement means you don’t have to work.

Retirement does not mean you won’t work at all. Those who retire early often work – doing the things they want to do, rather than what they have to do.

You may be compensated monetarily for your passions; that’s not bad at all. You can be retired and get paid – if it is on your terms.

Early retirees often want to enjoy things when they are younger rather than older – it’s much easier to do a 12 mile hike when you are in your 30’s, 40’s, or even 50’s rather than 75.

Money, Time, Life, & Freedom

“If you’ve got the money, honey, I’ve got the time”

– Willie Nelson

Time is the ultimate currency of life. We only get so much of it, and then it’s gone. Of course, we aren’t free to do most things without money.

Money is a store of value. The value you create with your time is stored as money. We use time to create value and store it as money. Then we use money to spend our time in ways we couldn’t before.

One of the tenants of finance is that money in the future is worth less than money today. This has been known since at least 620 B.C., when Aesop wrote:

“A bird in the hand is worth two in the bush”

Time is valuable. I argue that someone who spends 1 hour a week making $75,000 a year will likely be happier (all other things being equal) than someone who spends 80 hours a week to make $75,000 a year.

One needs a balance, however. If you spend all your time providing value and saving money, you will have no time to enjoy the fruits of your work. On the other hand, if you don’t provide any value and make no money, you will not be able to do much with your time.

Leave A Comment